managerial accounting

with excel fourmula please

managerial accounting

in excel foulas please

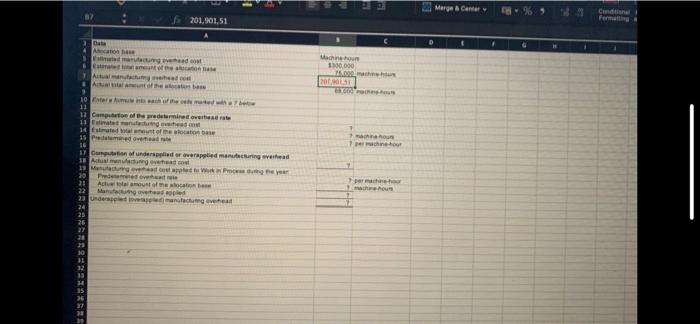

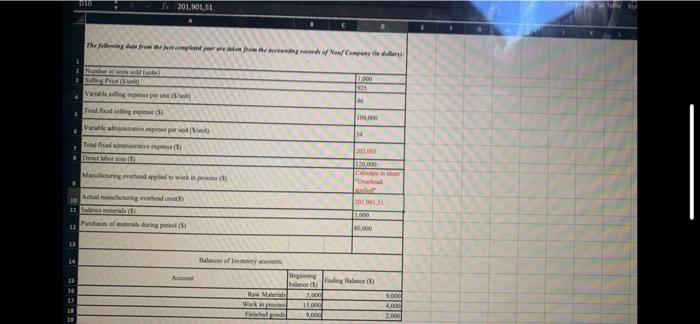

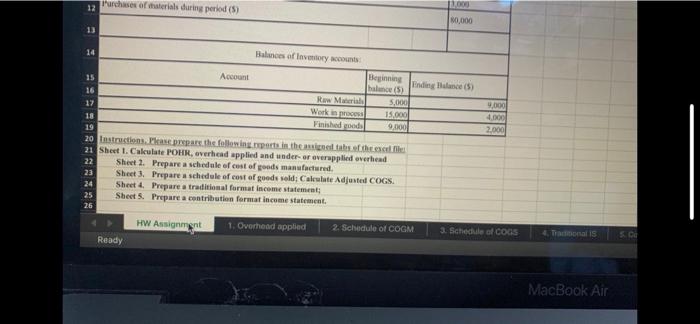

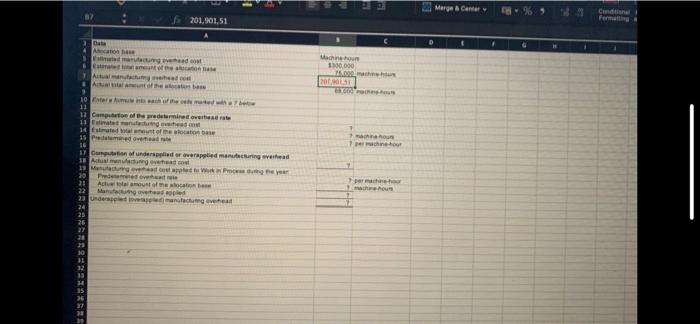

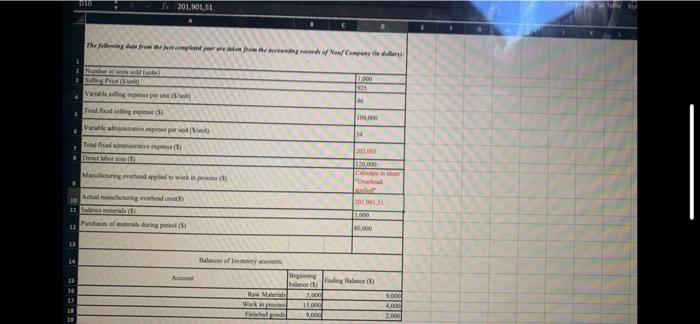

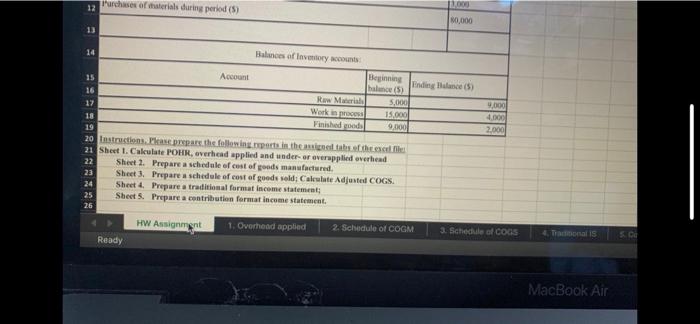

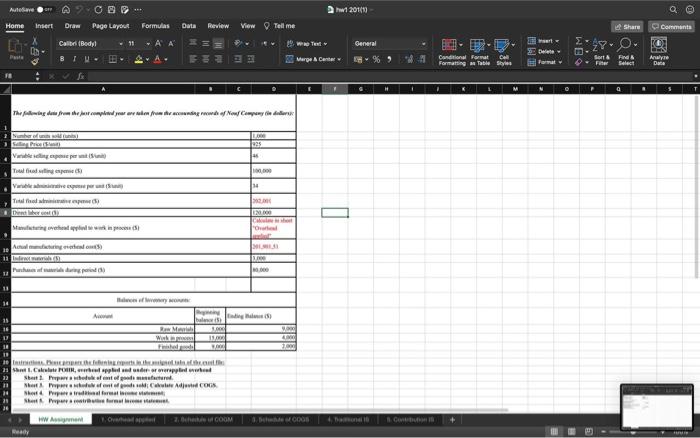

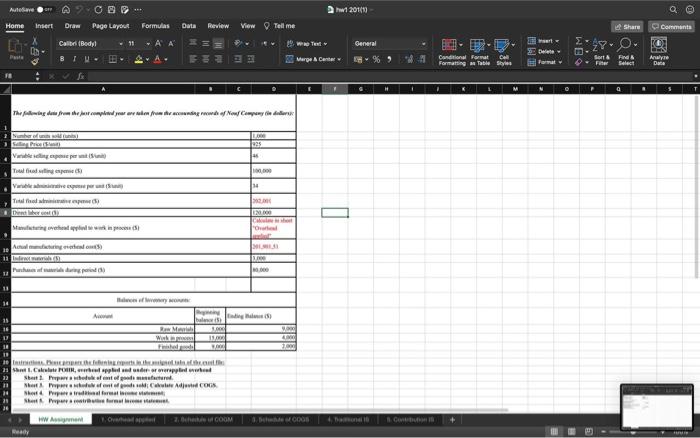

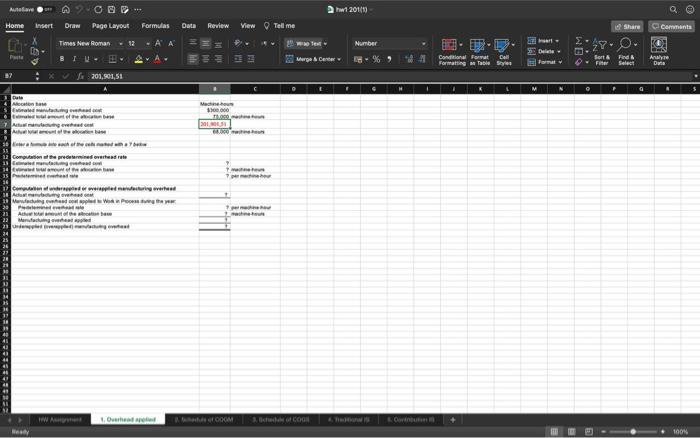

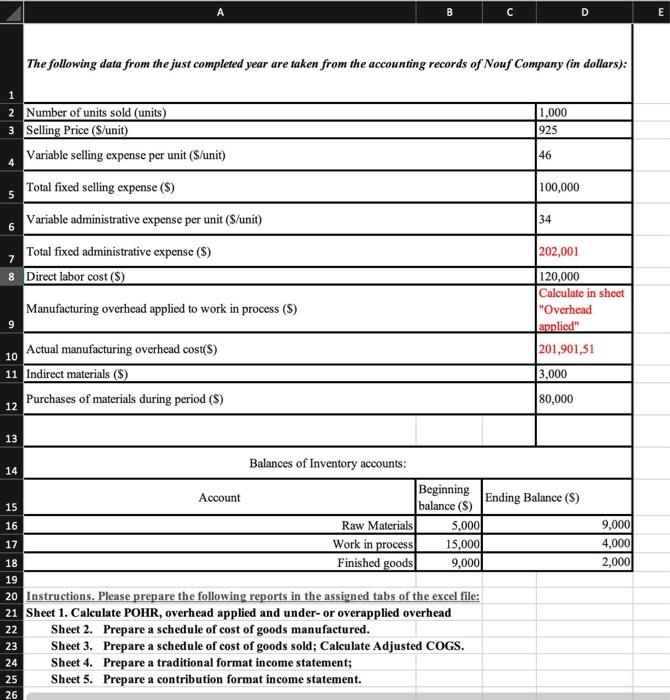

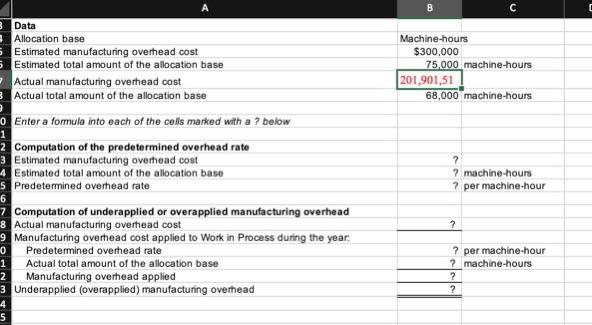

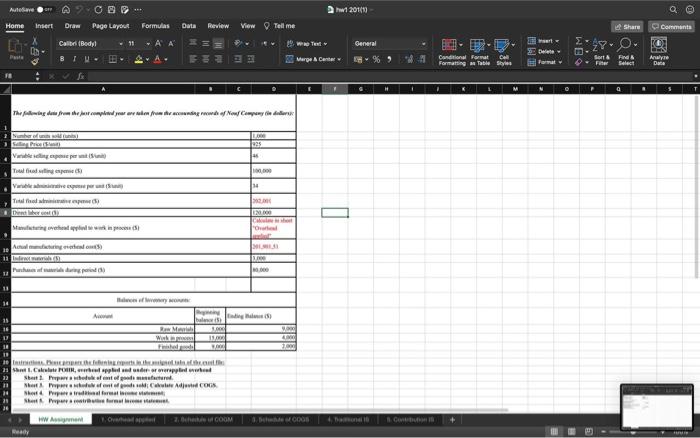

Shect t. Calculate POHH, everhead applied and ander-ar averapplical overhead Sheet 2. Prepare a schedale of cost of goods manafachared. Sheet 3. Prepare a schcdele of cost af noods soldy Calcalate Adjusted COGS. Sheet 4. Prepare a tratitional format income statement Sbect 5. Propare a centribution format income statement. 2 hat zot 20 Home inert oraw Page Layour formulas oota Rexiew vew 9. Tell me The following data from the just completed year are taken from the accounting records of Nouf Company (in dollars): Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. A B C Data Allocation base Machine-hours Estimated manufacturing overhead cost $300,000 Estimated total amount of the allocation base 75,000 machine-hours Actual manufacturing overhead cost Actual total amount of the allocation base 68,000201,901,51 machine-hours Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate 3 Estimated manufacturing overhead cost 7 Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine+hour Computation of underapplied or overapplied manufacturing overhead 8 Actual manufacturing overhead cost 9 Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead ?? Shect t. Calculate POHH, everhead applied and ander-ar averapplical overhead Sheet 2. Prepare a schedale of cost of goods manafachared. Sheet 3. Prepare a schcdele of cost af noods soldy Calcalate Adjusted COGS. Sheet 4. Prepare a tratitional format income statement Sbect 5. Propare a centribution format income statement. 2 hat zot 20 Home inert oraw Page Layour formulas oota Rexiew vew 9. Tell me The following data from the just completed year are taken from the accounting records of Nouf Company (in dollars): Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. A B C Data Allocation base Machine-hours Estimated manufacturing overhead cost $300,000 Estimated total amount of the allocation base 75,000 machine-hours Actual manufacturing overhead cost Actual total amount of the allocation base 68,000201,901,51 machine-hours Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate 3 Estimated manufacturing overhead cost 7 Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine+hour Computation of underapplied or overapplied manufacturing overhead 8 Actual manufacturing overhead cost 9 Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead