Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Making as many references to the case study as possible, please answer the following questions. (i) How much is the Return on Equity Shares of

Making as many references to the case study as possible, please answer the following questions.

(i) How much is the Return on Equity Shares of Dane sensitive to the Returns on Market Portfolio?

(ii) How do you think that the Efficient Market Hypothesis will affect Ms. Amanda Cohen's planning?

(iii) Calculate the weighted average cost of capital, using the most appropriate weights. Discuss implications of such computed weighted average cost of capital.

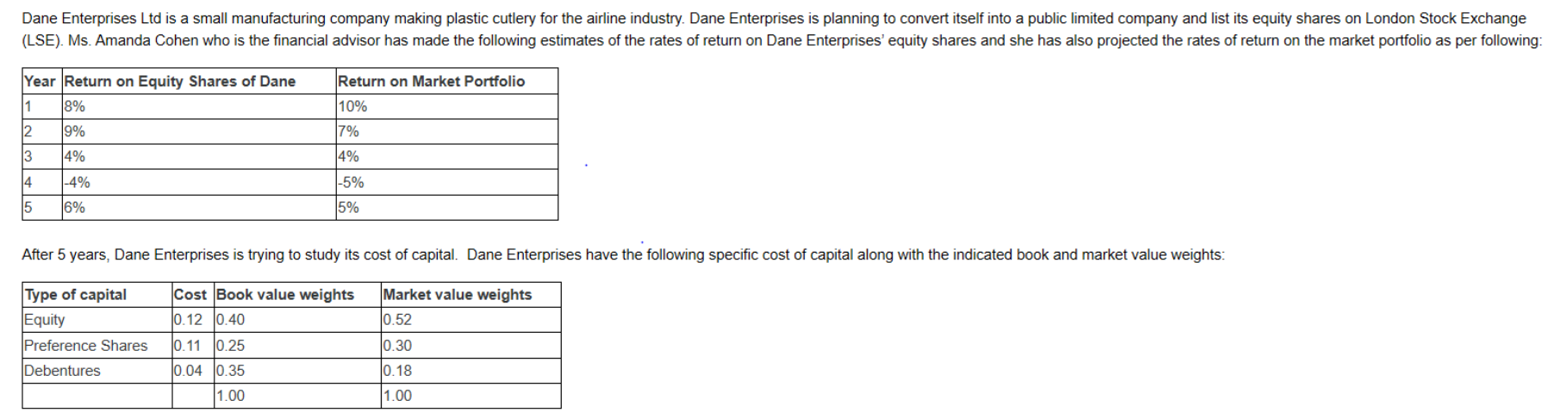

Dane Enterprises Ltd is a small manufacturing company making plastic cutlery for the airline industry. Dane Enterprises is planning to convert itself into a public limited company and list its equity shares on London Stock Exchange (LSE). Ms. Amanda Cohen who is the financial advisor has made the following estimates of the rates of return on Dane Enterprises' equity shares and she has also projected the rates of return on the market portfolio as per following: Year Return on Equity Shares of Dane Return on Market Portfolio 10% 18% 19% 34% 4 -4% 5 16% 7% 4% -5% 15% After 5 years, Dane Enterprises is trying to study its cost of capital. Dane Enterprises have the following specific cost of capital along with the indicated book and market value weights: Market value weights 0.52 Type of capital Equity Preference Shares Debentures Cost Book value weights 10.12 0.40 0.11 0.25 10.04 0.35 10.30 0.18 1.00 1.00 Dane Enterprises Ltd is a small manufacturing company making plastic cutlery for the airline industry. Dane Enterprises is planning to convert itself into a public limited company and list its equity shares on London Stock Exchange (LSE). Ms. Amanda Cohen who is the financial advisor has made the following estimates of the rates of return on Dane Enterprises' equity shares and she has also projected the rates of return on the market portfolio as per following: Year Return on Equity Shares of Dane Return on Market Portfolio 10% 18% 19% 34% 4 -4% 5 16% 7% 4% -5% 15% After 5 years, Dane Enterprises is trying to study its cost of capital. Dane Enterprises have the following specific cost of capital along with the indicated book and market value weights: Market value weights 0.52 Type of capital Equity Preference Shares Debentures Cost Book value weights 10.12 0.40 0.11 0.25 10.04 0.35 10.30 0.18 1.00 1.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started