Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Malaysian taxation Bell Bhd, a manufacturer of bell for residential and commercial properties with paid-up share capital of RM3.2 million. The accounts are closed on

Malaysian taxation

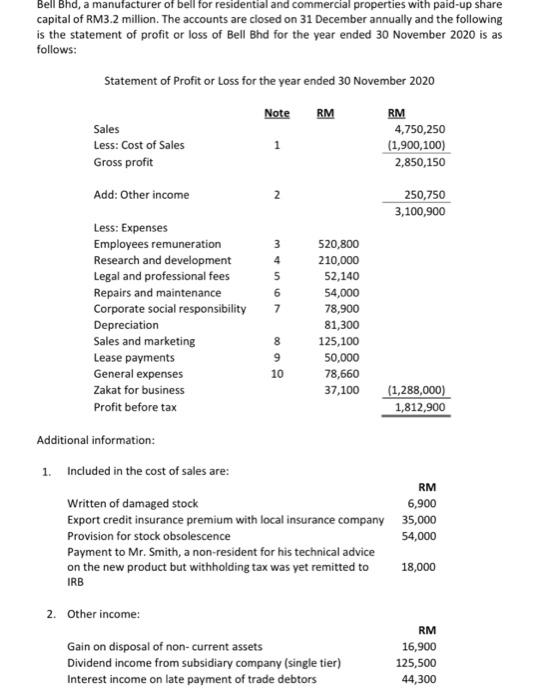

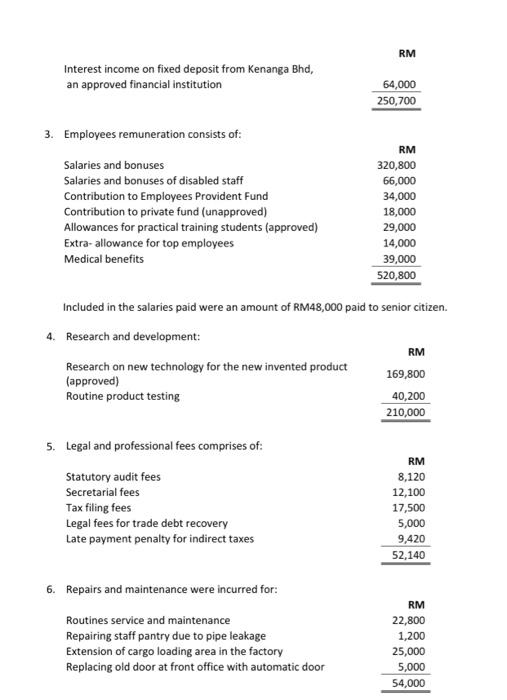

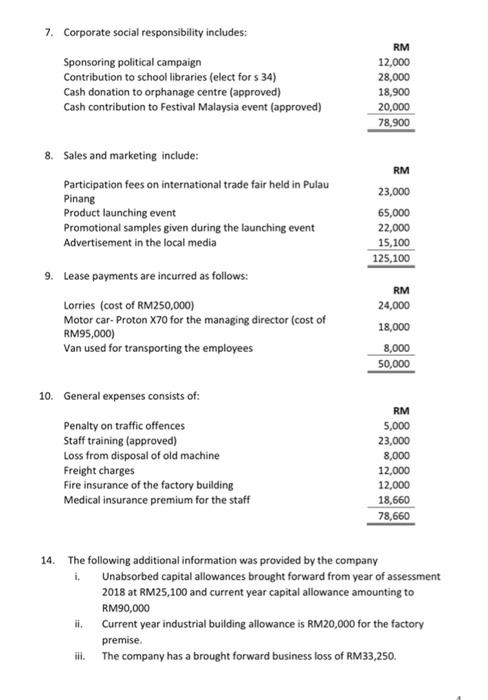

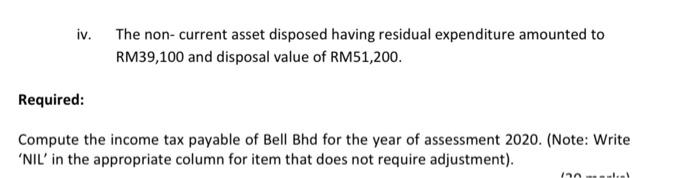

Bell Bhd, a manufacturer of bell for residential and commercial properties with paid-up share capital of RM3.2 million. The accounts are closed on 31 December annually and the following is the statement of profit or loss of Bell Bhd for the year ended 30 November 2020 is as follows: Statement of Profit or Loss for the year ended 30 November 2020 Note RM Sales Less: Cost of Sales Gross profit 1 RM 4,750,250 (1,900,100) 2,850,150 Add: Other income 2 250,750 3,100,900 3 4 5 6 7 Less: Expenses Employees remuneration Research and development Legal and professional fees Repairs and maintenance Corporate social responsibility Depreciation Sales and marketing Lease payments General expenses Zakat for business Profit before tax 520,800 210,000 52,140 54,000 78,900 81,300 125,100 50,000 78,660 37,100 8 9 10 (1,288,000) 1,812,900 Additional information: 1. Included in the cost of sales are: RM Written of damaged stock 6,900 Export credit insurance premium with local insurance company 35,000 Provision for stock obsolescence 54,000 Payment to Mr. Smith, a non-resident for his technical advice on the new product but withholding tax was yet remitted to 18,000 IRB 2. Other income: Gain on disposal of non-current assets Dividend income from subsidiary company (single tier) Interest income on late payment of trade debtors RM 16,900 125,500 44,300 RM Interest income on fixed deposit from Kenanga Bhd, an approved financial institution 64,000 250,700 3. Employees remuneration consists of: Salaries and bonuses Salaries and bonuses of disabled staff Contribution to Employees Provident Fund Contribution to private fund (unapproved) Allowances for practical training students (approved) Extra- allowance for top employees Medical benefits RM 320,800 66,000 34,000 18,000 29,000 14,000 39,000 520,800 Included in the salaries paid were an amount of RM48,000 paid to senior citizen. 4. Research and development: RM Research on new technology for the new invented product 169,800 (approved) Routine product testing 40,200 210,000 5. Legal and professional fees comprises of: Statutory audit fees Secretarial fees Tax filing fees Legal fees for trade debt recovery Late payment penalty for indirect taxes RM 8,120 12,100 17,500 5,000 9,420 52,140 6. Repairs and maintenance were incurred for: Routines service and maintenance Repairing staff pantry due to pipe leakage Extension of cargo loading area in the factory Replacing old door at front office with automatic door RM 22,800 1,200 25,000 5,000 54,000 7. Corporate social responsibility includes: Sponsoring political campaign Contribution to school libraries (elect for s 34) Cash donation to orphanage centre (approved) Cash contribution to Festival Malaysia event (approved) RM 12,000 28,000 18,900 20,000 78,900 8. Sales and marketing include: Participation fees on international trade fair held in Pulau Pinang Product launching event Promotional samples given during the launching event Advertisement in the local media RM 23,000 65,000 22,000 15,100 125,100 9. Lease payments are incurred as follows: Lorries (cost of RM250,000) Motor car- Proton X70 for the managing director (cost of RM95,000) Van used for transporting the employees RM 24,000 18,000 8,000 50,000 10. General expenses consists of: Penalty on traffic offences Staff training (approved) Loss from disposal of old machine Freight charges Fire insurance of the factory building Medical insurance premium for the staff RM 5,000 23,000 8,000 12,000 12,000 18,660 78,660 i. 14. The following additional information was provided by the company Unabsorbed capital allowances brought forward from year of assessment 2018 at RM25,100 and current year capital allowance amounting to RM90,000 Hi. Current year industrial building allowance is RM20,000 for the factory premise. The company has a brought forward business loss of RM33,250. it. iv. The non-current asset disposed having residual expenditure amounted to RM39,100 and disposal value of RM51,200. Required: Compute the income tax payable of Bell Bhd for the year of assessment 2020. (Note: Write "NIL' in the appropriate column for item that does not require adjustment). inn Bell Bhd, a manufacturer of bell for residential and commercial properties with paid-up share capital of RM3.2 million. The accounts are closed on 31 December annually and the following is the statement of profit or loss of Bell Bhd for the year ended 30 November 2020 is as follows: Statement of Profit or Loss for the year ended 30 November 2020 Note RM Sales Less: Cost of Sales Gross profit 1 RM 4,750,250 (1,900,100) 2,850,150 Add: Other income 2 250,750 3,100,900 3 4 5 6 7 Less: Expenses Employees remuneration Research and development Legal and professional fees Repairs and maintenance Corporate social responsibility Depreciation Sales and marketing Lease payments General expenses Zakat for business Profit before tax 520,800 210,000 52,140 54,000 78,900 81,300 125,100 50,000 78,660 37,100 8 9 10 (1,288,000) 1,812,900 Additional information: 1. Included in the cost of sales are: RM Written of damaged stock 6,900 Export credit insurance premium with local insurance company 35,000 Provision for stock obsolescence 54,000 Payment to Mr. Smith, a non-resident for his technical advice on the new product but withholding tax was yet remitted to 18,000 IRB 2. Other income: Gain on disposal of non-current assets Dividend income from subsidiary company (single tier) Interest income on late payment of trade debtors RM 16,900 125,500 44,300 RM Interest income on fixed deposit from Kenanga Bhd, an approved financial institution 64,000 250,700 3. Employees remuneration consists of: Salaries and bonuses Salaries and bonuses of disabled staff Contribution to Employees Provident Fund Contribution to private fund (unapproved) Allowances for practical training students (approved) Extra- allowance for top employees Medical benefits RM 320,800 66,000 34,000 18,000 29,000 14,000 39,000 520,800 Included in the salaries paid were an amount of RM48,000 paid to senior citizen. 4. Research and development: RM Research on new technology for the new invented product 169,800 (approved) Routine product testing 40,200 210,000 5. Legal and professional fees comprises of: Statutory audit fees Secretarial fees Tax filing fees Legal fees for trade debt recovery Late payment penalty for indirect taxes RM 8,120 12,100 17,500 5,000 9,420 52,140 6. Repairs and maintenance were incurred for: Routines service and maintenance Repairing staff pantry due to pipe leakage Extension of cargo loading area in the factory Replacing old door at front office with automatic door RM 22,800 1,200 25,000 5,000 54,000 7. Corporate social responsibility includes: Sponsoring political campaign Contribution to school libraries (elect for s 34) Cash donation to orphanage centre (approved) Cash contribution to Festival Malaysia event (approved) RM 12,000 28,000 18,900 20,000 78,900 8. Sales and marketing include: Participation fees on international trade fair held in Pulau Pinang Product launching event Promotional samples given during the launching event Advertisement in the local media RM 23,000 65,000 22,000 15,100 125,100 9. Lease payments are incurred as follows: Lorries (cost of RM250,000) Motor car- Proton X70 for the managing director (cost of RM95,000) Van used for transporting the employees RM 24,000 18,000 8,000 50,000 10. General expenses consists of: Penalty on traffic offences Staff training (approved) Loss from disposal of old machine Freight charges Fire insurance of the factory building Medical insurance premium for the staff RM 5,000 23,000 8,000 12,000 12,000 18,660 78,660 i. 14. The following additional information was provided by the company Unabsorbed capital allowances brought forward from year of assessment 2018 at RM25,100 and current year capital allowance amounting to RM90,000 Hi. Current year industrial building allowance is RM20,000 for the factory premise. The company has a brought forward business loss of RM33,250. it. iv. The non-current asset disposed having residual expenditure amounted to RM39,100 and disposal value of RM51,200. Required: Compute the income tax payable of Bell Bhd for the year of assessment 2020. (Note: Write "NIL' in the appropriate column for item that does not require adjustment). inn Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started