Manny and Althea are married entrepreneurs. Althea has a start-up sole proprietorship in which she works long hours. This year the business generated $500,000

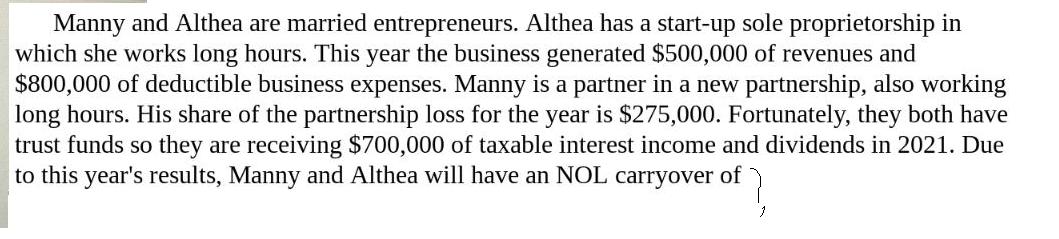

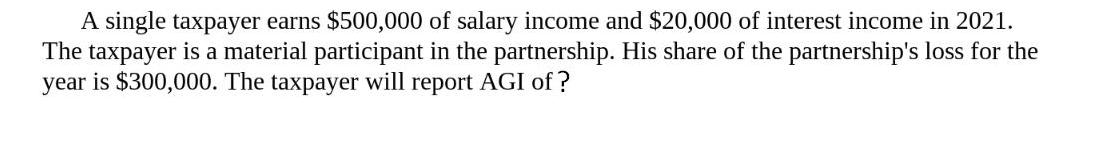

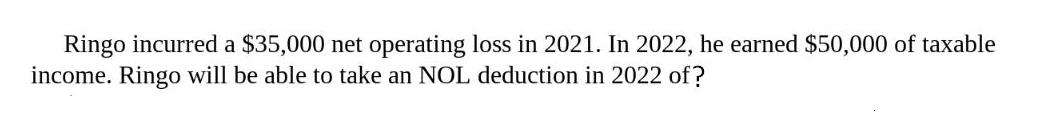

Manny and Althea are married entrepreneurs. Althea has a start-up sole proprietorship in which she works long hours. This year the business generated $500,000 of revenues and $800,000 of deductible business expenses. Manny is a partner in a new partnership, also working long hours. His share of the partnership loss for the year is $275,000. Fortunately, they both have trust funds so they are receiving $700,000 of taxable interest income and dividends in 2021. Due to this year's results, Manny and Althea will have an NOL carryover of A single taxpayer earns $500,000 of salary income and $20,000 of interest income in 2021. The taxpayer is a material participant in the partnership. His share of the partnership's loss for the year is $300,000. The taxpayer will report AGI of ? Ringo incurred a $35,000 net operating loss in 2021. In 2022, he earned $50,000 of taxable income. Ringo will be able to take an NOL deduction in 2022 of?

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine the NOL Net Operating Loss carryover for Manny and Althea we need to calculate their overall business incomeloss and total taxable income ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started