Question

Manas Clothing New Zealand Limited set up a subsidiary in Melbourne, Australia some years ago after creating a successful brand in New Zealand. You have

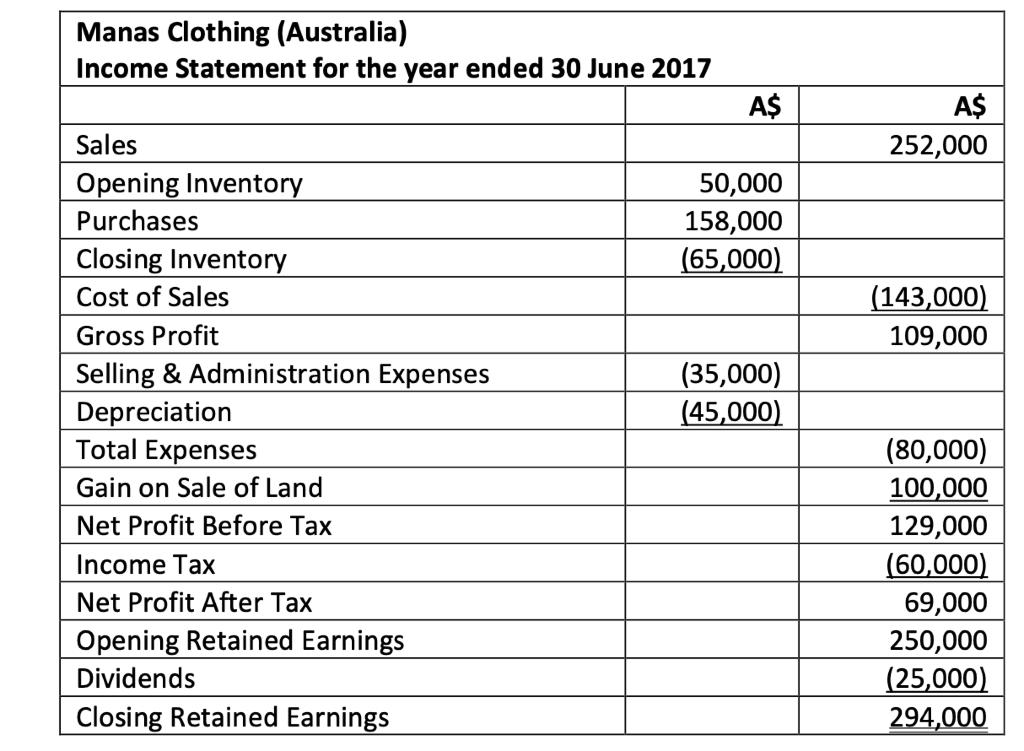

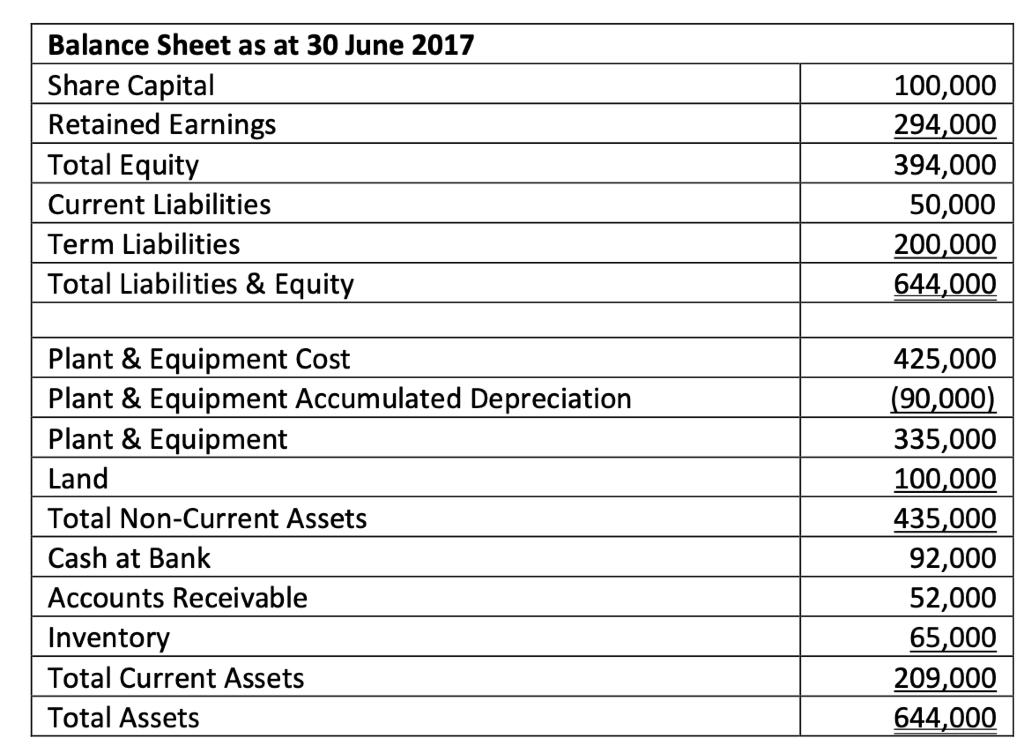

Manas Clothing New Zealand Limited set up a subsidiary in Melbourne, Australia some years ago after creating a successful brand in New Zealand. You have been asked to translate the results of the Manas Clothing (Australia) subsidiary in preparation to consolidate the results into the New Zealand parent company. You have been provided with the Income Statement and Balance Sheet for Manas Clothing (Australia) in Australian dollars (A$):

Other information:

No additional shares have been issued since Manas Clothing (Australia) was established.

Income Tax was incurred evenly through the year.

Selling and Administration Expenses were incurred evenly through the year.

The Land and Plant and Equipment were purchased when Manas Clothing (Australia) was

established.

During the current year Manas Clothing (Australia) sold a spare parcel of Land for A$200,000.

The original price paid for this land was A$100,000 and the Gain on Sale of Land was

A$100,000.

The opening balance of the Retained Earnings in NZ$ at 1 July 2016 was $320,000 using the

presentation currency method (also known as the “closing rate” method).

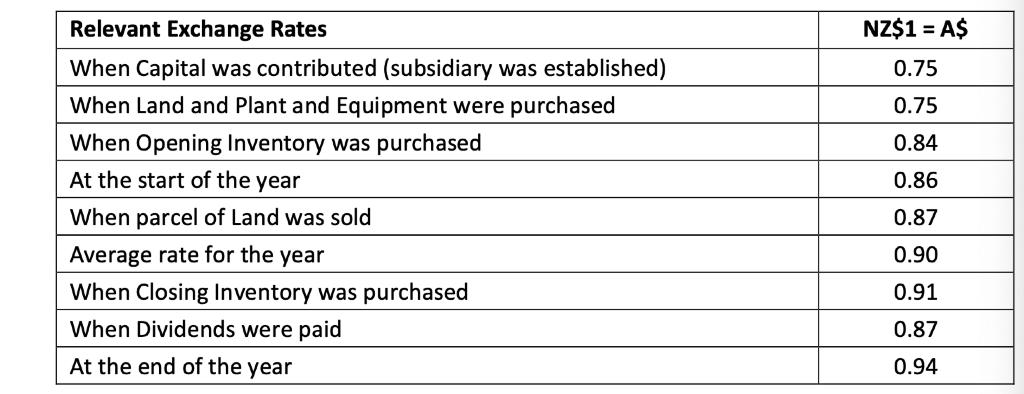

Relevant exchange rates are as follows:

(a) Assuming that the functional currency of Manas Clothing (Australia) is the A$ and the presentation currency is the NZ$, the financial statements of Manas Clothing (Australia) will be translated using the presentation currency method (which is sometimes known as the closing rate method) described in NZ IAS 21 paragraph 39. What is the opening balance of the Foreign Currency Translation Reserve at 1 July 2016, expressed in NZ$? Use WORKSHEET 1 provided on PAGE 4 of the ANSWER BOOKLET for your answer. Show all workings.

(3 marks)

(b) As well as the information provided above in this question, you are told that a foreign exchange loss on translation of NZ$32,613 has been calculated for the year ending 30 June 2017, which represents the movement in the FCTR. Is this correct? Use WORKSHEET 2 provided on PAGE 6 of the ANSWER BOOKLET for your answer. Show all workings.

(4 marks)

(c) Determining the functional currency of an entity can be a difficult exercise. Explain why, and what guidance NZ IAS 21 provides for determining the functional currency of an entity.

(3 Marks)

Manas Clothing (Australia) Income Statement for the year ended 30 June 2017 A$ A$ 252,000 Sales Opening Inventory 50,000 158,000 (65,000) Purchases Closing Inventory Cost of Sales (143,000) 109,000 Gross Profit Selling & Administration Expenses (35,000) (45,000) Depreciation Total Expenses (80,000) 100,000 129,000 Gain on Sale of Land Net Profit Before Tax (60,000) 69,000 250,000 (25,000) 294,000 Income Tax Net Profit After Tax Opening Retained Earnings Dividends Closing Retained Earnings

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the opening balance of the Foreign Currency Translation Reserve FCTR on 1 July 2016 we need to determine the exchange rate between the Australian dollar AUD and the New Zealand dollar N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started