Question

Malusi Zondo has been offered four investment opportunities, currently all equally priced at R45 000. Because the opportunities differ in terms of risk. Malusi's

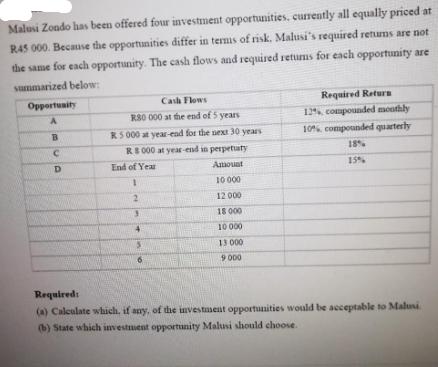

Malusi Zondo has been offered four investment opportunities, currently all equally priced at R45 000. Because the opportunities differ in terms of risk. Malusi's required returns are not the same for each opportunity. The cash flows and required returns for each opportunity are summarized below: Opportunity A B Cash Flows R80 000 at the end of 5 years R5 000 at year-end for the next 30 years RS 000 at year-end in perpetuity Amount 10000 12 000 18 000 10 000 End of Year 1 2 13.000 9.000 Required Return 12%, compounded monthly 10% compounded quarterly 18% 15% Required: (a) Calculate which, if any, of the investment opportunities would be acceptable to Malusi (b) State which investment opportunity Malusi should choose.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App