Answered step by step

Verified Expert Solution

Question

1 Approved Answer

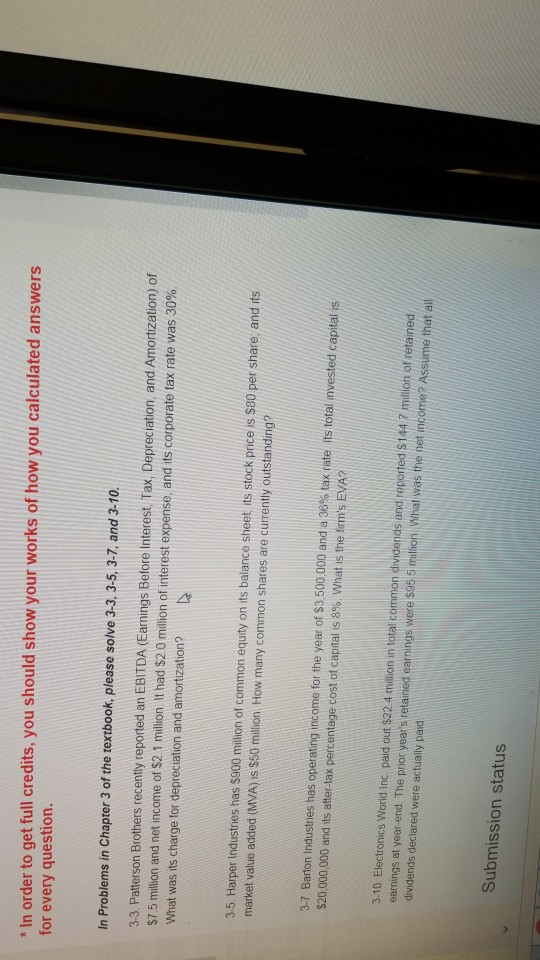

Managerial Finance questions. Calculate each problem In order to get full credits, you should show your works of how you calculated answers for every question.

Managerial Finance questions. Calculate each problem

In order to get full credits, you should show your works of how you calculated answers for every question. In Problems in Chapter 3 of the textbook please solve 3-3, 3-5, 3-7, and 3-10 33 Patterson Brothers recently reported an EBITDA (Earmings Before Interest, Tax, Depreciation, and Amortization) of $75 million and net income of $2.1 million It had S20 million of interest expense, and its corporate tax rate was 30% What was its charge for depreciation and amortization? 3-5. Harper Industries has $900 million of common equity on its balance sheet, its stock price is $80 per share; and its market value added (MVA) is $50 million How many common shares are currently outstanding? 37 Barton Industries has operating income for the year of S3500000 and a 36% tax rate its total invested capital is $20,000,000 and its after-tax percentage cost of capital is 890: What is the firm's Evan 3-10 Electronics World inc paid out $22 4 million in total common dividends and reported $144 7 milion of retained eamings at year-end The prior year's retained earnings were $95 5 milion What was the net income? Assume that all dividends declared were actually paid Submission statusStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started