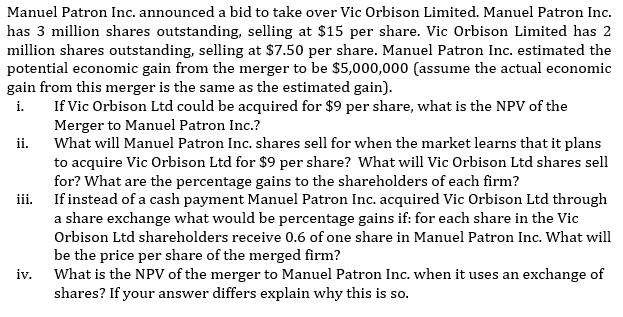

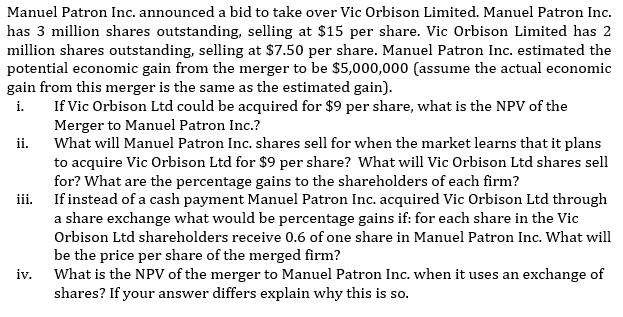

Manuel Patron Inc. announced a bid to take over Vic Orbison Limited. Manuel Patron Inc. has 3 million shares outstanding, selling at $15 per share. Vic Orbison Limited has 2 million shares outstanding, selling at $7.50 per share. Manuel Patron Inc. estimated the potential economic gain from the merger to be $5,000,000 (assume the actual economic gain from this merger is the same as the estimated gain). i. If Vic Orbison Ltd could be acquired for $9 per share, what is the NPV of the Merger to Manuel Patron Inc.? ii. What will Manuel Patron Inc. shares sell for when the market learns that it plans to acquire Vic Orbison Ltd for $9 per share? What will Vic Orbison Ltd shares sell for? What are the percentage gains to the shareholders of each firm? iii. If instead of a cash payment Manuel Patron Inc. acquired Vic Orbison Ltd through a share exchange what would be percentage gains if: for each share in the Vic Orbison Ltd shareholders receive 0.6 of one share in Manuel Patron Inc. What will be the price per share of the merged firm? iv. What is the NPV of the merger to Manuel Patron Inc. when it uses an exchange of shares? If your answer differs explain why this is so. Manuel Patron Inc. announced a bid to take over Vic Orbison Limited. Manuel Patron Inc. has 3 million shares outstanding, selling at $15 per share. Vic Orbison Limited has 2 million shares outstanding, selling at $7.50 per share. Manuel Patron Inc. estimated the potential economic gain from the merger to be $5,000,000 (assume the actual economic gain from this merger is the same as the estimated gain). i. If Vic Orbison Ltd could be acquired for $9 per share, what is the NPV of the Merger to Manuel Patron Inc.? ii. What will Manuel Patron Inc. shares sell for when the market learns that it plans to acquire Vic Orbison Ltd for $9 per share? What will Vic Orbison Ltd shares sell for? What are the percentage gains to the shareholders of each firm? iii. If instead of a cash payment Manuel Patron Inc. acquired Vic Orbison Ltd through a share exchange what would be percentage gains if: for each share in the Vic Orbison Ltd shareholders receive 0.6 of one share in Manuel Patron Inc. What will be the price per share of the merged firm? iv. What is the NPV of the merger to Manuel Patron Inc. when it uses an exchange of shares? If your answer differs explain why this is so