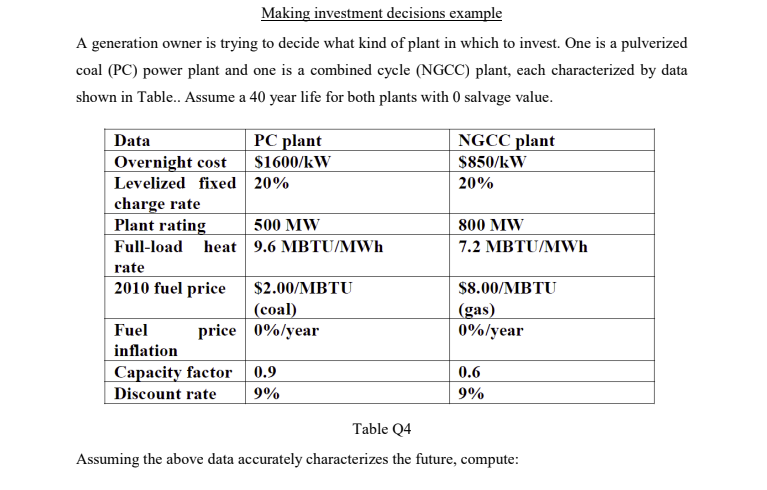

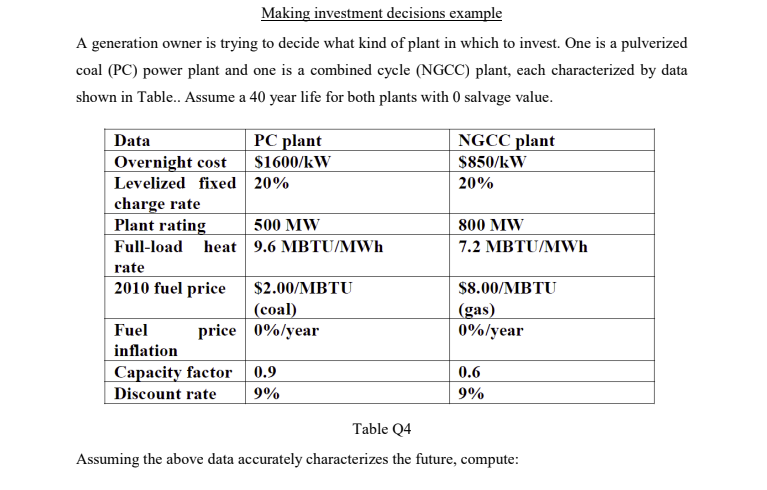

Making investment decisions example A generation owner is trying to decide what kind of plant in which to invest. One is a pulverized coal (PC) power plant and one is a combined cycle (NGCC) plant, each characterized by data shown in Table.. Assume a 40 year life for both plants with 0 salvage value. NGCC plant $850/kW 20% 800 MW 7.2 MBTU/MWh Data PC plant Overnight cost $1600/kW Levelized fixed 20% charge rate Plant rating 500 MW Full-load heat 9.6 MBTU/MWh rate 2010 fuel price $2.00/MBTU (coal) Fuel price 0%/year inflation Capacity factor 0.9 Discount rate 9% $8.00/ MBTU (gas) 0%/year 0.6 9% Table Q4 Assuming the above data accurately characterizes the future, compute: a) the lifetime operational cost for the two plants, assuming they operate at the given capacity factor 8760 hrs/year, b) the annual fixed charges for the two plants c) the total annual costs for the three plants d) the present value of the investment plus operating cost e) indicate which plant represents the least cost investment Making investment decisions example A generation owner is trying to decide what kind of plant in which to invest. One is a pulverized coal (PC) power plant and one is a combined cycle (NGCC) plant, each characterized by data shown in Table.. Assume a 40 year life for both plants with 0 salvage value. NGCC plant $850/kW 20% 800 MW 7.2 MBTU/MWh Data PC plant Overnight cost $1600/kW Levelized fixed 20% charge rate Plant rating 500 MW Full-load heat 9.6 MBTU/MWh rate 2010 fuel price $2.00/MBTU (coal) Fuel price 0%/year inflation Capacity factor 0.9 Discount rate 9% $8.00/ MBTU (gas) 0%/year 0.6 9% Table Q4 Assuming the above data accurately characterizes the future, compute: a) the lifetime operational cost for the two plants, assuming they operate at the given capacity factor 8760 hrs/year, b) the annual fixed charges for the two plants c) the total annual costs for the three plants d) the present value of the investment plus operating cost e) indicate which plant represents the least cost investment