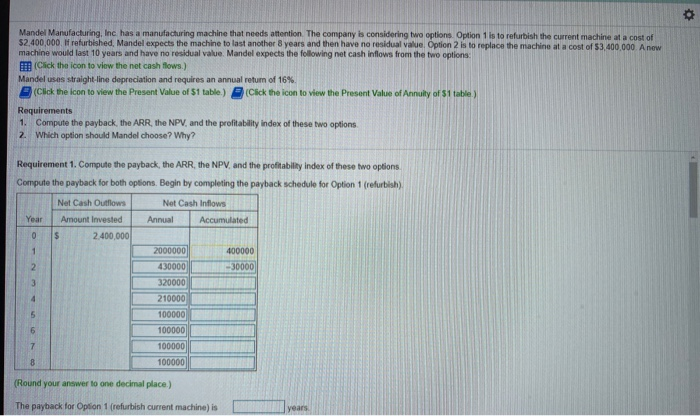

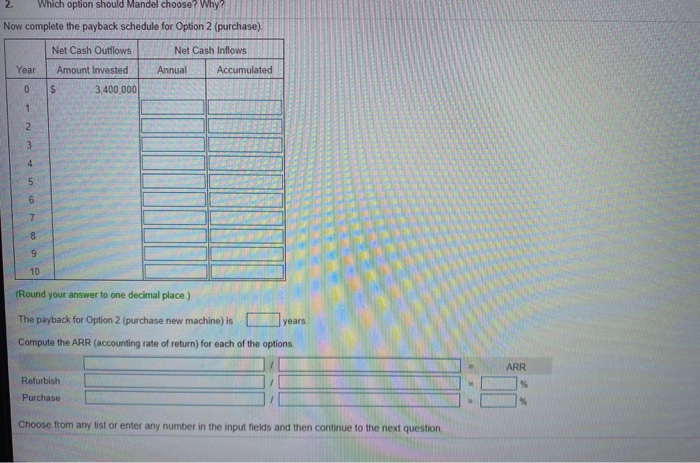

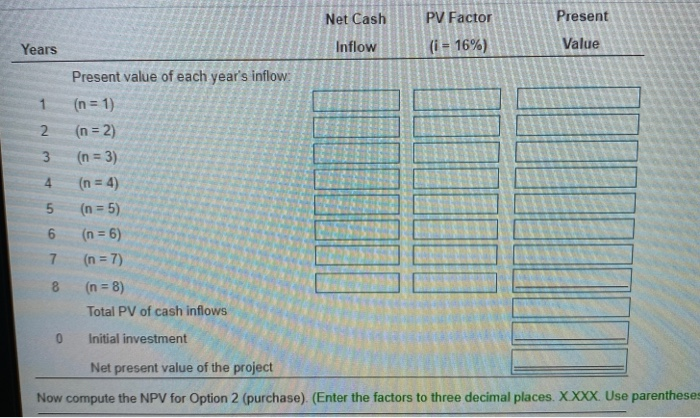

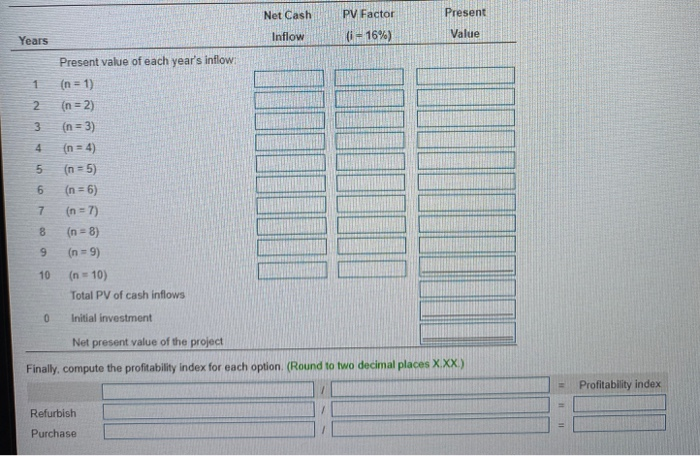

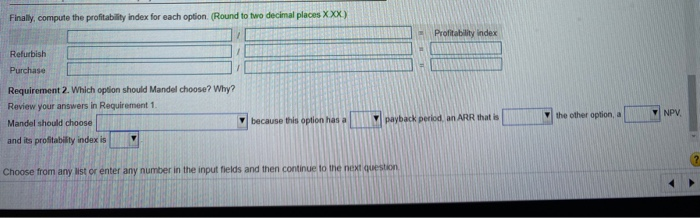

$ Mandel Manufacturing, Inc has a manufacturing machine that needs attention. The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2.400,000 refurbished, Mandel expects the machine to last another 8 years and then have no residual value Option 2 is to replace the machine at a cost of $3,400,000 A now machine would last 10 years and have no residual value Mandel expects the following net cash inflows from the two options Click the icon to view the net cash flows.) Mandel uses straight-line depreciation and requires an annual return of 16% (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of Annuity of S1 table.) Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options 2. Which option should Mandel choose? Why? Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish) Net Cash Outflows Net Cash Inflows Year Amount invested Annual Accumulated 0 $ 2.400,000 1 2000000 400000 430000 30000 320000 210000 100000 100000 100000 8 100000 (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years Which option should Mandel choose? Why? Now complete the payback schedule for Option 2 (purchase) Net Cash Outflows Net Cash Inflows Year Amount Invested Annual Accumulated 0 S 3,400,000 1 2 4 5 6 7 B 9 10 (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is years Compute the ARR (accounting rate of return) for each of the options ARR % Refurbish Purchase % Choose from any list or enter any number in the input fields and then continue to the next question Net Cash PV Factor Present Years Inflow (i = 16%) Value 2. 3 Present value of each year's inflow: (n = 1) (n=2) (n = 3) (n = 4) (n = 5) (n = 6) (n = 7) 4 5 6 8 (n = 8) Total PV of cash inflows 0 Initial investment Net present value of the project Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places. X.XXX. Use parentheses Net Cash PV Factor Present Years Inflow (i = 16%) Value 1 2 3 4 5 Present value of each year's inflow: (n = 1) (n=2) (n = 3) (n = 4) (n = 5) (n = 6) (n=7) (n = 8) (n=9) (n = 10) Total PV of cash inflows 6 7 8 9 10 0 Initial investment Net present value of the project Finally, compute the profitability index for each option (Round to two decimal places X.XX.) Profitability index Refurbish Purchase Finally, compute the profitability Index for each option (Round to two decimal places XXX) Profitability Index Refurbish Purchase Requirement 2. Which option should Mandel choose? Why? Review your answers in Requirement 1 Mandel should choose and its profitability index is the other option, a NPV because this option has a M payback period, an ARR that is Choose from any list or enter any number in the input fields and then continue to the next question $ Mandel Manufacturing, Inc has a manufacturing machine that needs attention. The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2.400,000 refurbished, Mandel expects the machine to last another 8 years and then have no residual value Option 2 is to replace the machine at a cost of $3,400,000 A now machine would last 10 years and have no residual value Mandel expects the following net cash inflows from the two options Click the icon to view the net cash flows.) Mandel uses straight-line depreciation and requires an annual return of 16% (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of Annuity of S1 table.) Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options 2. Which option should Mandel choose? Why? Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish) Net Cash Outflows Net Cash Inflows Year Amount invested Annual Accumulated 0 $ 2.400,000 1 2000000 400000 430000 30000 320000 210000 100000 100000 100000 8 100000 (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years Which option should Mandel choose? Why? Now complete the payback schedule for Option 2 (purchase) Net Cash Outflows Net Cash Inflows Year Amount Invested Annual Accumulated 0 S 3,400,000 1 2 4 5 6 7 B 9 10 (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is years Compute the ARR (accounting rate of return) for each of the options ARR % Refurbish Purchase % Choose from any list or enter any number in the input fields and then continue to the next question Net Cash PV Factor Present Years Inflow (i = 16%) Value 2. 3 Present value of each year's inflow: (n = 1) (n=2) (n = 3) (n = 4) (n = 5) (n = 6) (n = 7) 4 5 6 8 (n = 8) Total PV of cash inflows 0 Initial investment Net present value of the project Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places. X.XXX. Use parentheses Net Cash PV Factor Present Years Inflow (i = 16%) Value 1 2 3 4 5 Present value of each year's inflow: (n = 1) (n=2) (n = 3) (n = 4) (n = 5) (n = 6) (n=7) (n = 8) (n=9) (n = 10) Total PV of cash inflows 6 7 8 9 10 0 Initial investment Net present value of the project Finally, compute the profitability index for each option (Round to two decimal places X.XX.) Profitability index Refurbish Purchase Finally, compute the profitability Index for each option (Round to two decimal places XXX) Profitability Index Refurbish Purchase Requirement 2. Which option should Mandel choose? Why? Review your answers in Requirement 1 Mandel should choose and its profitability index is the other option, a NPV because this option has a M payback period, an ARR that is Choose from any list or enter any number in the input fields and then continue to the next