Managerial Accounting problem. Journal entries and income statement. Answer format attached as well. Thanks!

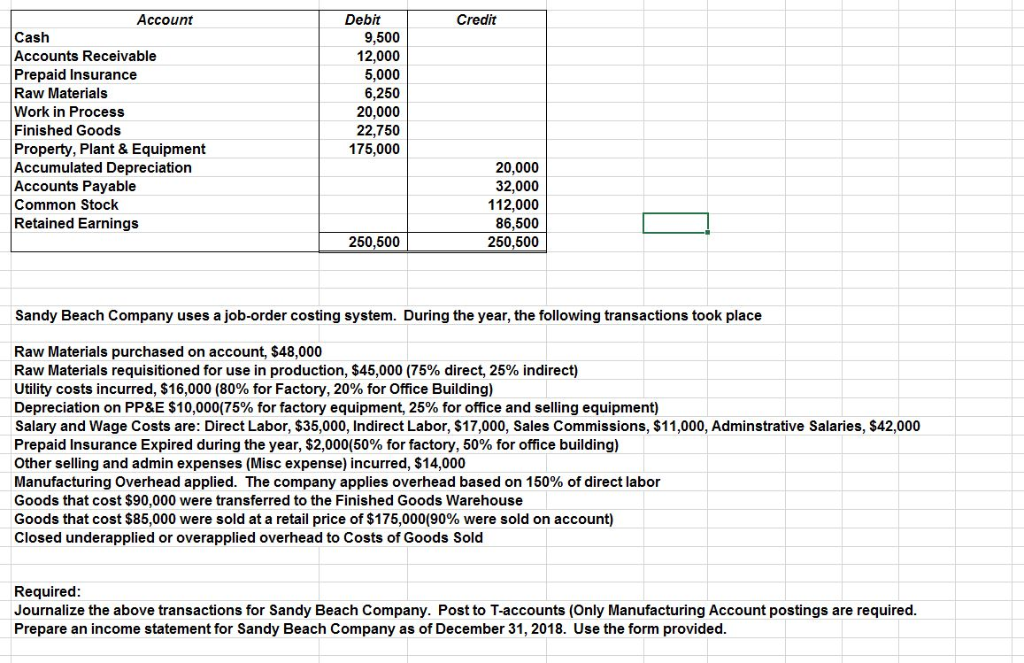

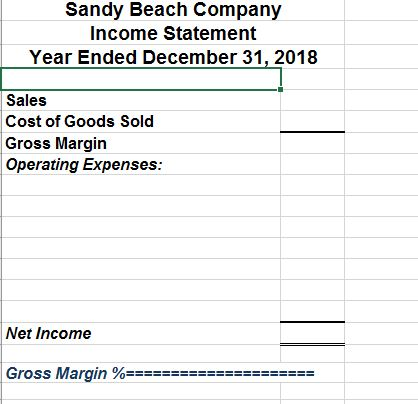

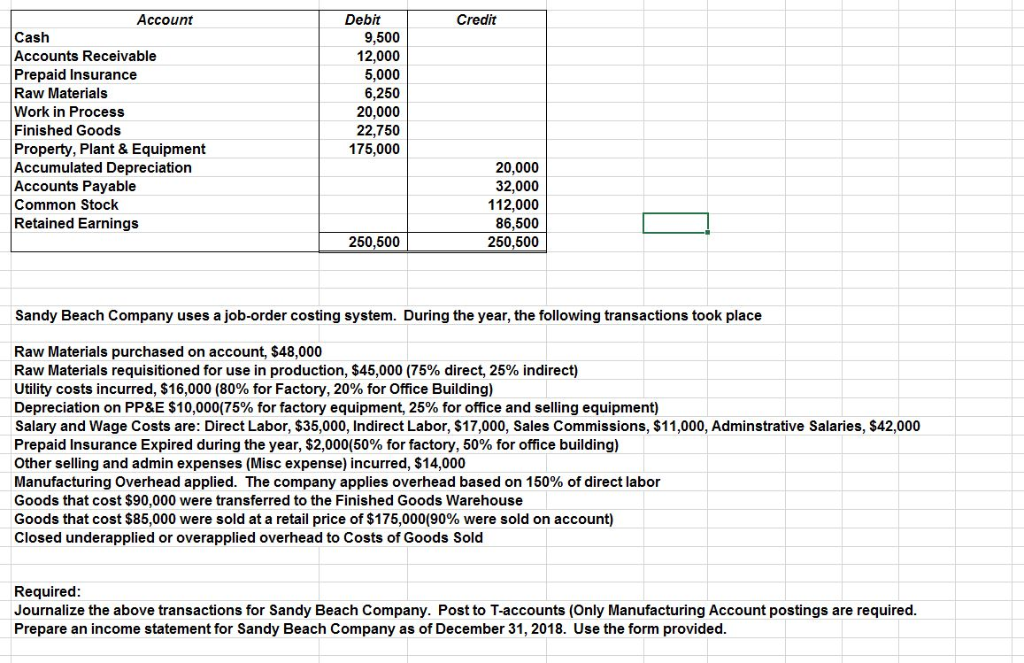

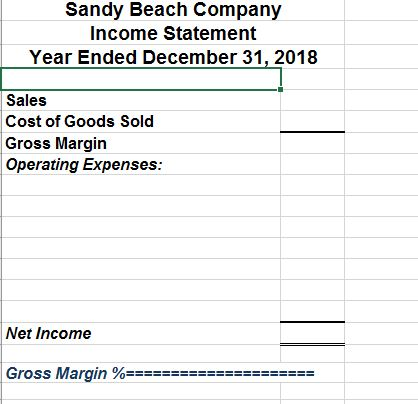

Account Debit Credit Cash 9,500 12,000 5,000 6,250 Accounts Receivable Prepaid Insurance Raw Materials Work in Process Finished Goods Property, Plant & Equipment Accumulated Depreciation Accounts Payable Common Stock Retained Earnings 20,000 22,750 175,000 20,000 32,000 112,000 86,500 250,500 250,500 Sandy Beach Company uses a job-order costing system. During the year, the following transactions took place Raw Materials purchased on account, $48,000 Raw Materials requisitioned for use in production, $45,000 (75% direct , 25% indirect) Utility costs incurred, $16,000 (80% for Factory, 20% for Office Building) Depreciation on PP&E $10,000(75% for factory equipment, 25% for office and selling equipment) Salary and Wage Costs are: Direct Labor, $35,000, Indirect Labor, $17,000, Sales Commissions, $11,000, Adminstrative Salaries, $42,000 Prepaid Insurance Expired during the year, $2,000(50% for factory, 50% for office building) Other selling and admin expenses (Misc expense) incurred, $14, Manufacturing Overhead applied. The company applies overhead based on 150% of direct labor Goods that cost $90,000 were transferred to the Finished Goods Warehouse Goods that cost $85,000 were sold at a retail price of $175,000(90% were sold on account) Closed underapplied or overapplied overhead to Costs of Goods Sold Required: Journalize the above transactions for Sandy Beach Company. Post to T-accounts (Only Manufacturing Account postings are required. Prepare an income statement for Sandy Beach Company as of December 31, 2018. Use the form provided. Journal Manufacturing Overhead Raw Materials Date Account Debit Credit Cost of Goods Sold WIP Finished Goods Sandy Beach Company Income Statement Year Ended December 31, 2018 Sales Cost of Goods Sold Gross Margin Operating Expenses: Net Income Gross Margin %=== Account Debit Credit Cash 9,500 12,000 5,000 6,250 Accounts Receivable Prepaid Insurance Raw Materials Work in Process Finished Goods Property, Plant & Equipment Accumulated Depreciation Accounts Payable Common Stock Retained Earnings 20,000 22,750 175,000 20,000 32,000 112,000 86,500 250,500 250,500 Sandy Beach Company uses a job-order costing system. During the year, the following transactions took place Raw Materials purchased on account, $48,000 Raw Materials requisitioned for use in production, $45,000 (75% direct , 25% indirect) Utility costs incurred, $16,000 (80% for Factory, 20% for Office Building) Depreciation on PP&E $10,000(75% for factory equipment, 25% for office and selling equipment) Salary and Wage Costs are: Direct Labor, $35,000, Indirect Labor, $17,000, Sales Commissions, $11,000, Adminstrative Salaries, $42,000 Prepaid Insurance Expired during the year, $2,000(50% for factory, 50% for office building) Other selling and admin expenses (Misc expense) incurred, $14, Manufacturing Overhead applied. The company applies overhead based on 150% of direct labor Goods that cost $90,000 were transferred to the Finished Goods Warehouse Goods that cost $85,000 were sold at a retail price of $175,000(90% were sold on account) Closed underapplied or overapplied overhead to Costs of Goods Sold Required: Journalize the above transactions for Sandy Beach Company. Post to T-accounts (Only Manufacturing Account postings are required. Prepare an income statement for Sandy Beach Company as of December 31, 2018. Use the form provided. Journal Manufacturing Overhead Raw Materials Date Account Debit Credit Cost of Goods Sold WIP Finished Goods Sandy Beach Company Income Statement Year Ended December 31, 2018 Sales Cost of Goods Sold Gross Margin Operating Expenses: Net Income Gross Margin %===