Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Management of Braden Boats, Inc. is considering an expansion in the firm's product line that requires the purchase of an additional $199,000 in equipment with

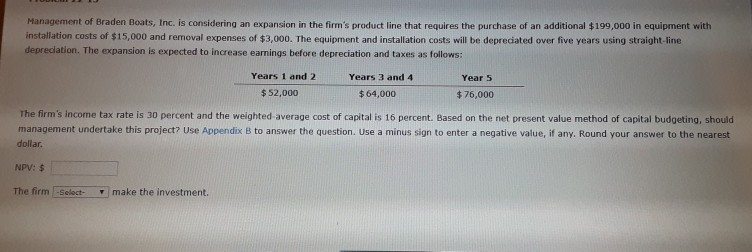

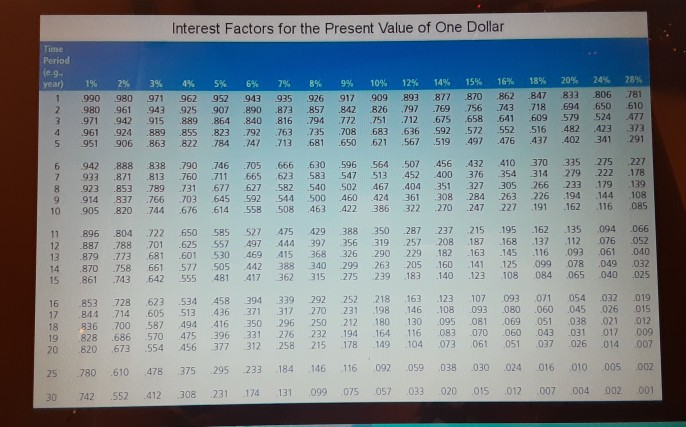

Management of Braden Boats, Inc. is considering an expansion in the firm's product line that requires the purchase of an additional $199,000 in equipment with installation costs of $15,000 and removal expenses of $3,000. The equipment and installation costs will be depreciated over five years using straight line depreciation. The expansion is expected to increase earnings before depreciation and taxes as follows: Years 1 and 2 $ 52,000 Years 3 and 4 $ 64,000 Year 5 $76,000 The firm's income tax rate is 30 percent and the weighted average cost of capital is 16 percent. Based on the net present value method of capital budgeting, should management undertake this project? Use Appendix B to answer the question. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar NPV: 5 The firm -Select- make the investment. Interest Factors for the Present Value of One Dollar Time Period Yel 18 4. W W W 9 909.12% 149. 15% 6% 18% 0. 4. 28 1 990 90 971962 952 94 95 97691390989] BI B70862,847.83] BDE JB) 198096193 95 907 BOHO R18578 Bf 1956 3718 6916506C 99429158940816 1 5658 E-M1 E959 9b9248985 15063359:55:56 APP173314 95|90b96 1 5810 1 599TATE 11 A03011 6 942 888 838 190 46 05 666 6 96 564507 456 / 410 30 335 25 277 1933 BJTB130 11 Ethini 583 54 11 42 400 1h 54 31 222 1TB H915111116262) 2012 ) 111112766731 139 1937601 6459254 500 460 424 AL) 10 284263 226 1990 14 106 | 905 820 44 676 614 558 508 46] 422 385 322 270 247 227 191 162 116 085 | % www | 896 804 22 887788 701 879 III 68] 50 FS 1861 43 642 650 585 527 475 429 388 350 287 237 215 195 162 135094 066 ES (5) 9 ) 26 319 ) 208 187 168 13 112076052 10695365 26 00 20182 163 15 16093 | file01.179 80.0 T- 55 481 7 362 15 25 29 183 140 22 108 084 065 041 125 ww 3 728 623 4 458 0 330 192 252 218 163 23 107 093071054 032 019 | DMM 10 1119316 ( 31) Fre 836700 58/ 94 46 350 96 250 212 180 130 095 08] 09051018 021 012 | 878 686 50 475 6 331 26 232 194 164 16 083 0 060 043 031 117 B20673 54 46 37 31P 5 25 178 19 104 07 06/ 05] 007 026 0h4607 25780 610 478 375 95 233 184 146 116 092 059 038 030 1024 016 010 005 002 742552 412308 231 174 131 099 05 05/033 020 015 012 007 004 002 001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started