Answered step by step

Verified Expert Solution

Question

1 Approved Answer

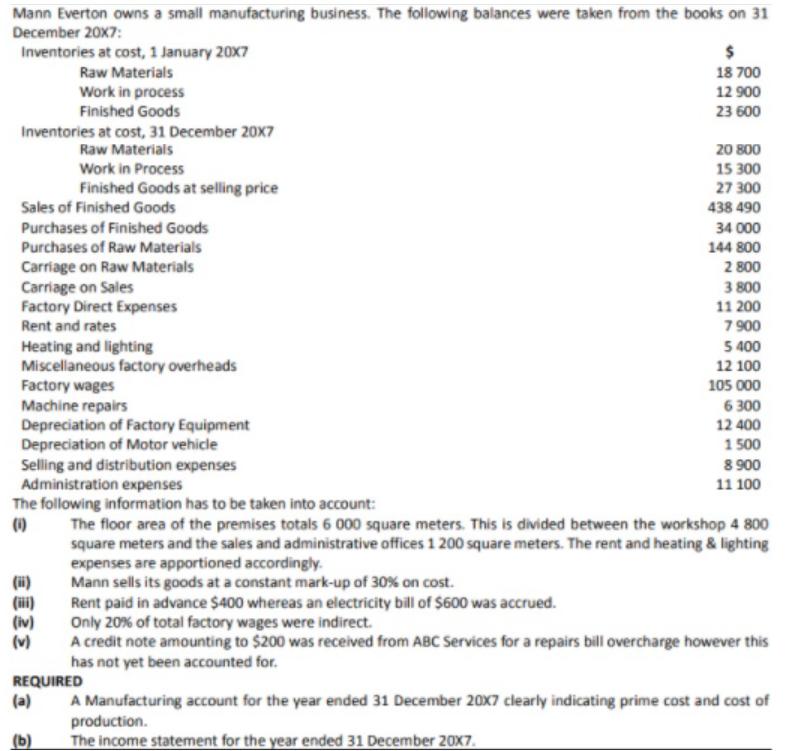

Mann Everton owns a small manufacturing business. The following balances were taken from the books on 31 December 20X7: Inventories at cost, 1 January

Mann Everton owns a small manufacturing business. The following balances were taken from the books on 31 December 20X7: Inventories at cost, 1 January 20X7 Raw Materials 18 700 Work in process Finished Goods 12 900 23 600 Inventories at cost, 31 December 20X7 Raw Materials 20 800 Work in Process 15 300 Finished Goods at selling price 27 300 Sales of Finished Goods 438 490 Purchases of Finished Goods 34 000 Purchases of Raw Materials Carriage on Raw Materials Carriage on Sales Factory Direct Expenses 144 800 2 800 3 800 11 200 7 900 5 400 12 100 Rent and rates Heating and lighting Miscellaneous factory overheads Factory wages Machine repairs Depreciation of Factory Equipment Depreciation of Motor vehicle Selling and distribution expenses Administration expenses The following information has to be taken into account: (1) 105 000 6 300 12 400 1 500 8 900 11 100 The floor area of the premises totals 6 000 square meters. This is divided between the workshop 4 800 square meters and the sales and administrative offices 1 200 square meters. The rent and heating & lighting expenses are apportioned accordingly. Mann sells its goods at a constant mark-up of 30 % on cost. Rent paid in advance $400 whereas an electricity bill of $600 was accrued. Only 20% of total factory wages were indirect. A credit note amounting to $200 was received from ABC Services for a repairs bill overcharge however this has not yet been accounted for. (i) (ii) (iv) (v) REQUIRED (a) A Manufacturing account for the year ended 31 December 20X7 clearly indicating prime cost and cost of production. The income statement for the year ended 31 December 20X7. (b)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Manufacturing Account Cost of Material Consumed 145500 EndWork in Process Inventory 15300 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started