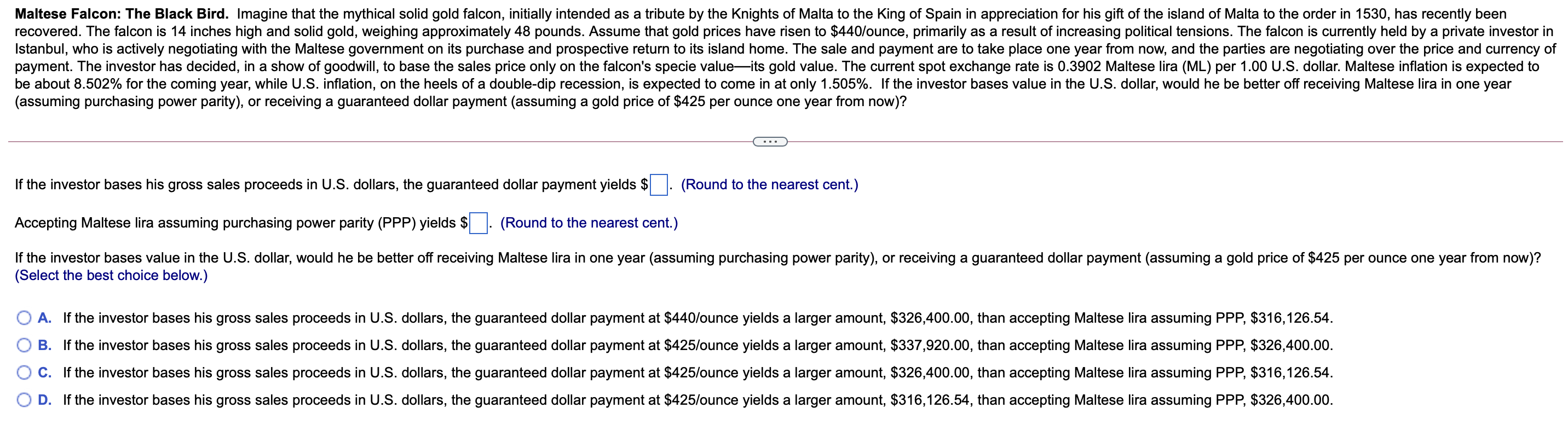

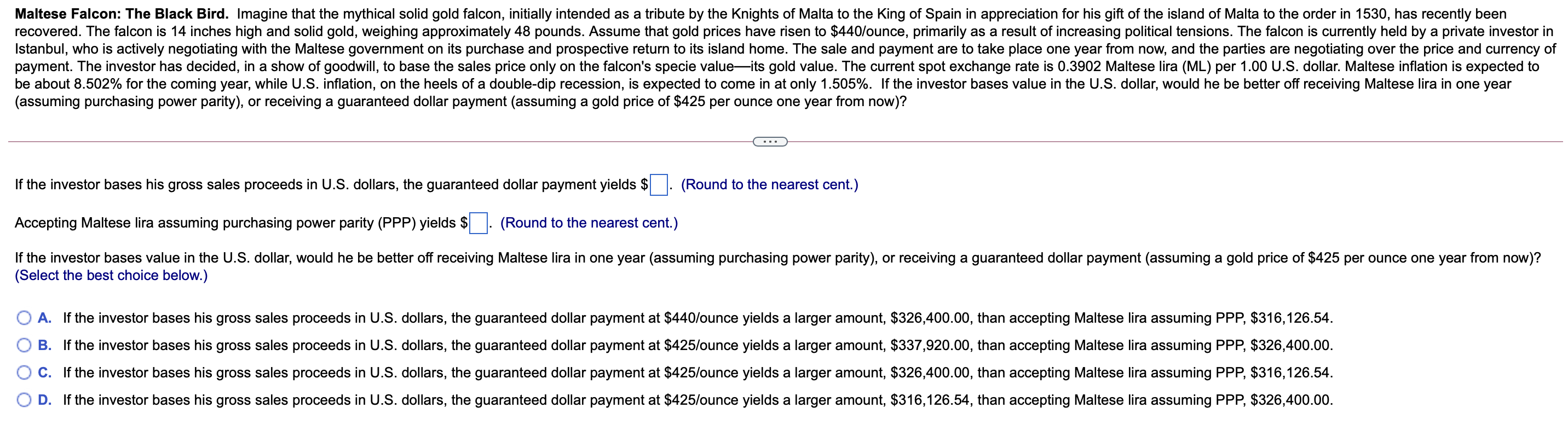

Maltese Falcon: The Black Bird. Imagine that the mythical solid gold falcon, initially intended as a tribute by the Knights of Malta to the King of Spain in appreciation for his gift of the island of Malta to the order in 1530, has recently been recovered. The falcon is 14 inches high and solid gold, weighing approximately 48 pounds. Assume that gold prices have risen to $440/ounce, primarily as a result of increasing political tensions. The falcon is currently held by a private investor in Istanbul, who is actively negotiating with the Maltese government on its purchase and prospective return to its island home. The sale and payment are to take place one year from now, and the parties are negotiating over the price and currency of payment. The investor has decided, in a show of goodwill, to base the sales price only on the falcon's specie valueits gold value. The current spot exchange rate is 0.3902 Maltese lira (ML) per 1.00 U.S. dollar. Maltese inflation is expected to be about 8.502% for the coming year, while U.S. inflation, on the heels of a double-dip recession, is expected to come in at only 1.505%. If the investor bases value in the U.S. dollar, would he be better off receiving Maltese lira in one year (assuming purchasing power parity), or receiving a guaranteed dollar payment (assuming a gold price of $425 per ounce one year from now)? If the investor bases his gross sales proceeds in U.S. dollars, the guaranteed dollar payment yields $ (Round to the nearest cent.) Accepting Maltese lira assuming purchasing power parity (PPP) yields $ (Round to the nearest cent.) If the investor bases value in the U.S. dollar, would he be better off receiving Maltese lira in one year (assuming purchasing power parity), or receiving a guaranteed dollar payment (assuming a gold price of $425 per ounce one year from now)? (Select the best choice below.) A. If the investor bases his gross sales proceeds in U.S. dollars, the guaranteed dollar payment at $440/ounce yields a larger amount, $326,400.00, than accepting Maltese lira assuming PPP, $316,126.54. B. If the investor bases his gross sales proceeds in U.S. dollars, the guaranteed dollar payment at $425/ounce yields a larger amount, $337,920.00, than accepting Maltese lira assuming PPP, $326,400.00. C. If the investor bases his gross sales proceeds in U.S. dollars, the guaranteed dollar payment at $425/ounce yields a larger amount, $326,400.00, than accepting Maltese lira assuming PPP, $316,126.54. D. If the investor bases his gross sales proceeds in U.S. dollars, the guaranteed dollar payment at $425/ounce yields a larger amount, $316,126.54, than accepting Maltese lira assuming PPP, $326,400.00