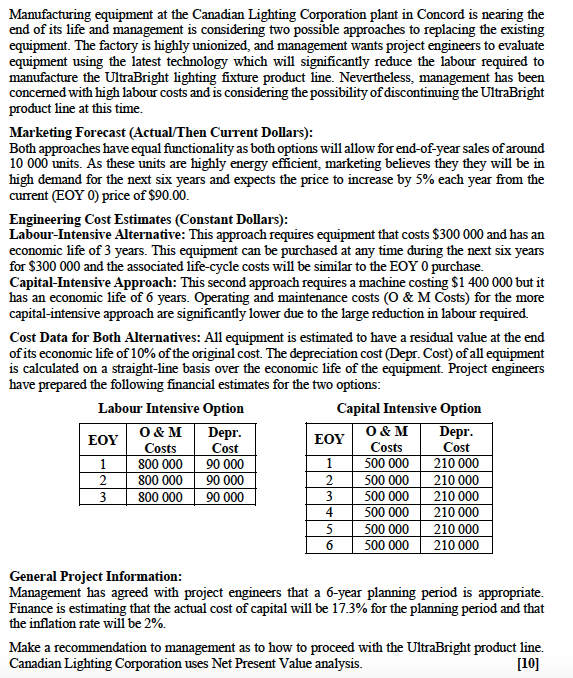

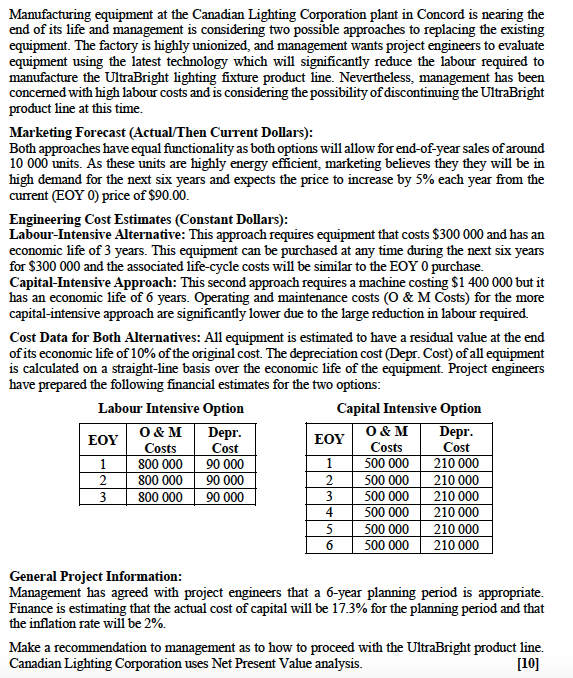

Manufacturing equipment at the Canadian Lighting Corporation plant in Concord is nearing the end of its life and management is considering two possible approaches to replacing the existing equipment. The factory is highly unionized, and management wants project engineers to evaluate equipment using the latest technology which will significantly reduce the labour required to manufacture the UltraBright lighting fixture product line. Nevertheless, management has been concerned with high labour costs and is considering the possibility of discontinuing the UltraBright product line at this time. Marketing Forecast (Actual/Then Current Dollars): Both approaches have equal functionality as both options will allow for end-of-year sales of around 10 000 units. As these units are highly energy efficient, marketing believes they they will be in high demand for the next six years and expects the price to increase by 5% each year from the current (EOY 0) price of $90.00. Engineering Cost Estimates (Constant Dollars): Labour-Intensive Alternative: This approach requires equipment that costs $300 000 and has an economic life of 3 years. This equipment can be purchased at any time during the next six years for $300 000 and the associated life-cycle costs will be similar to the EOY 0 purchase. Capital-Intensive Approach: This second approach requires a machine costing $1 400 000 but it has an economic life of 6 years. Operating and maintenance costs (O & M Costs) for the more capital-intensive approach are significantly lower due to the large reduction in labour required. Cost Data for Both Alternatives: All equipment is estimated to have a residual value at the end of its economic life of 10% of the original cost. The depreciation cost (Depr. Cost) of all equipment is calculated on a straight-line basis over the economic life of the equipment . Project engineers have prepared the following financial estimates for the two options: Labour Intensive Option Capital Intensive Option O&M Depr. O&M EOY EOY Depr. Costs Cost Costs Cost 1 800 000 90 000 500 000 210 000 2 800 000 90 000 500 000 210 000 3 800 000 90 000 500 000 210 000 500 000 210 000 500 000 210 000 6 500 000 210 000 General Project Information: Management has agreed with project engineers that a 6-year planning period is appropriate. Finance is estimating that the actual cost of capital will be 17.3% for the planning period and that the inflation rate will be 2%. Make a recommendation to management as to how to proceed with the UltraBright product line. Canadian Lighting Corporation uses Net Present Value analysis. [10] 1 2 3 4 5 Manufacturing equipment at the Canadian Lighting Corporation plant in Concord is nearing the end of its life and management is considering two possible approaches to replacing the existing equipment. The factory is highly unionized, and management wants project engineers to evaluate equipment using the latest technology which will significantly reduce the labour required to manufacture the UltraBright lighting fixture product line. Nevertheless, management has been concerned with high labour costs and is considering the possibility of discontinuing the UltraBright product line at this time. Marketing Forecast (Actual/Then Current Dollars): Both approaches have equal functionality as both options will allow for end-of-year sales of around 10 000 units. As these units are highly energy efficient, marketing believes they they will be in high demand for the next six years and expects the price to increase by 5% each year from the current (EOY 0) price of $90.00. Engineering Cost Estimates (Constant Dollars): Labour-Intensive Alternative: This approach requires equipment that costs $300 000 and has an economic life of 3 years. This equipment can be purchased at any time during the next six years for $300 000 and the associated life-cycle costs will be similar to the EOY 0 purchase. Capital-Intensive Approach: This second approach requires a machine costing $1 400 000 but it has an economic life of 6 years. Operating and maintenance costs (O & M Costs) for the more capital-intensive approach are significantly lower due to the large reduction in labour required. Cost Data for Both Alternatives: All equipment is estimated to have a residual value at the end of its economic life of 10% of the original cost. The depreciation cost (Depr. Cost) of all equipment is calculated on a straight-line basis over the economic life of the equipment . Project engineers have prepared the following financial estimates for the two options: Labour Intensive Option Capital Intensive Option O&M Depr. O&M EOY EOY Depr. Costs Cost Costs Cost 1 800 000 90 000 500 000 210 000 2 800 000 90 000 500 000 210 000 3 800 000 90 000 500 000 210 000 500 000 210 000 500 000 210 000 6 500 000 210 000 General Project Information: Management has agreed with project engineers that a 6-year planning period is appropriate. Finance is estimating that the actual cost of capital will be 17.3% for the planning period and that the inflation rate will be 2%. Make a recommendation to management as to how to proceed with the UltraBright product line. Canadian Lighting Corporation uses Net Present Value analysis. [10] 1 2 3 4 5