Answered step by step

Verified Expert Solution

Question

1 Approved Answer

managerial accounting 5 of them 1. Replace Equipment A manager at White Co. wants to replace an old machine with a new, more efficient machine.

managerial accounting

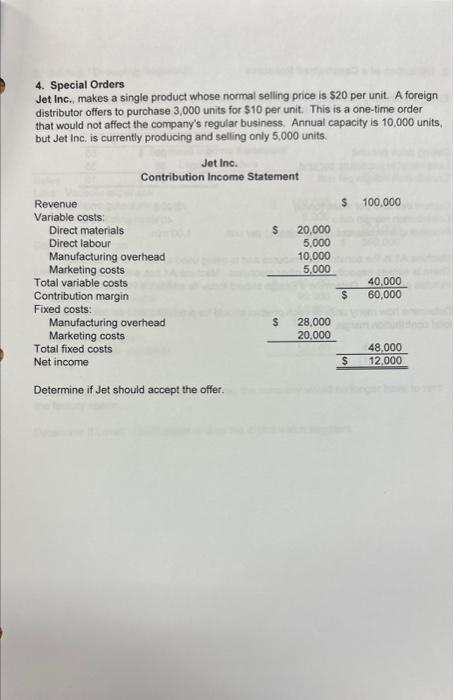

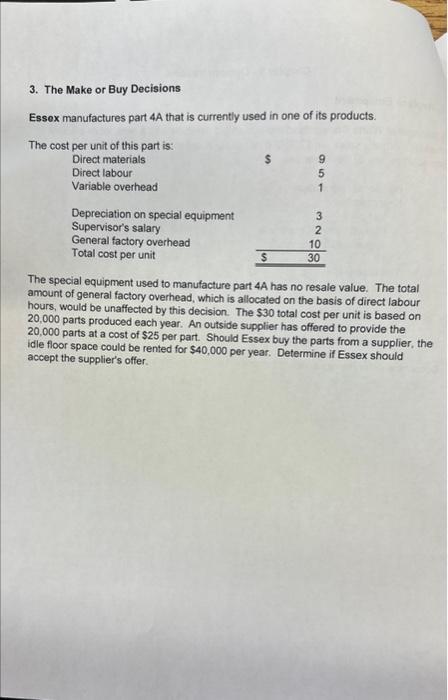

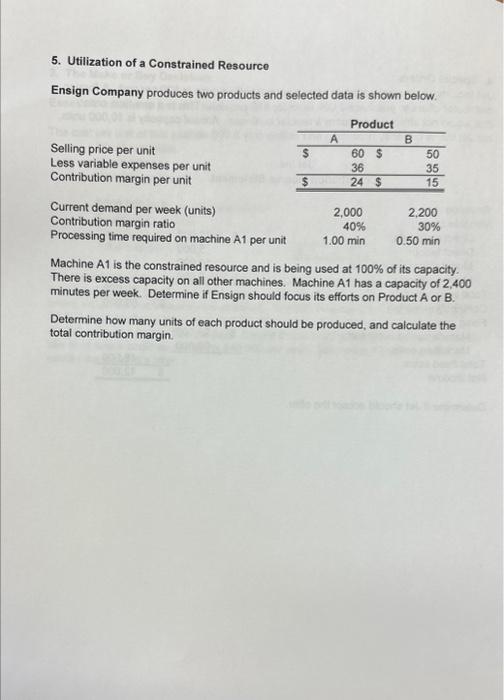

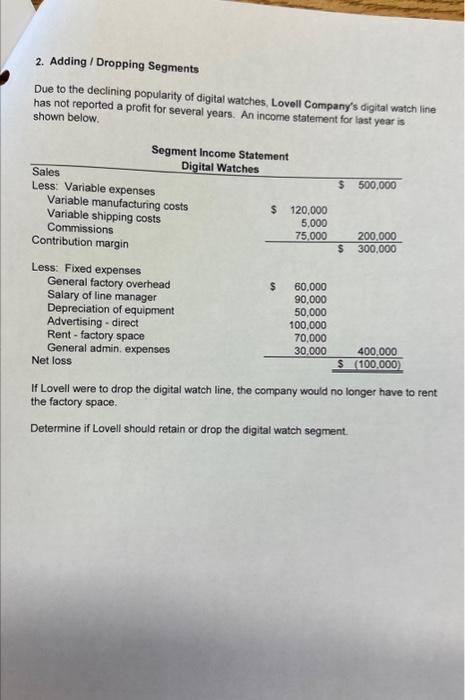

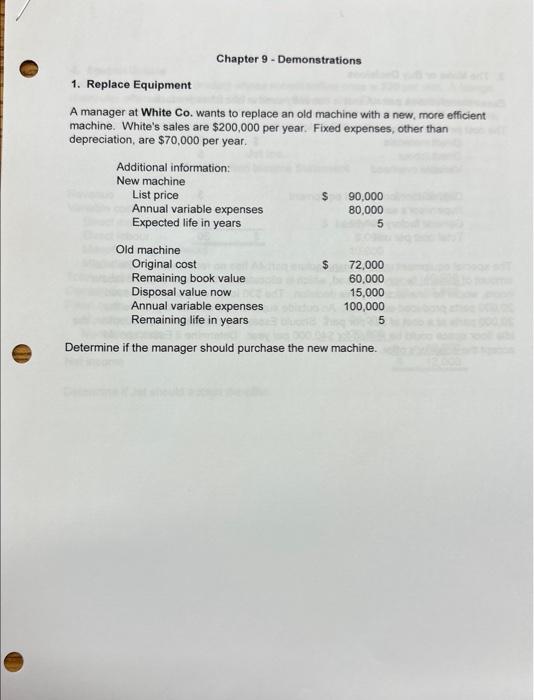

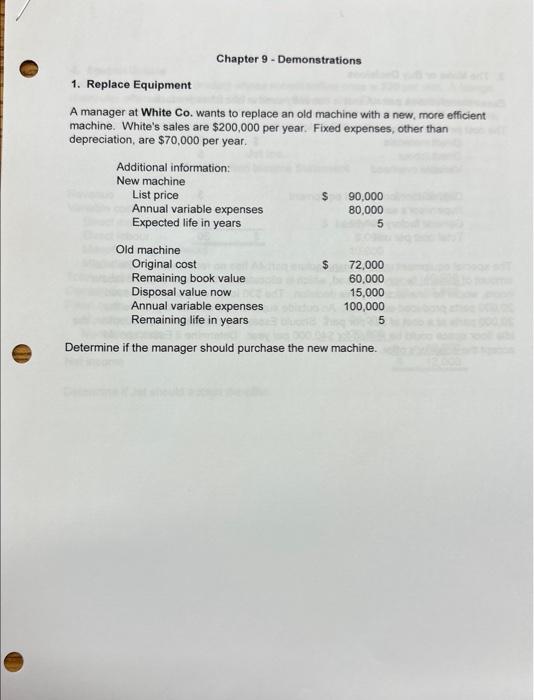

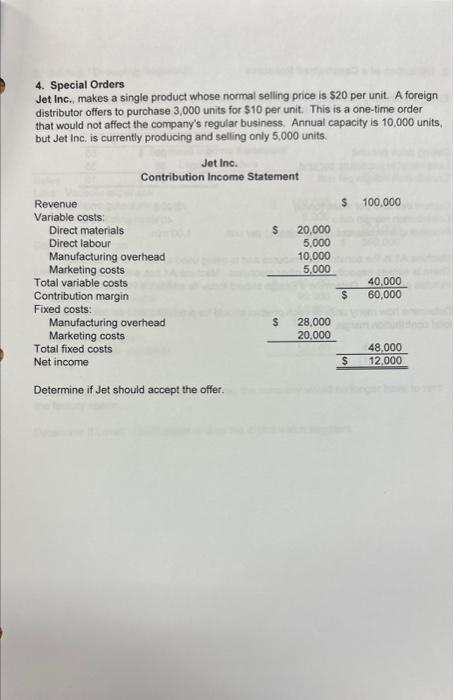

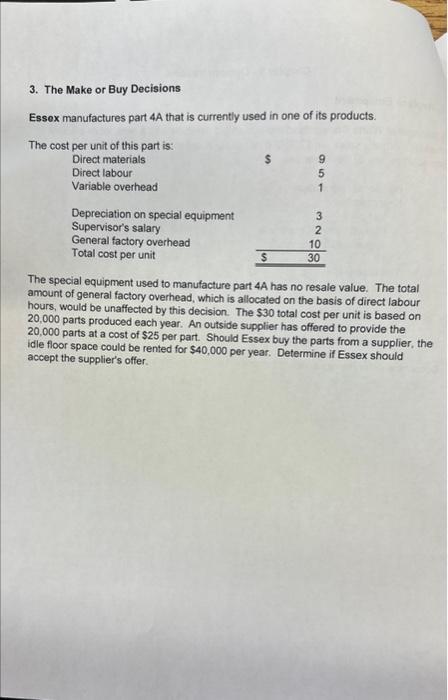

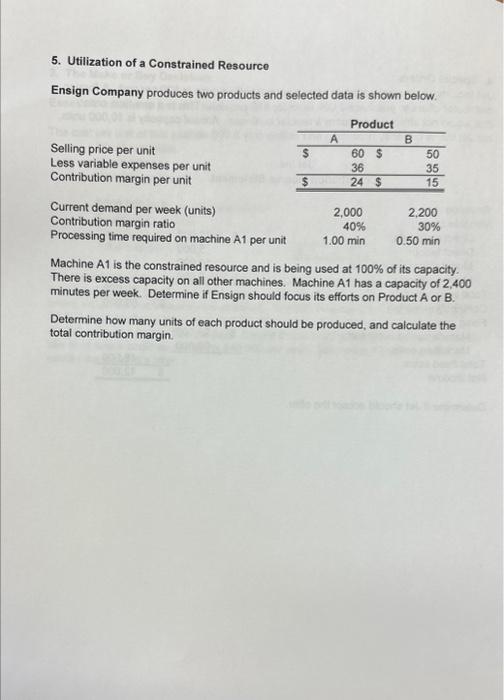

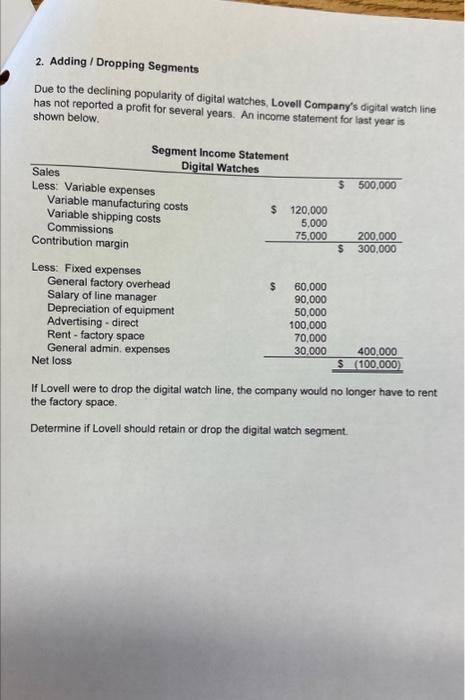

1. Replace Equipment A manager at White Co. wants to replace an old machine with a new, more efficient machine. White's sales are $200,000 per year. Fixed expenses, other than depreciation, are $70,000 per year. Determine if the manager should purchase the new machine. 4. Special Orders Jet Inc., makes a single product whose normal selling price is $20 per unit. A foreign distributor offers to purchase 3,000 units for $10 per unit. This is a one-time order that would not affect the company's regular business. Annual capacity is 10,000 units, but Jet Inc. is currently producing and selling only 5,000 units. Determine if Jet should accept the offer. 3. The Make or Buy Decisions Essex manufactures part 4A that is currently used in one of its products. The special equipment used to manufacture part 4A has no resale value. The total amount of general factory overhead, which is allocated on the basis of direct labour hours, would be unaffected by this decision. The $30 total cost per unit is based on 20,000 parts produced each year. An outside supplier has offered to provide the 20,000 parts at a cost of $25 per part. Should Essex buy the parts from a supplier, the idle floor space could be rented for $40,000 per year. Determine if Essex should accept the supplier's offer. 5. Utilization of a Constrained Resource Ensign Company produces two products and selected data is shown below. Machine A1 is the constrained resource and is being used at 100% of its capacity. There is excess capacity on all other machines. Machine A1 has a capacity of 2,400 minutes per week. Determine if Ensign should focus its efforts on Product A or B. Determine how many units of each product should be produced, and calculate the total contribution margin. 2. Adding / Dropping Segments Due to the declining popularity of digital watches, Lovell Company's digital watch line has not reported a profit for several years. An income statement for last year is shown below. If Lovell were to drop the digital watch line, the company would no longer have to rent. the factory space. Determine if Lovell should retain or drop the digital watch segment 5 of them

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started