Answered step by step

Verified Expert Solution

Question

1 Approved Answer

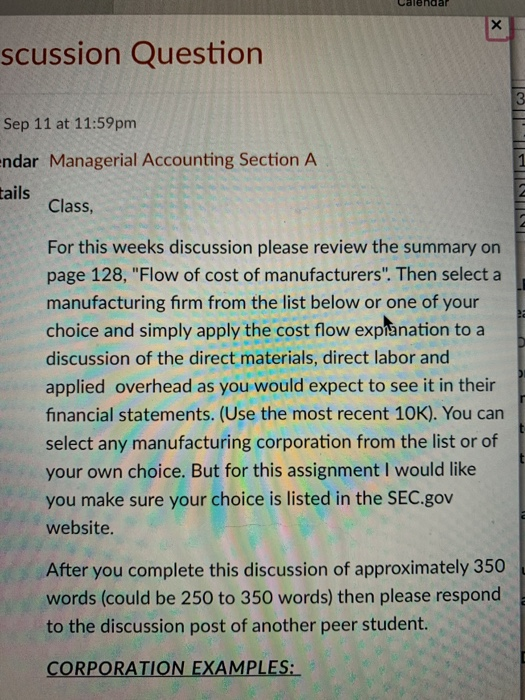

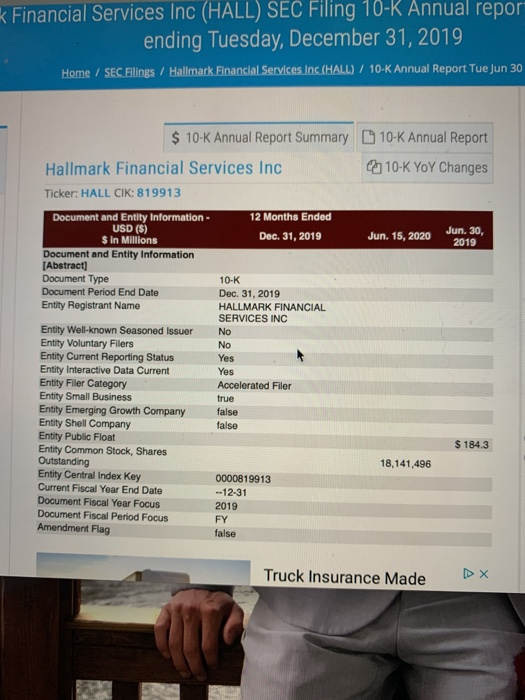

manufacturing corporation- Hallmark I believe this is it not sure what else to provide Calendar scussion Question Sep 11 at 11:59pm Endar Managerial Accounting Section

manufacturing corporation- Hallmark

I believe this is it

not sure what else to provide

Calendar scussion Question Sep 11 at 11:59pm Endar Managerial Accounting Section A tails Class, IMPRIW For this weeks discussion please review the summary on page 128, "Flow of cost of manufacturers". Then select a manufacturing firm from the list below or one of your choice and simply apply the cost flow explanation to a discussion of the direct materials, direct labor and applied overhead as you would expect to see it in their financial statements. (Use the most recent 10K). You can select any manufacturing corporation from the list or of your own choice. But for this assignment I would like you make sure your choice is listed in the SEC.gov website. After you complete this discussion of approximately 350 words (could be 250 to 350 words) then please respond to the discussion post of another peer student. CORPORATION EXAMPLES: k Financial Services Inc (HALL) SEC Filing 10-K Annual repor ending Tuesday, December 31, 2019 Home / SEC Filings / Hallmark Financial Services Inc (HALL) / 10-K Annual Report Tue Jun 30 $ 10-K Annual Report Summary 10-K Annual Report Hallmark Financial Services Inc 10-K YOY Changes Ticker: HALL CIK: 819913 12 Months Ended Dec. 31, 2019 Jun 15, 2020 Jun 30, 2019 Document and Entity Information - USD ($) Sin Millions Document and Entity Information [Abstract] Document Type Document Period End Date Entity Registrant Name Entity Well-known Seasoned Issuer Entity Voluntary Filers Entity Current Reporting Status Entity Interactive Data Current Entity Filer Category Entity Small Business Entity Emerging Growth Company Entity Shell Company Entity Public Float Entity Common Stock, Shares Outstanding Entity Central Index Key Current Fiscal Year End Date Document Fiscal Year Focus Document Fiscal Period Focus Amendment Flag 10-K Dec 31, 2019 HALLMARK FINANCIAL SERVICES INC No No Yes Yes Accelerated Filer true false false $184.3 18,141,496 0000819913 --12-31 2019 FY false Truck Insurance Made Calendar scussion Question Sep 11 at 11:59pm Endar Managerial Accounting Section A tails Class, IMPRIW For this weeks discussion please review the summary on page 128, "Flow of cost of manufacturers". Then select a manufacturing firm from the list below or one of your choice and simply apply the cost flow explanation to a discussion of the direct materials, direct labor and applied overhead as you would expect to see it in their financial statements. (Use the most recent 10K). You can select any manufacturing corporation from the list or of your own choice. But for this assignment I would like you make sure your choice is listed in the SEC.gov website. After you complete this discussion of approximately 350 words (could be 250 to 350 words) then please respond to the discussion post of another peer student. CORPORATION EXAMPLES: k Financial Services Inc (HALL) SEC Filing 10-K Annual repor ending Tuesday, December 31, 2019 Home / SEC Filings / Hallmark Financial Services Inc (HALL) / 10-K Annual Report Tue Jun 30 $ 10-K Annual Report Summary 10-K Annual Report Hallmark Financial Services Inc 10-K YOY Changes Ticker: HALL CIK: 819913 12 Months Ended Dec. 31, 2019 Jun 15, 2020 Jun 30, 2019 Document and Entity Information - USD ($) Sin Millions Document and Entity Information [Abstract] Document Type Document Period End Date Entity Registrant Name Entity Well-known Seasoned Issuer Entity Voluntary Filers Entity Current Reporting Status Entity Interactive Data Current Entity Filer Category Entity Small Business Entity Emerging Growth Company Entity Shell Company Entity Public Float Entity Common Stock, Shares Outstanding Entity Central Index Key Current Fiscal Year End Date Document Fiscal Year Focus Document Fiscal Period Focus Amendment Flag 10-K Dec 31, 2019 HALLMARK FINANCIAL SERVICES INC No No Yes Yes Accelerated Filer true false false $184.3 18,141,496 0000819913 --12-31 2019 FY false Truck Insurance Made Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started