Answered step by step

Verified Expert Solution

Question

1 Approved Answer

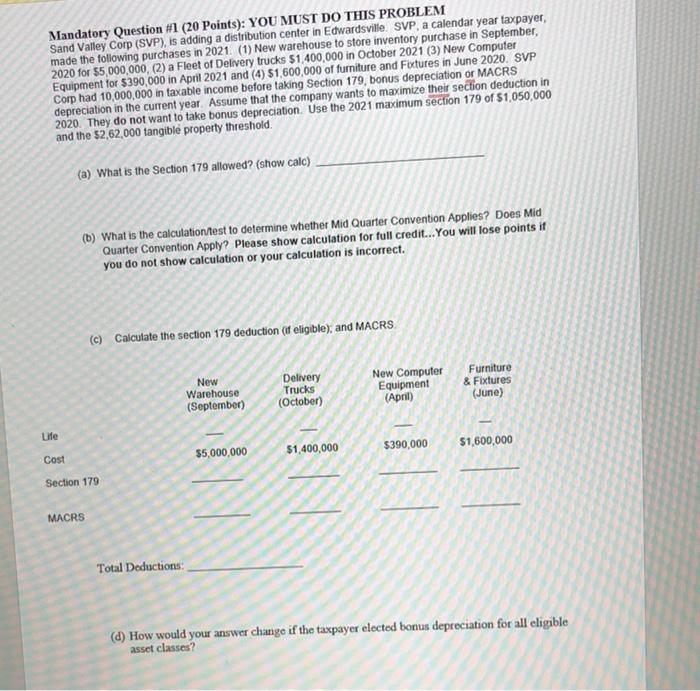

Mandatory Question #1 (20 Points): YOU MUST DO THIS PROBLEM Sand Valley Corp (SVP), is adding a distribution center in Edwardsville. SVP, a calendar

Mandatory Question #1 (20 Points): YOU MUST DO THIS PROBLEM Sand Valley Corp (SVP), is adding a distribution center in Edwardsville. SVP, a calendar year taxpayer, made the following purchases in 2021. (1) New warehouse to store inventory purchase in September, 2020 for $5,000,000, (2) a Fleet of Delivery trucks $1,400,000 in October 2021 (3) New Computer Equipment for $390,000 in April 2021 and (4) $1,600,000 of furniture and Fixtures in June 2020. SVP Corp had 10,000,000 in taxable income before taking Section 179, bonus depreciation or MACRS depreciation in the current year. Assume that the company wants to maximize their section deduction in 2020. They do not want to take bonus depreciation. Use the 2021 maximum section 179 of $1,050,000 and the $2,62,000 tangible property threshold. (a) What is the Section 179 allowed? (show calc) (b) What is the calculation/test to determine whether Mid Quarter Convention Applies? Does Mid Quarter Convention Apply? Please show calculation for full credit... You will lose points if you do not show calculation or your calculation is incorrect. (c) Calculate the section 179 deduction (if eligible); and MACRS New Warehouse Delivery Trucks (September) (October) New Computer Equipment (April) Furniture & Fixtures (June) Life Cost $5,000,000 $1,400,000 $390,000 $1,600,000 Section 179 MACRS Total Deductions: (d) How would your answer change if the taxpayer elected bonus depreciation for all eligible asset classes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started