Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Management Accounting marks) Assignment-2(5 Due: (11:59 pm, Oct 31) Instruction: Make a group of 3 to 5 students, and choose a team leader. The

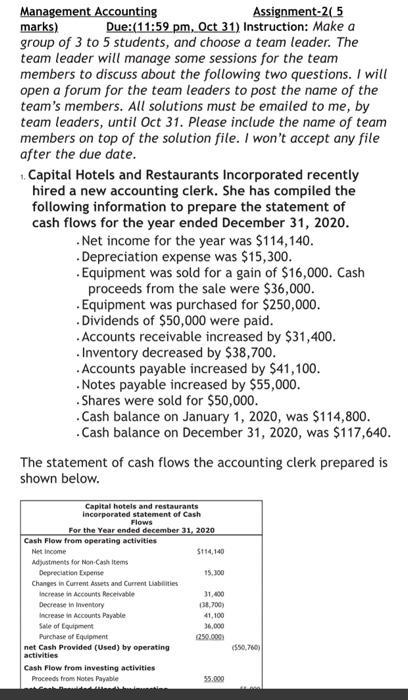

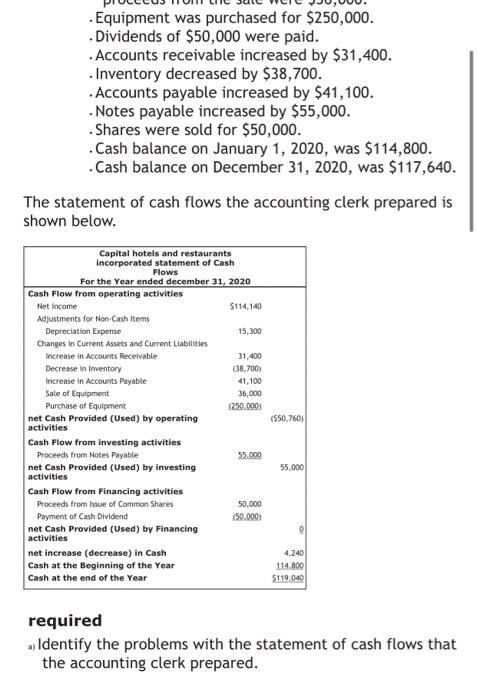

Management Accounting marks) Assignment-2(5 Due: (11:59 pm, Oct 31) Instruction: Make a group of 3 to 5 students, and choose a team leader. The team leader will manage some sessions for the team members to discuss about the following two questions. I will open a forum for the team leaders to post the name of the team's members. All solutions must be emailed to me, by team leaders, until Oct 31. Please include the name of team members on top of the solution file. I won't accept any file after the due date. 1. Capital Hotels and Restaurants Incorporated recently hired a new accounting clerk. She has compiled the following information to prepare the statement of cash flows for the year ended December 31, 2020. .Net income for the year was $114,140. .Depreciation expense was $15,300. Equipment was sold for a gain of $16,000. Cash proceeds from the sale were $36,000. Equipment was purchased for $250,000. .Dividends of $50,000 were paid. .Accounts receivable increased by $31,400. .Inventory decreased by $38,700. Accounts payable increased by $41,100. .Notes payable increased by $55,000. .Shares were sold for $50,000. . Cash balance on January 1, 2020, was $114,800. Cash balance on December 31, 2020, was $117,640. The statement of cash flows the accounting clerk prepared is shown below. Capital hotels and restaurants incorporated statement of Cash Flows For the Year ended december 31, 2020 Cash Flow from operating activities Net Income Adjustments for Non-Cash Items Depreciation Expense Changes in Current Assets and Current Liabilities increase in Accounts Receivable Decrease in Inventory Increase in Accounts Payable Sale of Equipment Purchase of Equipment net Cash Provided (Used) by operating activities Cash Flow from investing activities Proceeds from Notes Payable Med mi $114,140 15.300 31,400 (38,700) 41,100 36,000 55.000 (550,760) . Equipment was purchased for $250,000. .Dividends of $50,000 were paid. .Accounts receivable increased by $31,400. . Inventory decreased by $38,700. Accounts payable increased by $41,100. .Notes payable increased by $55,000. . Shares were sold for $50,000. . Cash balance on January 1, 2020, was $114,800. .Cash balance on December 31, 2020, was $117,640. The statement of cash flows the accounting clerk prepared is shown below. Capital hotels and restaurants incorporated statement of Cash Flows For the Year ended december 31, 2020 $114,140 Cash Flow from operating activities Net Income Adjustments for Non-Cash Items Depreciation Expense Changes in Current Assets and Current Liabilities Increase in Accounts Receivable Decrease in Inventory Increase in Accounts Payable Sale of Equipment Purchase of Equipment net Cash Provided (Used) by operating activities Cash Flow from investing activities Proceeds from Notes Payable net Cash Provided (Used) by investing activities Cash Flow from Financing activities Proceeds from Issue of Common Shares Payment of Cash Dividend net Cash Provided (Used) by Financing activities net increase (decrease) in Cash Cash at the Beginning of the Year Cash at the end of the Year 15,300 31,400 (38,700) 41,100 36,000 (250.000) 55.000 50,000 (50.000) ($50,760) 55,000 0 4,240 114.800 $119,040 required a) Identify the problems with the statement of cash flows that the accounting clerk prepared.

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The problems with the statement of cash flows prepared by the accounting clerk are as follows Incr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started