Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Managers use projected financial statements in four ways: (1) By looking at projected statements, they can assess whether the firm's anticipated performance is in

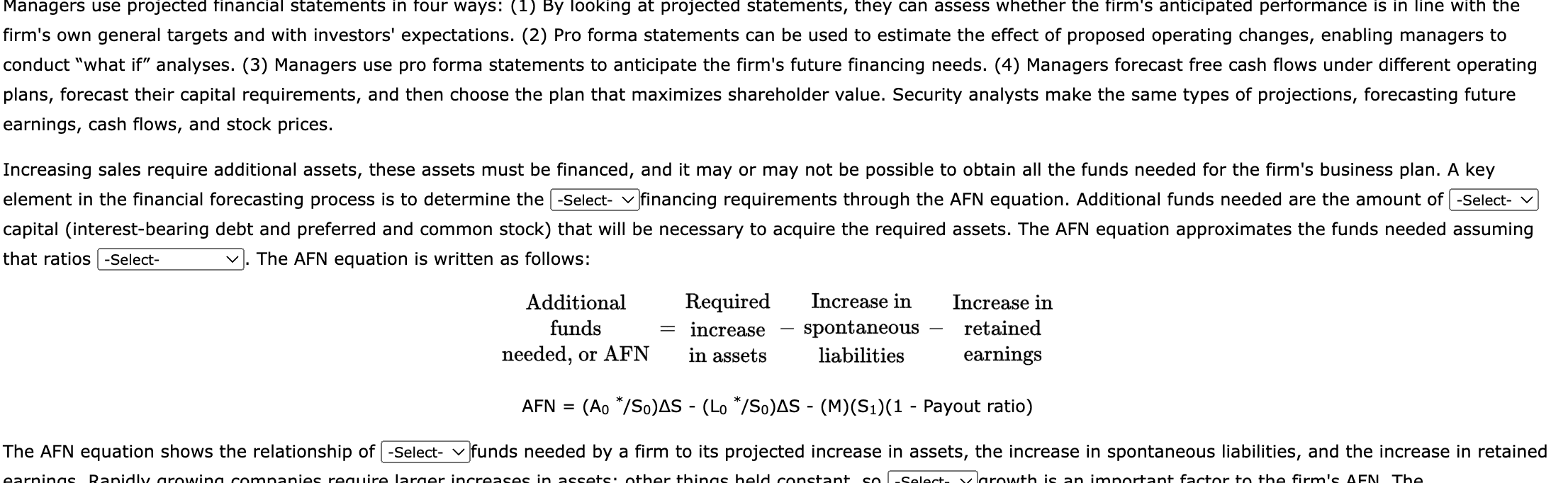

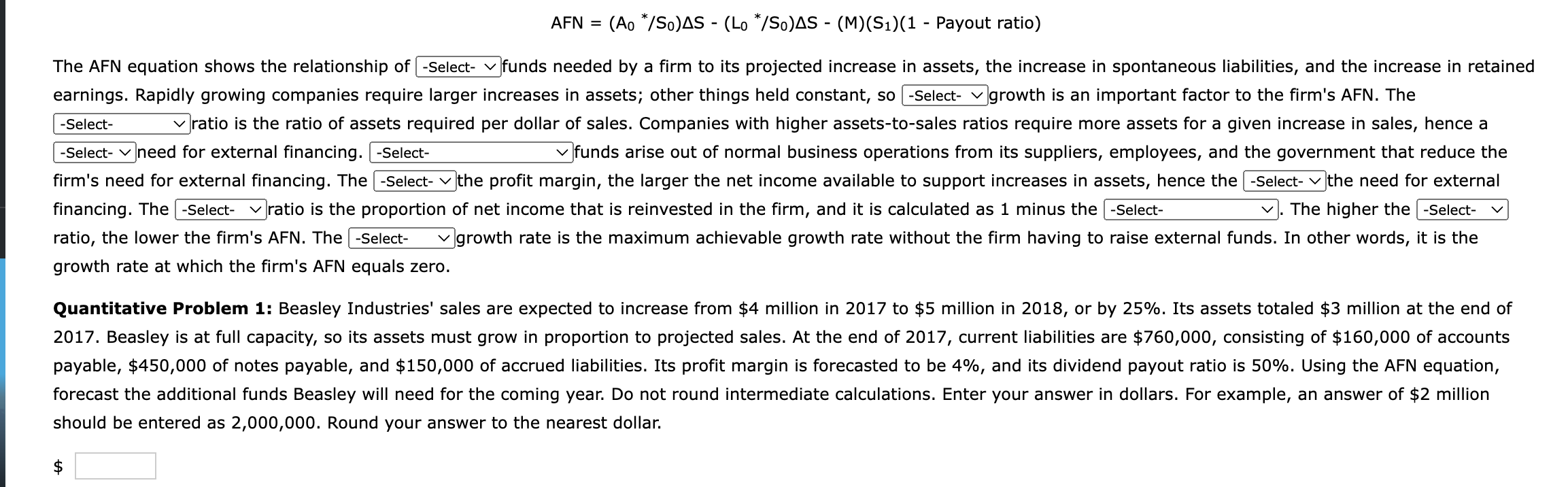

Managers use projected financial statements in four ways: (1) By looking at projected statements, they can assess whether the firm's anticipated performance is in line with the firm's own general targets and with investors' expectations. (2) Pro forma statements can be used to estimate the effect of proposed operating changes, enabling managers to conduct "what if" analyses. (3) Managers use pro forma statements to anticipate the firm's future financing needs. (4) Managers forecast free cash flows under different operating plans, forecast their capital requirements, and then choose the plan that maximizes shareholder value. Security analysts make the same types of projections, forecasting future earnings, cash flows, and stock prices. Increasing sales require additional assets, these assets must be financed, and it may or may not be possible to obtain all the funds needed for the firm's business plan. A key element in the financial forecasting process is to determine the [ -Select- financing requirements through the AFN equation. Additional funds needed are the amount of -Select- capital (interest-bearing debt and preferred and common stock) that will be necessary to acquire the required assets. The AFN equation approximates the funds needed assuming that ratios -Select- The AFN equation is written as follows: Additional funds needed, or AFN Required increase in assets Increase in spontaneous liabilities - Increase in retained earnings AFN = (Ao */So)AS (Lo */So)AS - (M)(S1) (1 - Payout ratio) The AFN equation shows the relationship of -Select- funds needed by a firm to its projected increase in assets, the increase in spontaneous liabilities, and the increase in retained earnings Rapidly growing companies require larger increases in assets: other things held constant co -Select- Vlarowth is an important factor to the firm's AFN The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started