Answered step by step

Verified Expert Solution

Question

1 Approved Answer

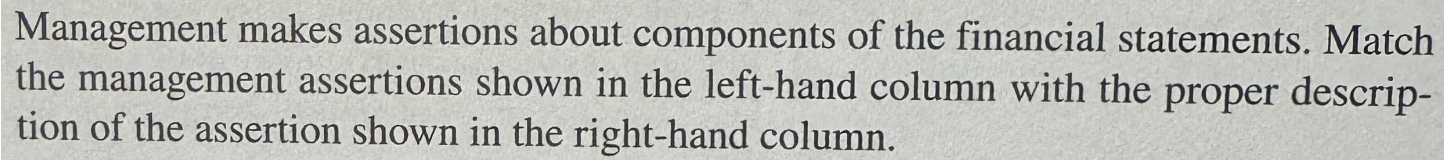

Management makes assertions about components of the financial statements. Match the management assertions shown in the left-hand column with the proper descrip- tion of

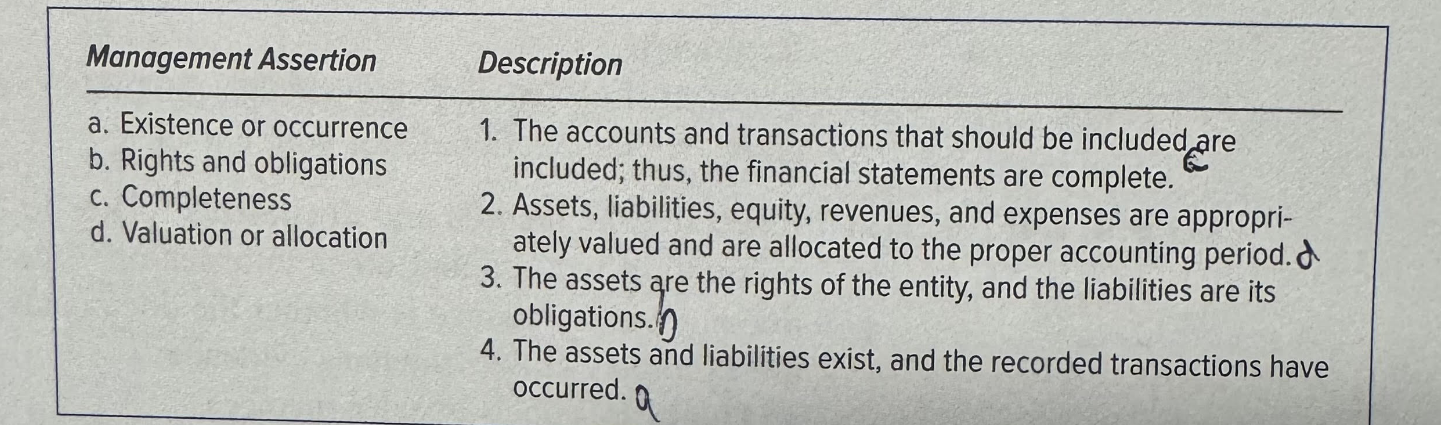

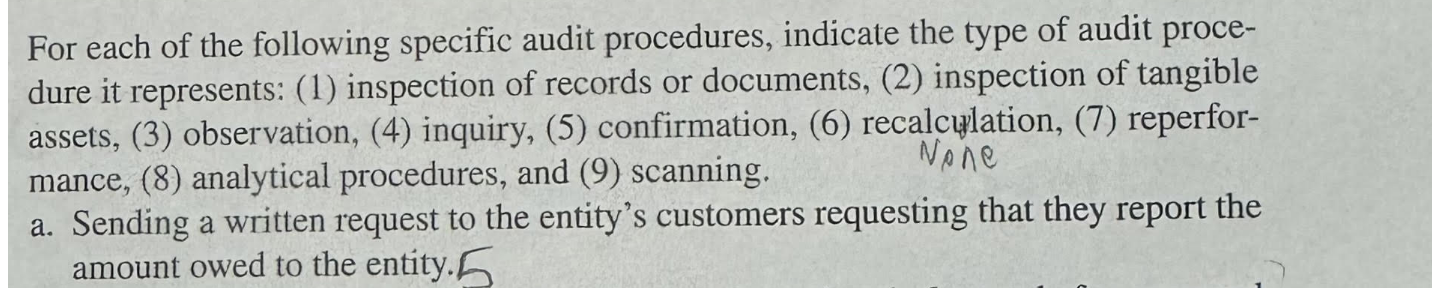

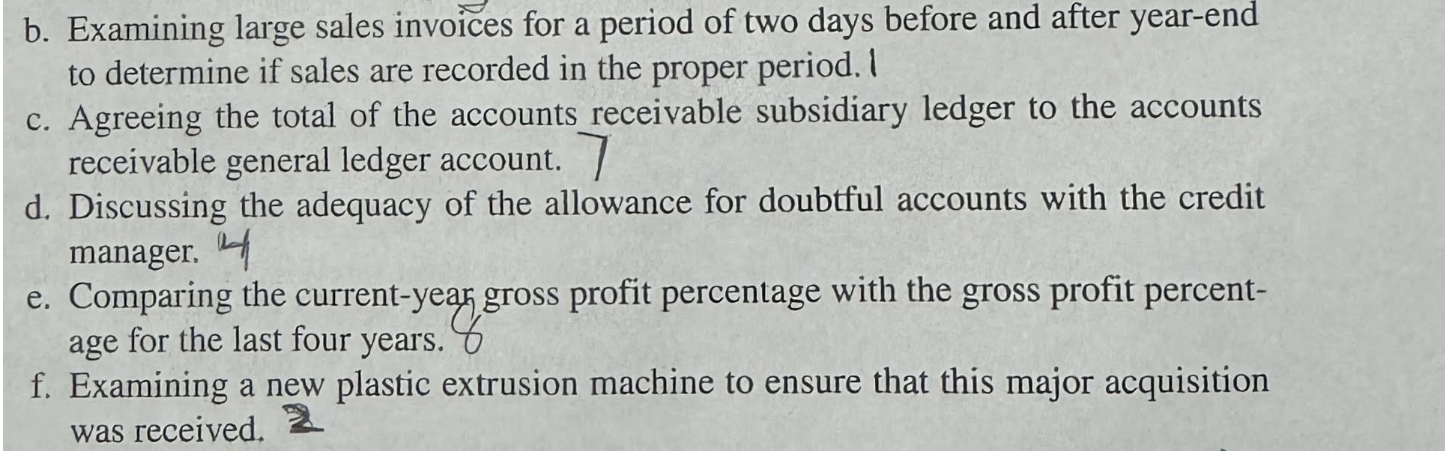

Management makes assertions about components of the financial statements. Match the management assertions shown in the left-hand column with the proper descrip- tion of the assertion shown in the right-hand column. Management Assertion a. Existence or occurrence b. Rights and obligations c. Completeness d. Valuation or allocation Description 1. The accounts and transactions that should be included are included; thus, the financial statements are complete. 2. Assets, liabilities, equity, revenues, and expenses are appropri- ately valued and are allocated to the proper accounting period. 3. The assets are the rights of the entity, and the liabilities are its obligations. 4. The assets and liabilities exist, and the recorded transactions have occurred. For each of the following specific audit procedures, indicate the type of audit proce- dure it represents: (1) inspection of records or documents, (2) inspection of tangible assets, (3) observation, (4) inquiry, (5) confirmation, (6) recalculation, (7) reperfor- None mance, (8) analytical procedures, and (9) scanning. a. Sending a written request to the entity's customers requesting that they report the amount owed to the entity. b. Examining large sales invoices for a period of two days before and after year-end to determine if sales are recorded in the proper period. c. Agreeing the total of the accounts receivable subsidiary ledger to the accounts receivable general ledger account. 7 d. Discussing the adequacy of the allowance for doubtful accounts with the credit manager. e. Comparing the current-year gross profit percentage with the gross profit percent- f. Examining a new plastic extrusion machine to ensure that this major acquisition was received. 2 g. Watching the entity's warehouse personnel count the raw materials inventory. h. Performing test counts of the warehouse personnel's count of the raw material. i. Obtaining a letter from the entity's attorney indicating that there were no lawsuits in progress against the entity. j. Tracing the prices used by the entity's billing program for pricing sales invoices to the entity's approved price list. k. Reviewing the general ledger for unusual adjusting entries. 9 5-33 For each of the audit procedures listed in Problem 5-32, identify the category (asser- tions about classes of transactions and events or assertions about account balances) and the primary assertion being tested. 5-35 Inspection of records and documents relates to the auditor's examination of entity accounting records and other information. One issue that affects the reliability of documentary evidence is whether the documents are internal or external. Following are examples of documentary evidence: 1. Duplicate copies of sales invoices. 2. Purchase orders. 3. Bank statements. 4. Remittance advices. 5. Vendors' invoices. 6. Materials requisition forms. 7. Overhead cost allocation sheets. 8. Shipping documents. 9. Payroll checks. 10. Long-term debt agreements. Required: a. Classify each document as internal or external evidence. b. Classify each document as to its reliability (high, moderate, or low) F 5-37 Audit documentation is the auditor's record of work performed and conclusions reached on an audit engagement. Required: a. What are the functions of audit documentation? b. List and describe the various types of audit documents. c. What factors affect the auditor's judgment about the form, content, and extent of audit documentation for a particular engagement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Management Assertions 1 c Completeness 2 d Valuation or allocation 3 b Rights and obligations 4 a Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started