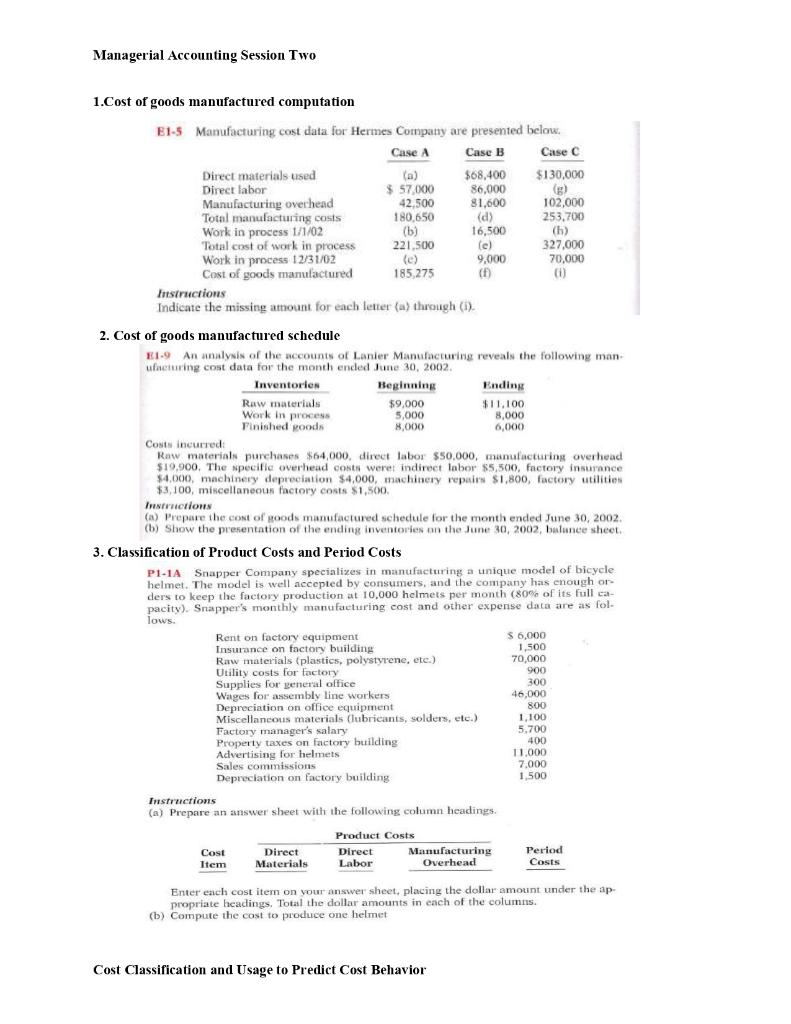

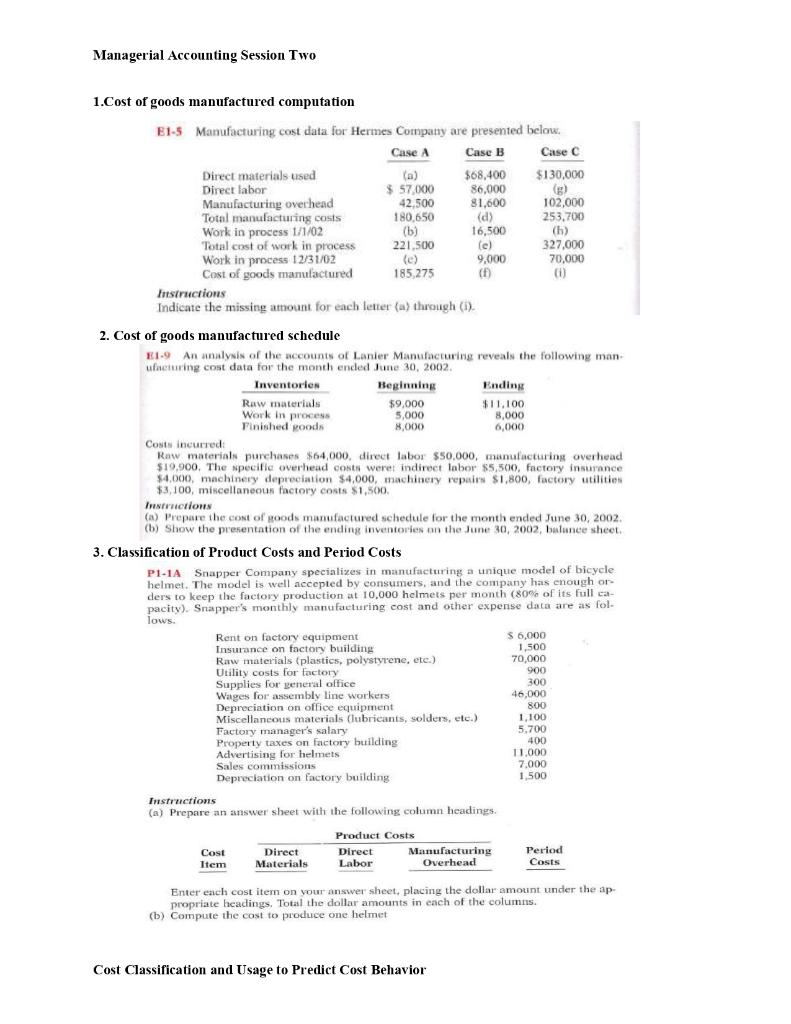

Managerial Accounting Session Two 1.Cost of goods manufactured computation E1-5 Manufacturing cost data for Hermes Company are presented below. Case A Case B Case C Direct materials used $68,400 $130,000 Direct labor $ 57,000 86,000 Manufacturing overhead 42,500 81,600 102,000 Total manufacturing costs 180,650 (d) 253,700 Work in process 1/1/02 (b) 16,500 (h) Total cost of work in process 221.500 (e) 327,000 Work in process 12/31/02 9,000 70,000 Cost of goods manufactured 185,275 ( (1) Instructions Indicate the missing amount for each letter (a) through (1) 2. Cost of goods manufactured schedule E1.9 An analysis of the accounts of Lanier Manufacturing reveals the following man ufacturing cost data for the month ended June 30, 2002 Inventories Beginning Ending Raw materials $9,000 $11,100 Work in process 5,000 8,000 Finished goods 8,000 6,000 Costs incurred Raw materials purchases $64,000. direct labor $50.000, manufacturing overhead $19,900. The specific overhead costs werer indirect labor $5,500, factory insurance $4,000, machinery depreciation $4,000, machinery repairs $1,800, factory utilities $3,100, miscellaneous factory costs $1,500. . Instructions (A) Prepare the cost of goods manufactured schedule for the month ended June 30, 2002. (b) Show the presentation of the ending inventories on the June 30, 2002, balance sheet 3. Classification of Product Costs and Period Costs PL-1A Snapper Company specializes in manufacturing a unique model of bicycle helmet. The model is well accepted by consumers, and the company has enough or ders to keep the factory production at 10.000 helmets per month (80% of its full ca pacity). Snapper's monthly manufacturing cost and other expense data are as fol- lows. Rent on factory equipment $ 6,000 Insurance on factory building 1,500 Raw materials (plastics, polystyrene, etc.) 70,000 Utility costs for factory 900 Supplies for general office 300 Wages for assembly line workers 46,000 Depreciation on office equipment Miscellaneous materials (lubricants, solders, etc.) 1,100 Factory manager's salary 5.700 Property taxes on factory building 400 Advertising for helmets 11.000 Sales commissions 7.000 Depreciation on factory building 1,500 Instructions (a) Prepare an answer sheet with the following column headings 800 Cost Item Direct Materials Product Costs Direct Manufacturing Labor Overhead Period Costs Enter each cost item on your answer sheet, placing the dollar amount under the ap- propriate headings. Total the dollar amounts in each of the columns (b) Compute the cost to produce one helmet Cost Classification and Usage to Predict Cost Behavior