Answered step by step

Verified Expert Solution

Question

1 Approved Answer

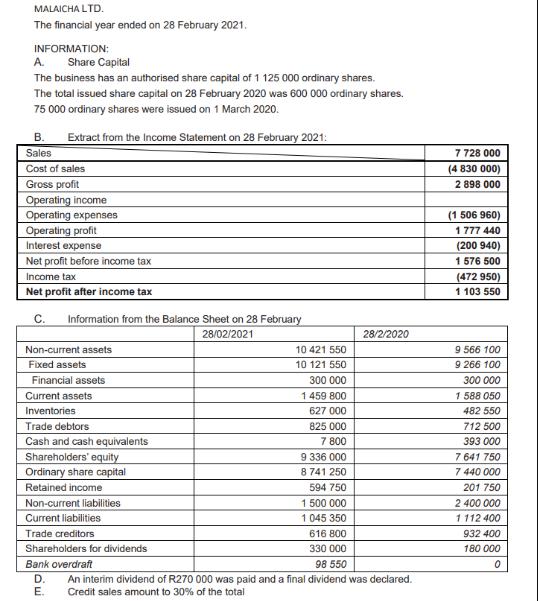

MALAICHA LTD. The financial year ended on 28 February 2021. INFORMATION: A. Share Capital The business has an authorised share capital of 1 125

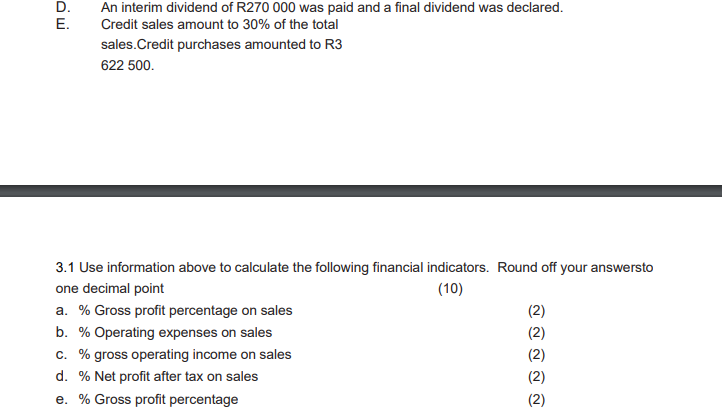

MALAICHA LTD. The financial year ended on 28 February 2021. INFORMATION: A. Share Capital The business has an authorised share capital of 1 125 000 ordinary shares. The total issued share capital on 28 February 2020 was 600 000 ordinary shares. 75 000 ordinary shares were issued on 1 March 2020. Extract from the Income Statement on 28 February 2021: B. Sales Cost of sales Gross profit Operating income Operating expenses Operating profit Interest expense Net profit before income tax Income tax Net profit after income tax C. Information from the Balance Sheet on 28 February 28/02/2021 Non-current assets Fixed assets Financial assets Current assets Inventories Trade debtors Cash and cash equivalents Shareholders' equity Ordinary share capital Retained income 10 421 550 10 121 550 300 000 1 459 800 627 000 825 000 7 800 9 336 000 8 741 250 594 750 1 500 000 1 045 350 28/2/2020 Non-current liabilities Current liabilities Trade creditors Shareholders for dividends Bank overdraft D. An interim dividend of R270 000 was paid and a final dividend was declared. Credit sales amount to 30% of the total E. 616 800 330 000 98 550 7 728 000 (4 830 000) 2 898 000 (1 506 960) 1 777 440 (200 940) 1 576 500 (472 950) 1 103 550 9 566 100 9 266 100 300 000 1 588 050 482 550 712 500 393 000 7 641 750 7 440 000 201 750 2 400 000 1 112 400 932 400 180 000 0 D. E. An interim dividend of R270 000 was paid and a final dividend was declared. Credit sales amount to 30% of the total sales.Credit purchases amounted to R3 622 500. 3.1 Use information above to calculate the following financial indicators. Round off your answersto one decimal point (10) a. % Gross profit percentage on sales b. % Operating expenses on sales c. % gross operating income on sales d. % Net profit after tax on sales e. % Gross profit percentage (2) (2) (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Gross profit percentage on sales To calculate the gross profit percentage on sales we use the following formula Gross Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started