Answered step by step

Verified Expert Solution

Question

1 Approved Answer

managerial accounting Hard Division completed a home in the De wonito income la dern, invece, date Endy, I'm beg to worry about my jobbe moaned

managerial accounting

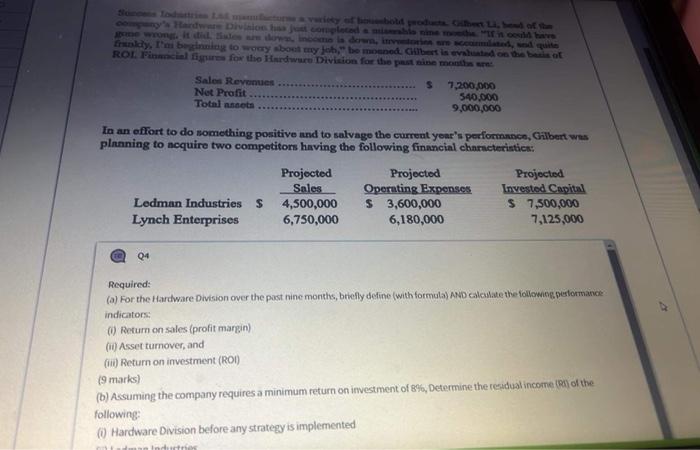

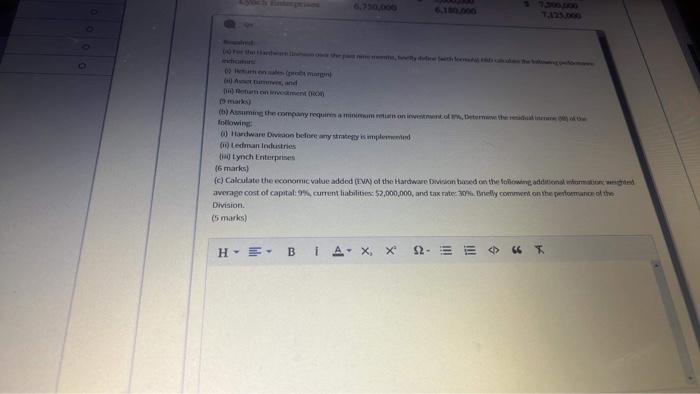

Hard Division completed a home in the De wonito income la dern, invece, date Endy, I'm beg to worry about my jobbe moaned ametissed on the beat ROL Financial for the Hardware Division for the past nine month Sales Revenues $ 7,200.000 Net Profit 540.000 Total acts 9,000,000 In an effort to do something positive and to salvage the current your's performance, Gilbert wa planning to acquire two competitors having the following financial characteristics: Projected Projected Projected Sales Operating Expenses Invested Capital Ledman Industries S 4,500,000 $ 3,600,000 $ 7,500,000 Lynch Enterprises 6,750,000 6,180,000 7,125,000 04 Required: (a) For the Hardware Division over the past nine months, briefly define (with formula) AND clone the following pestormance indicators: Return on sales (profit margin) (11) Asset turnover, and (1) Return on investment (ROI) (9 marks) (b) Assuming the company requires a minimum return on investment of 8%, Determine the residual income of the following: Hardware Division before any strategy is implemented dan Industri 6.100 1.125 (b) Assuming the company require a minimum on into turn the tellowing 0 Hardware Dion before any strategy is implemented (Ledman Industries Lynch Enterpris (6 marks) (c) Calculate the economic value added of the Hardware Dion based on the following . average cost of capital: 9% current liabilities: 57,000,000, and tax rate nelly comment on the performance of the Division (5 marks) H. E. BIA = Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started