Answered step by step

Verified Expert Solution

Question

1 Approved Answer

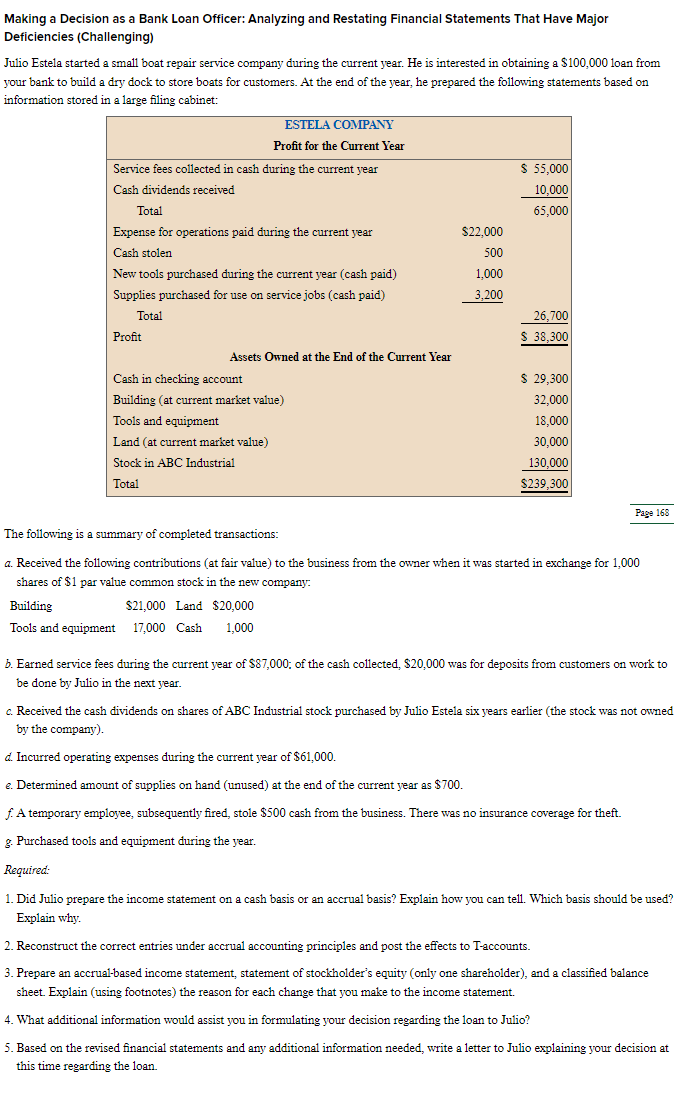

Making a Decision as a Bank Loan Officer: Analyzing and Restating Financial Statements That Have Major Deficiencies (Challenging) Julio Estela started a small boat repair

Making a Decision as a Bank Loan Officer: Analyzing and Restating Financial Statements That Have Major Deficiencies (Challenging) Julio Estela started a small boat repair service company during the current year. He is interested in obtaining a $100,000 loan from your bank to build a dry dock to store boats for customers. At the end of the year, he prepared the following statements based on information stored in a large filing cabinet: Page 168 The following is a summary of completed transactions: a. Received the following contributions (at fair value) to the business from the owner when it was started in exchange for 1,000 shares of \$1 par value common stock in the new company: b. Earned service fees during the current year of $87,000; of the cash collected, $20,000 was for deposits from customers on work to be done by Julio in the next year. c. Received the cash dividends on shares of ABC Industrial stock purchased by Julio Estela six years earlier (the stock was not owned by the company). d. Incurred operating expenses during the current year of $61,000. e. Determined amount of supplies on hand (unused) at the end of the current year as $700. f. A temporary employee, subsequently fired, stole $500 cash from the business. There was no insurance coverage for theft. g. Purchased tools and equipment during the year. Required: 1. Did Julio prepare the income statement on a cash basis or an accrual basis? Explain how you can tell. Which basis should be used? Explain why. 2. Reconstruct the correct entries under accrual accounting principles and post the effects to T-accounts. 3. Prepare an accrual-based income statement, statement of stockholder's equity (only one shareholder), and a classified balance sheet. Explain (using footnotes) the reason for each change that you make to the income statement. 4. What additional information would assist you in formulating your decision regarding the loan to Julio? 5. Based on the revised financial statements and any additional information needed, write a letter to Julio explaining your decision at this time regarding the loan. Making a Decision as a Bank Loan Officer: Analyzing and Restating Financial Statements That Have Major Deficiencies (Challenging) Julio Estela started a small boat repair service company during the current year. He is interested in obtaining a $100,000 loan from your bank to build a dry dock to store boats for customers. At the end of the year, he prepared the following statements based on information stored in a large filing cabinet: Page 168 The following is a summary of completed transactions: a. Received the following contributions (at fair value) to the business from the owner when it was started in exchange for 1,000 shares of \$1 par value common stock in the new company: b. Earned service fees during the current year of $87,000; of the cash collected, $20,000 was for deposits from customers on work to be done by Julio in the next year. c. Received the cash dividends on shares of ABC Industrial stock purchased by Julio Estela six years earlier (the stock was not owned by the company). d. Incurred operating expenses during the current year of $61,000. e. Determined amount of supplies on hand (unused) at the end of the current year as $700. f. A temporary employee, subsequently fired, stole $500 cash from the business. There was no insurance coverage for theft. g. Purchased tools and equipment during the year. Required: 1. Did Julio prepare the income statement on a cash basis or an accrual basis? Explain how you can tell. Which basis should be used? Explain why. 2. Reconstruct the correct entries under accrual accounting principles and post the effects to T-accounts. 3. Prepare an accrual-based income statement, statement of stockholder's equity (only one shareholder), and a classified balance sheet. Explain (using footnotes) the reason for each change that you make to the income statement. 4. What additional information would assist you in formulating your decision regarding the loan to Julio? 5. Based on the revised financial statements and any additional information needed, write a letter to Julio explaining your decision at this time regarding the loan

Making a Decision as a Bank Loan Officer: Analyzing and Restating Financial Statements That Have Major Deficiencies (Challenging) Julio Estela started a small boat repair service company during the current year. He is interested in obtaining a $100,000 loan from your bank to build a dry dock to store boats for customers. At the end of the year, he prepared the following statements based on information stored in a large filing cabinet: Page 168 The following is a summary of completed transactions: a. Received the following contributions (at fair value) to the business from the owner when it was started in exchange for 1,000 shares of \$1 par value common stock in the new company: b. Earned service fees during the current year of $87,000; of the cash collected, $20,000 was for deposits from customers on work to be done by Julio in the next year. c. Received the cash dividends on shares of ABC Industrial stock purchased by Julio Estela six years earlier (the stock was not owned by the company). d. Incurred operating expenses during the current year of $61,000. e. Determined amount of supplies on hand (unused) at the end of the current year as $700. f. A temporary employee, subsequently fired, stole $500 cash from the business. There was no insurance coverage for theft. g. Purchased tools and equipment during the year. Required: 1. Did Julio prepare the income statement on a cash basis or an accrual basis? Explain how you can tell. Which basis should be used? Explain why. 2. Reconstruct the correct entries under accrual accounting principles and post the effects to T-accounts. 3. Prepare an accrual-based income statement, statement of stockholder's equity (only one shareholder), and a classified balance sheet. Explain (using footnotes) the reason for each change that you make to the income statement. 4. What additional information would assist you in formulating your decision regarding the loan to Julio? 5. Based on the revised financial statements and any additional information needed, write a letter to Julio explaining your decision at this time regarding the loan. Making a Decision as a Bank Loan Officer: Analyzing and Restating Financial Statements That Have Major Deficiencies (Challenging) Julio Estela started a small boat repair service company during the current year. He is interested in obtaining a $100,000 loan from your bank to build a dry dock to store boats for customers. At the end of the year, he prepared the following statements based on information stored in a large filing cabinet: Page 168 The following is a summary of completed transactions: a. Received the following contributions (at fair value) to the business from the owner when it was started in exchange for 1,000 shares of \$1 par value common stock in the new company: b. Earned service fees during the current year of $87,000; of the cash collected, $20,000 was for deposits from customers on work to be done by Julio in the next year. c. Received the cash dividends on shares of ABC Industrial stock purchased by Julio Estela six years earlier (the stock was not owned by the company). d. Incurred operating expenses during the current year of $61,000. e. Determined amount of supplies on hand (unused) at the end of the current year as $700. f. A temporary employee, subsequently fired, stole $500 cash from the business. There was no insurance coverage for theft. g. Purchased tools and equipment during the year. Required: 1. Did Julio prepare the income statement on a cash basis or an accrual basis? Explain how you can tell. Which basis should be used? Explain why. 2. Reconstruct the correct entries under accrual accounting principles and post the effects to T-accounts. 3. Prepare an accrual-based income statement, statement of stockholder's equity (only one shareholder), and a classified balance sheet. Explain (using footnotes) the reason for each change that you make to the income statement. 4. What additional information would assist you in formulating your decision regarding the loan to Julio? 5. Based on the revised financial statements and any additional information needed, write a letter to Julio explaining your decision at this time regarding the loan Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started