Answered step by step

Verified Expert Solution

Question

1 Approved Answer

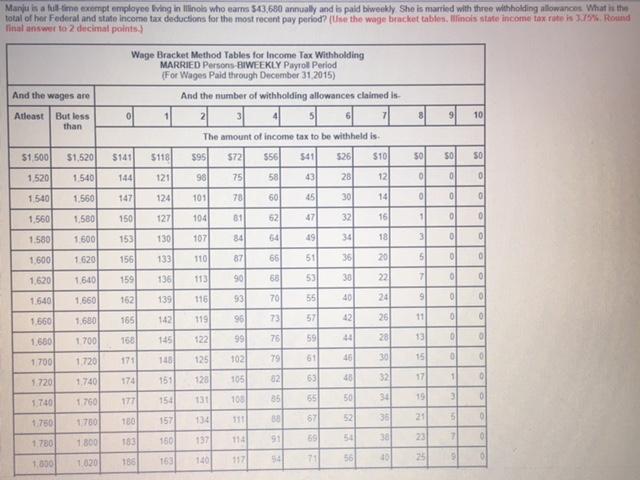

Manju is a full-time exempt employee living in Illinois who earns $43,680 annually and is paid biweekly. She is married with three withholding allowances. What

Manju is a full-time exempt employee living in Illinois who earns $43,680 annually and is paid biweekly. She is married with three withholding allowances. What is the total of her Federal and state income tax deductions for the most recent pay period?

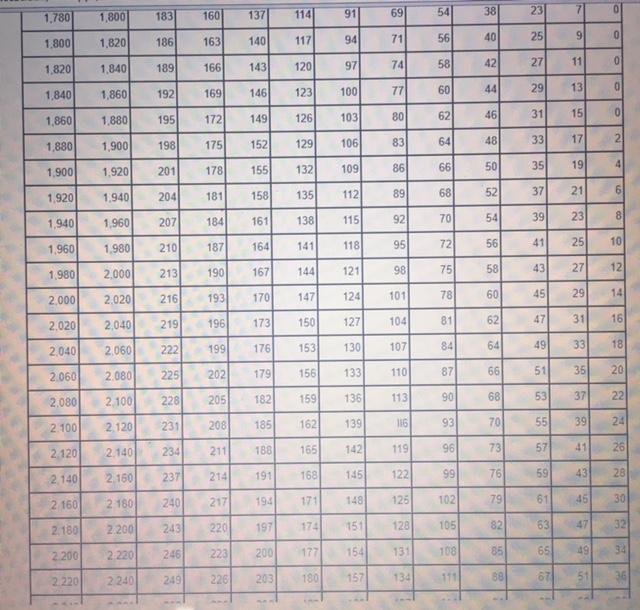

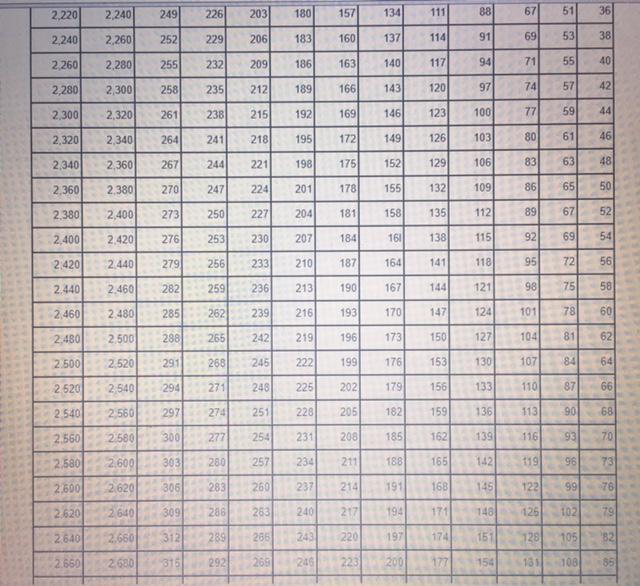

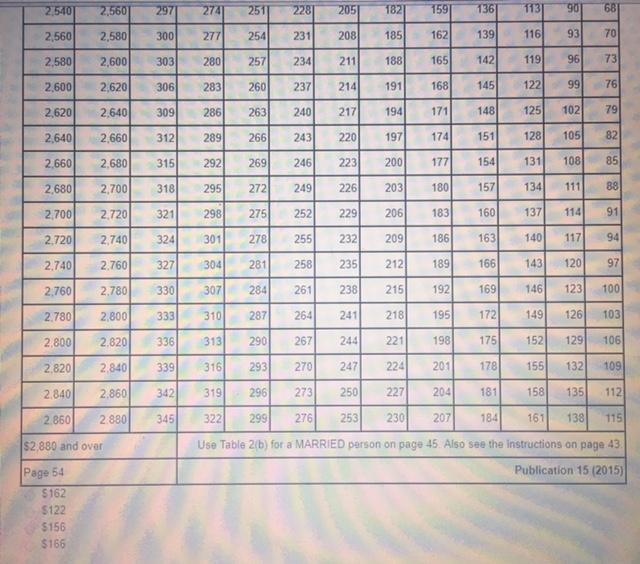

Manju is a ful-lime exempt employee iving in linoin who earns $43,680 annually and is paid biweekly She is married with three withholding allowancos What is the total of her Federal and state income tax deductions for the most recent pay period? (Use the wage bracket tablen. linois state income tax rate is 315%. Round inal answer to 2 decimal points) Wage Bracket Method Tables for Income Tax Withholding MARRIED Persons-BIWEEKLY Payroll Period (For Wages Paid through December 31,2015) And the wages are And the number of withholding allowances claimed is Atleast But less than 21 10 The amount of income tax to be withheld is $1.500 $1,520 $118 $95 $72 $56 $41 $26 $10 $141 1,520 1,540 144 121 98 75 58 43 28 12 1.540 1.560 147 124 101 70 60 45 30 14 1,560 1,580 150 127 104 81 62 47 32 16 1.580 1,600 153 130 107 84 64 49 34 18 3. 1,600 1.620 156 133 110 87 66 51 36 20 1,620 1.640 159 136 113 90 68 53 30 22 1.640 139 116 70 55 40 24 6. 1,660 162 93 1,660 1,680 165 142 119 96 73 57 42 26 11 1,660 1.700 145 122 99 76 59 44 28 13 168 1700 1,720 148 125 102 79 61 46 30 15 171 1,740 105 62 63 46 32 17 1.720 174 151 128 177 108 85 65 50 34 19 1,740 1.760 154 131 134 67 52 36 21 1.760 1700 180 157 111 1.800 160 137 114 91 69 54 38 23 1,780 183 1.000 163 140 117 54 71 56 40 25 1.020 186

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Biweekly payment to Manju Annualy payment 26 weeks 43680 26 1680 She is m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started