Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mangoba Nkomo, CFA, a senior equity analyst with Robertson-Butler Investments, South Africa, has been assigned a recent graduate, Manga Mahlangu, to assist in valuations.

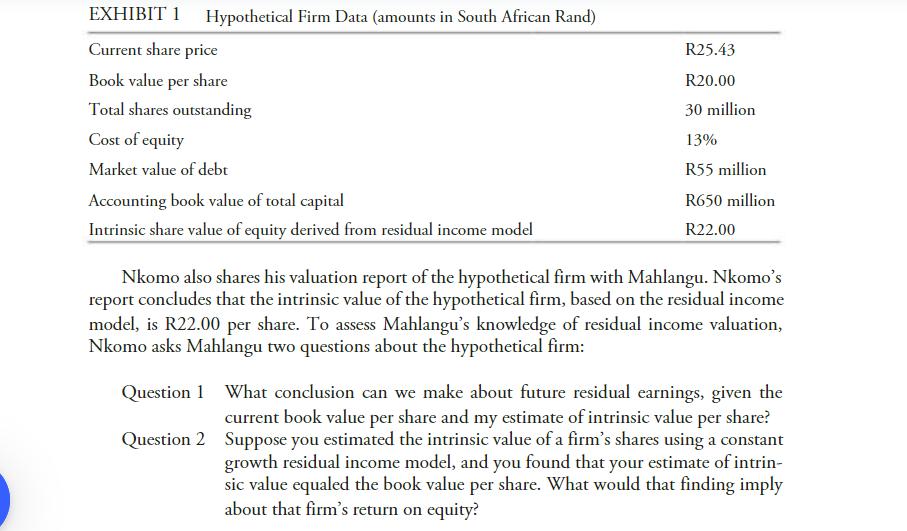

Mangoba Nkomo, CFA, a senior equity analyst with Robertson-Butler Investments, South Africa, has been assigned a recent graduate, Manga Mahlangu, to assist in valuations. Mahl- angu is interested in pursuing a career in equity analysis. In their first meeting, Nkomo and Mahlangu discuss the concept of residual income and its commercial applications. Nkomo asks Mahlangu to determine the market value added for a hypothetical South African firm using the data provided in Exhibit 1. EXHIBIT 1 Hypothetical Firm Data (amounts in South African Rand) Current share price Book value per share Total shares outstanding Cost of equity Market value of debt Accounting book value of total capital Intrinsic share value of equity derived from residual income model R25.43 R20.00 30 million 13% R55 million R650 million R22.00 Nkomo also shares his valuation report of the hypothetical firm with Mahlangu. Nkomo's report concludes that the intrinsic value of the hypothetical firm, based on the residual income model, is R22.00 per share. To assess Mahlangu's knowledge of residual income valuation, Nkomo asks Mahlangu two questions about the hypothetical firm: Question 1 Question 2 What conclusion can we make about future residual earnings, given the current book value per share and my estimate of intrinsic value per share? Suppose you estimated the intrinsic value of a firm's shares using a constant growth residual income model, and you found that your estimate of intrin- sic value equaled the book value per share. What would that finding imply about that firm's return on equity?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The conclusion we can draw about future residual earnings given the current book value pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started