Trial balance Extract as at 31 December 2020 Debit Inventory Vehicles: at cost Sales revenue Vehicles: accumulated depreciation Compute the following figures: (a) the

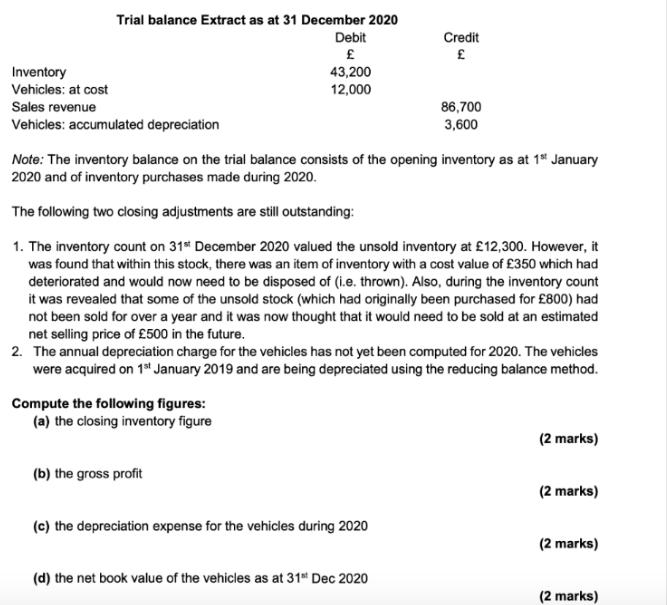

Trial balance Extract as at 31 December 2020 Debit Inventory Vehicles: at cost Sales revenue Vehicles: accumulated depreciation Compute the following figures: (a) the closing inventory figure 43,200 12,000 (b) the gross profit Note: The inventory balance on the trial balance consists of the opening inventory as at 1st January 2020 and of inventory purchases made during 2020. The following two closing adjustments are still outstanding: 1. The inventory count on 31st December 2020 valued the unsold inventory at 12,300. However, it was found that within this stock, there was an item of inventory with a cost value of 350 which had deteriorated and would now need to be disposed of (i.e. thrown). Also, during the inventory count it was revealed that some of the unsold stock (which had originally been purchased for 800) had not been sold for over a year and it was now thought that it would need to be sold at an estimated net selling price of 500 in the future. 2. The annual depreciation charge for the vehicles has not yet been computed for 2020. The vehicles were acquired on 1st January 2019 and are being depreciated using the reducing balance method. (c) the depreciation expense for the vehicles during 2020 Credit (d) the net book value of the vehicles as at 31st Dec 2020 86,700 3,600 (2 marks) (2 marks) (2 marks) (2 marks)

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

And a Closing Inventory calculation T st 30 Dn 31 A bor Less Disposed item in Inventory hess Cost ne...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started