Answered step by step

Verified Expert Solution

Question

1 Approved Answer

managerial accounting excel need help with 9 & 10. Because absorption costing assigns fixed manufacturing overhead costs to units produced ($6 vs. $3.75 per unit

managerial accounting excel need help with 9 & 10.

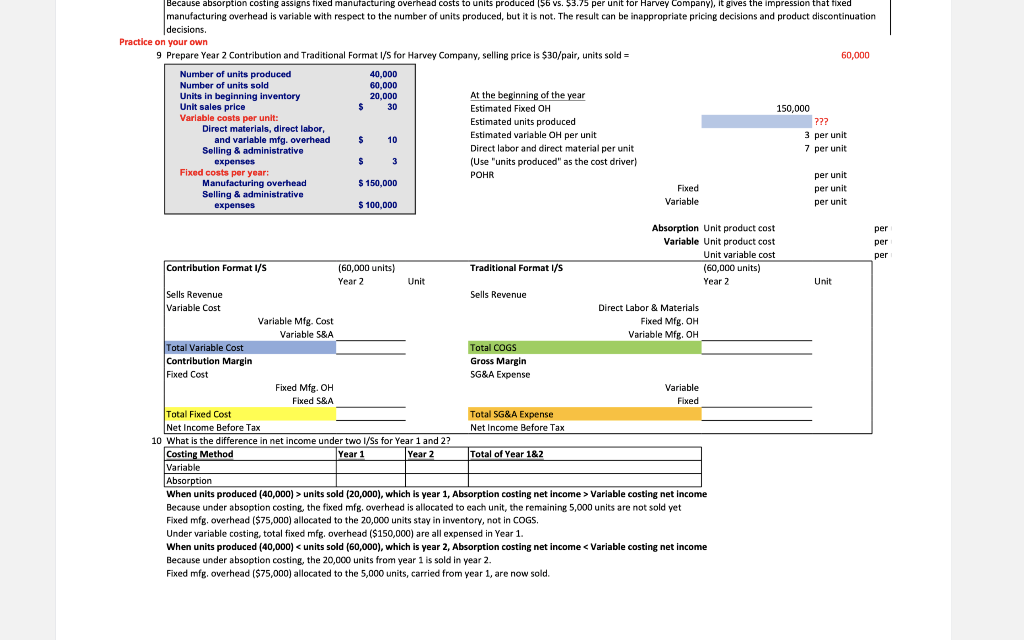

Because absorption costing assigns fixed manufacturing overhead costs to units produced ($6 vs. $3.75 per unit for Harvey Company), it gives the impression that fixed manufacturing overhead is variable with respect to the number of units produced, but it is not. The result can be inappropriate pricing decisions and product discontinuation decisions Practice on your own 9 Prepare Year 2 Contribution and Traditional Format 1/5 for Harvey Company, selling price is $30/pair, units sold = 60,000 Number of units produced 40,000 Number of units sold 60,000 Units in beginning inventory 20,000 At the beginning of the year Unit sales price $ 30 Estimated Fixed OH 150,000 Variable costs per unit: Estimated units produced Direct materials, direct labor, ??? and variable mfg. overhead $ 10 Estimated variable OH per unit 3 per unit Selling & administrative Direct labor and direct material per unit 7 per unit expenses $ 3 (Use "units produced as the cost driver) Fixed costs per year: POHR Manufacturing overhead $ 150,000 per unit Selling & administrative Fixed per unit expenses $ 100,000 Variable per unit per per per Unit Absorption Unit product cost Variable Unit product cost Unit variable cost Contribution Format 1/S (60,000 units) Traditional Format I/S (60,000 units) Year 2 Unit Year 2 Sells Revenue Sells Revenue Variable Cost Direct Labor & Materials Variable Mfg. Cost Fixed Mfg. OH Variable S&A Variable Mfg. OH Total Variable Cost Total COGS Contribution Margin Gross Margin Fixed Cost SG&A Expense Fixed Mfg. OH Variable Fixed S&A Fixed Total Fixed Cost Total SG&A Expense Net Income Before Tax Net Income Before Tax 10 What is the difference in net income under two l/Ss for Year 1 and 2? Costing Method Year 1 Year 2 Total of Year 1&2 Variable Absorption When units produced (40,000) > units sold (20,000), which is year 1, Absorption costing net income > Variable costing net income Because under absoption costing, the fixed mig, overhead is allocated to each unit, the remaining 5,000 units are not sold yet Fixed mig, overhead ($75,000) allocated to the 20,000 units stay in inventory, not in COGS Under variable costing, total fixed mfg. overhead ($150,000) are all expensed in Year 1. When units produced (40,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started