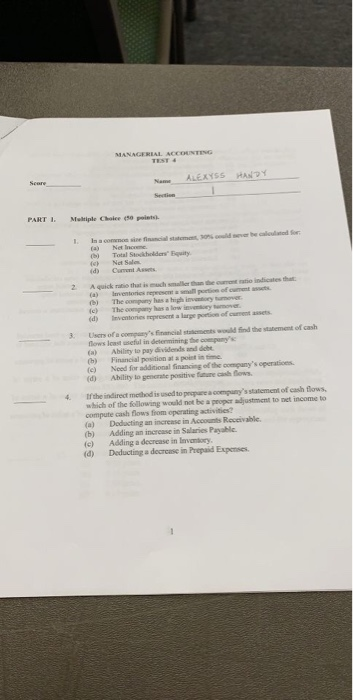

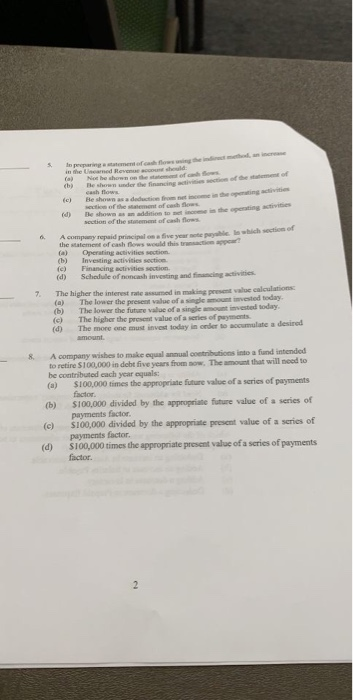

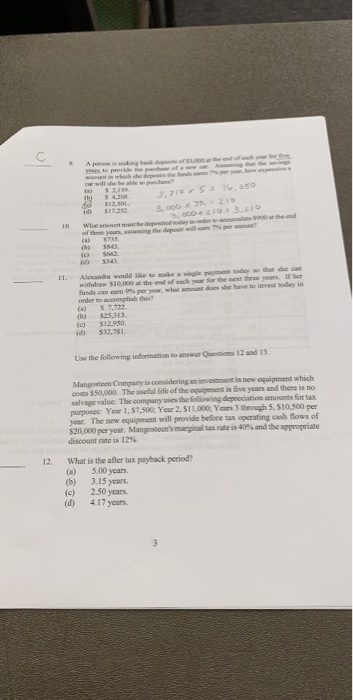

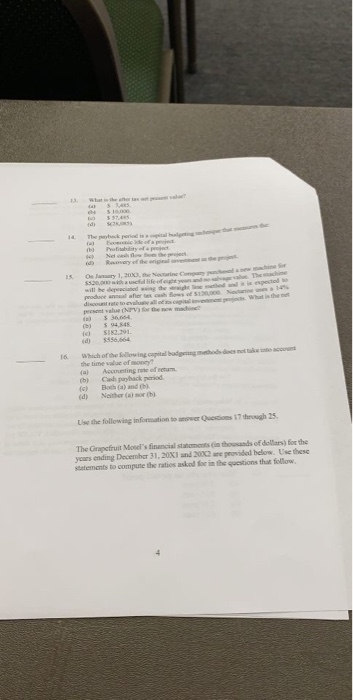

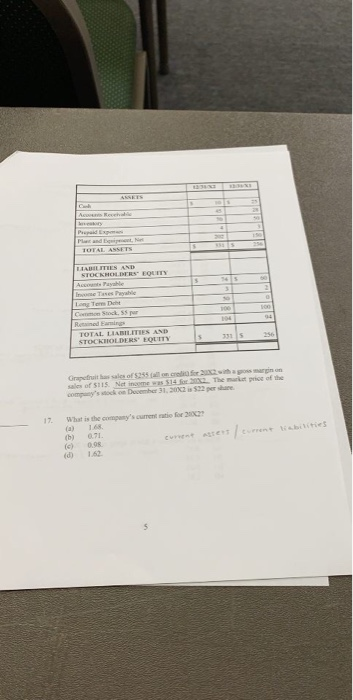

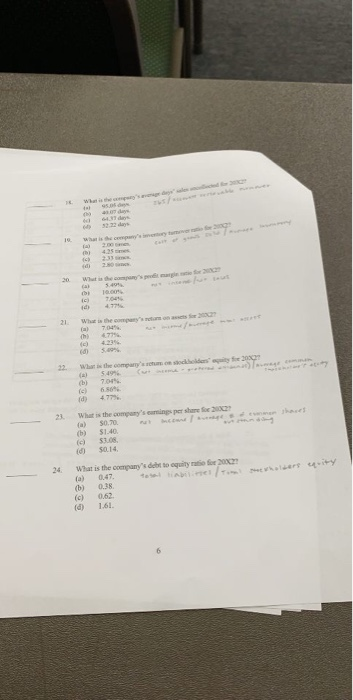

MANAGEREAL ACCOUNTING TEST 4 ALEXYSS HANDY Seare Name Section PART 1. Multiple Choice (t0 poieta Ina common sine financial statemet 30could ever be caleulated Sor (a) (b) Net Inome Total Stokhelders Bquity Net Sale Cument Asuts (d) A quick ratio that is much smeller than the curent atio indicates that Iventories rerrescta mal prtion of cument asets The company has a high invtory tumever The company has a low inventry temover Inventories represent a large portion of curent assets 2. (a) (b) (e) (d) Users of a company's financial statements would find the statement of cash flows lenst useful in determining the company's Ability to pay dividends and debe Financial position at a point in time. (a) (h) Nood for additional financing of the company's operations (c) Ability to generate positive funure cash flows (d) tthe indirect method is used to preparea company's statement of cash flows, which of the following would not be a proper adjustment to net income to compute cash flows from operating activities? Doducting an increase in Accounts Receivable. Adding an inorease in Salaries Payable. Adding a decrease in Invantory. Deducting a decrcase in Prepaid Expenses. 4. (a) (b) (d) preparing tatementof cah flows using the indiret metho, an incree in the Unearmed Revene ocou sheuld (a (b) Nee he shownm on the stateent of c os le shown under e financing ativitien anction of he stutement of cash flows He shown asa deductie fm net income in the opeating activition section of the statement of cash flows he shown as an addition to net incrme iin the operating activities section of the stanement of cash flows (c) (d) A company repaid principal on a five vear ete peable la which section of the statement of cash flows would this transaction appear (a) Operating activities section. (b) Investing activities section (c) Financing activities section. Schedule of noncash investing and financing (d) gativities The higher the interest rate assumed inmaking present value caleulations: The lower the present value of a single amount invested today. The lower the future value of a single amount invested today. The higher the present value of a series of payments The more one must invest today in crder to accumulate a desired 7. (a) (b) (c) (4) amount. A company wishes to make equal annual oontributions into a fund intended to retire S100,000 in debt five years from now, The amount that will need to be contributed each year equals: (a) S100,000 times the appropriate future value of a series of payments factor S100,000 divided by the appropriate future value of a series of payments factor. S100,000 divided by the appropriate present value of a series of payments factor. S100,000 times the appropriate present value of a series of payments factor. (b) (c) (d) end fh yer for five Auming tht the ving youhow expe e 9. A peisking hank depoits of S yees to provide te purhe of e ant in which she depi the fnds car will she he ahle te puchane a) (b) $2.19 5 4.20 3,7105= 16, a50 S12.501 S17.252 3,000x 7 210 What aunt mut he deposted day inonder colate so00 he end of three years, aing the deposit will eam 7% per a (a 10 S735 5341 Alexandra would lke to make a single payment oday so that she can withdrgw S10,000 a the end of each year Sor the next three years If her funds can ean per year, what amount does she have to invest today in order to acomplish this? (a) (b) (c) (d) S7 325311 S12.950. S32,781. Use the following information to answer Questions 12 and 13. Mangosteen Company is considering an investment in new equipment which costs $50.000. The useful life of the equipment is five years and there is no salvage value. The company uses the following depreciation amounts for tax purposes: Year 1, 57,500; Year 2, S11,000; Years 3 through 5, S10.500 per year. The new equipment will provide before tax operating cash flows of $20,000 per year. Mangosteen's marginal tas rate is 40% and the appropriale discount rate is 12% What is the after tax payback period? 5.00 years. 12. (a) 3.15 years. 2.50 years (b) (c) 4.17 years (d) What in the ater ta ps (di The paytuck perid i dhleti sh t Eo ie eofa pje Profitablity ofa pt Net ch o em the prjet Reoery of the original veet e pev 14. O Janary 1,203, the Nesturine Com heol a new machine Sor $320,00wtha uefd life ofeute ve nteesaaval The machine will he depeaciated wig the ide e tod nl i epected to produce anneal after te o fows of SI0.00 Notarine uea 14 discotte to evalue all of s cpi tet pects What is the net present value (NPV or the now madine S94.45 SIK2.291. d) Which of the following oopital badgeting methods does net take o ccount the time value of money 16 (a) Accounting rete of retum. Cah payhack period. Both (a) and (b) Neither (a) or (h) (b) (c) (4) Lise the following information to anwer Questioms 17 through 25. The Grapefruit Monel's financial statements (in thousands of dollars) for the years ending December 31, 20XI and 202 are provided below. Use these statements to compute the ratios askod for in the questions that follow. ANSETS Acco Reochae 45 Prepaid Expm and tiquipent, Ne Pla 150 TOTAL ASSETS Is 256 LIABILITIES AND STOCKHONDERS EQUITY Acconts Payahle Income Tases Payahle Long Term Deht Common Stock. S5 pur Retained Eamings 100 104 TOTAL LIABILITIES AND STOCKHOLDERS EQUITY 256 Grpefruit has sales of 5255 all on credi for 22wth a gos margin on sales of S115. Net inoome was $14 for 202 The market price of the company's stock on Deoemher 31, 202 is 22 per share. 17. What is the compeny's curent atie for 20O2 168 0.71 0.98. 162 (a) (b) (e) turrent iabilitieS curent ASters Whet i the ge's d le ctedor2 32.22 day 2 10 wha is he cpays ey tumve 4.25 times 233 20 What is the oopan's pei nargin tie r 2 10.00 7.04 4.77 What is the company's notum on asets for 22 (a) (h) 21. 7.04% 423% 5.4% (4) 22. Whar the comeany's setum on sokholders ty fe 200 5.49 (a) r atty (b) (c) 7.0% 6. 4.77 23 What is the company's eanings per share for 22 (a) (h) (6) S0.70 S1.40. $3.08 S0.14 What is the company's debt to oquity ratio fer 200 0,47. 0.38. 0,62. 161. 24. t a nes/ thalers qity (a) (b) (c) (d)