Answered step by step

Verified Expert Solution

Question

1 Approved Answer

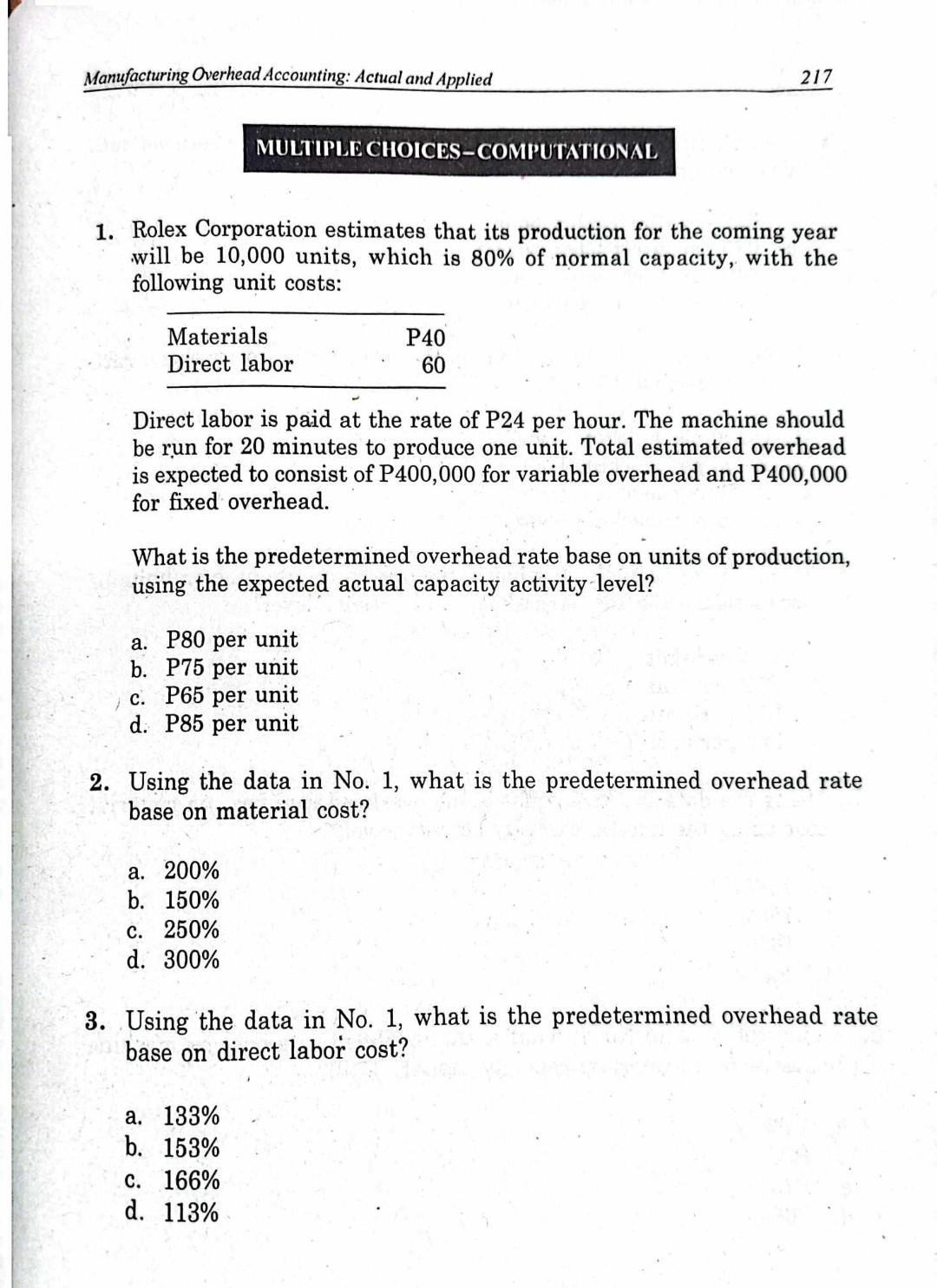

Manufacturing Overhead Accounting: Actual and Applied 217 MULTIPLE CHOICES - COMPUTATIONAL 1. Rolex Corporation estimates that its production for the coming year will be 10,000

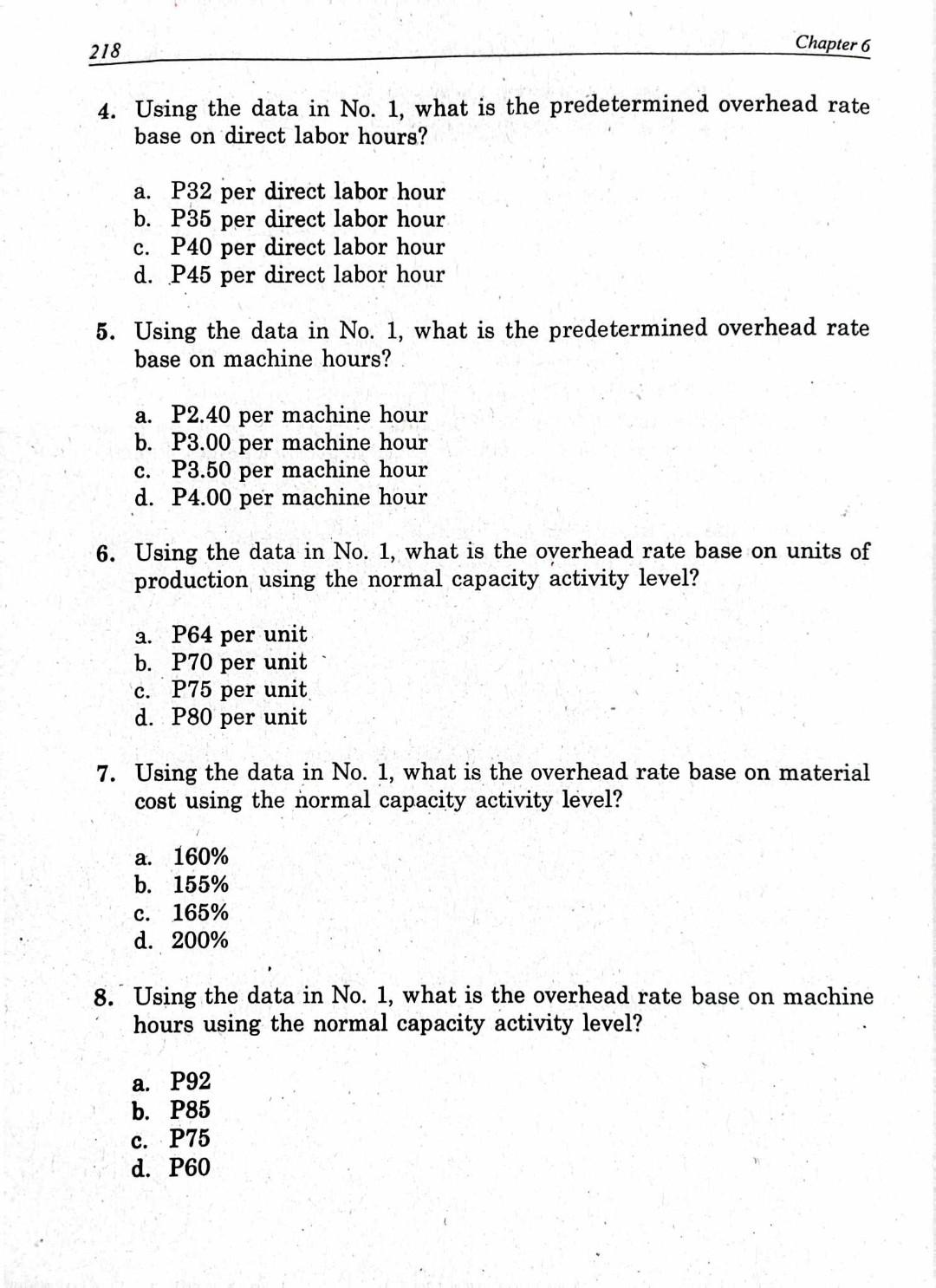

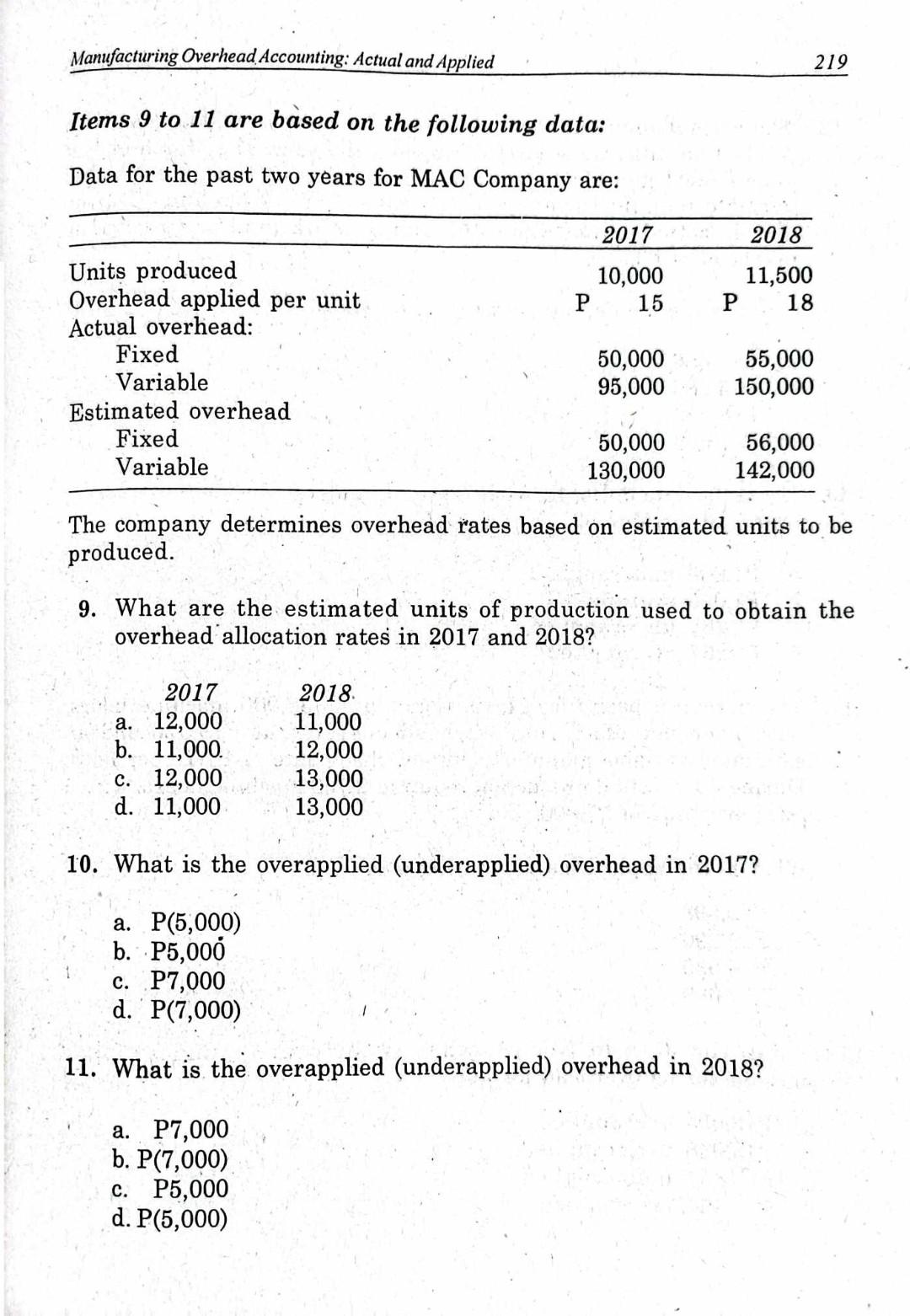

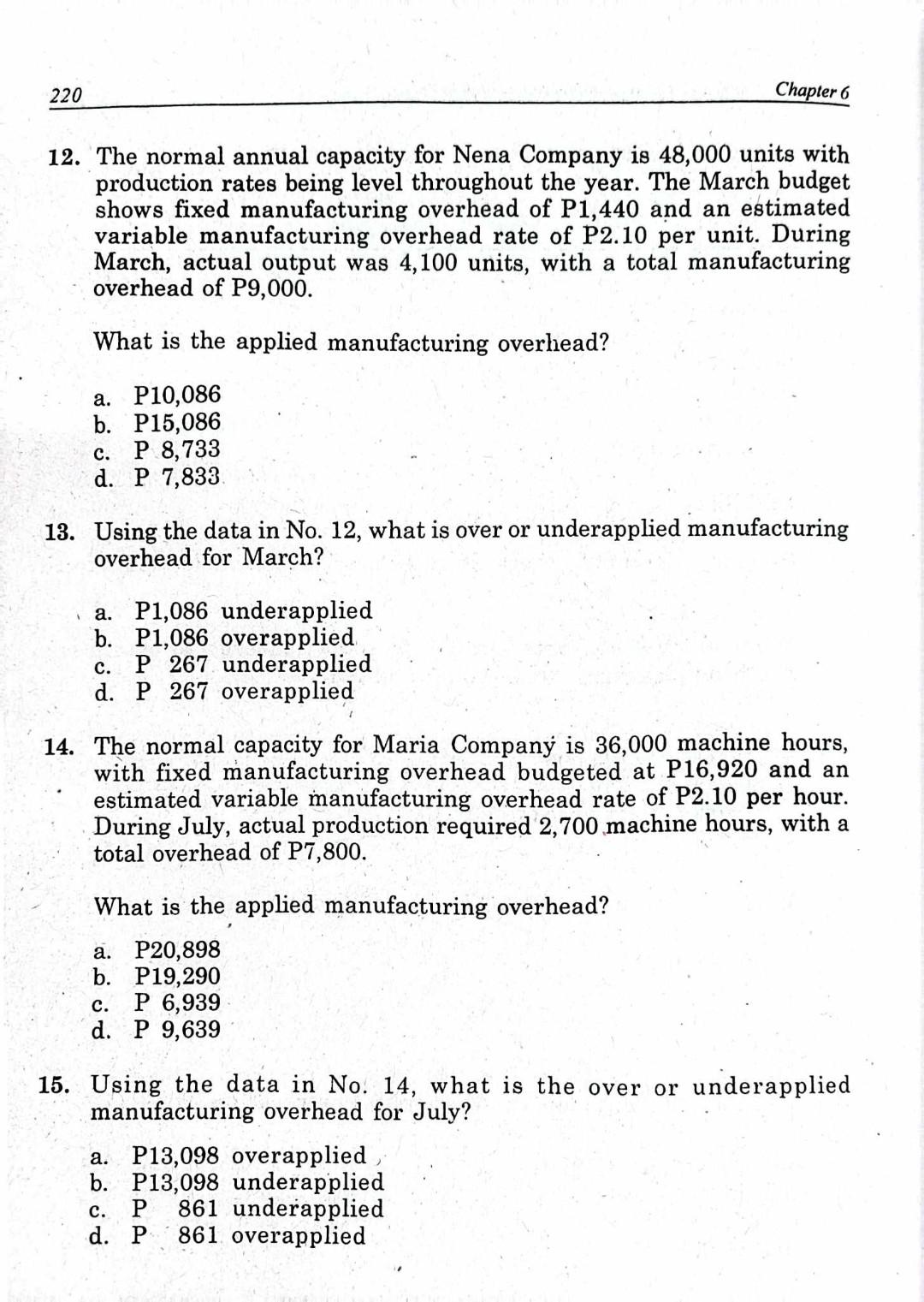

Manufacturing Overhead Accounting: Actual and Applied 217 MULTIPLE CHOICES - COMPUTATIONAL 1. Rolex Corporation estimates that its production for the coming year will be 10,000 units, which is 80% of normal capacity, with the following unit costs: Direct labor is paid at the rate of P24 per hour. The machine should be run for 20 minutes to produce one unit. Total estimated overhead is expected to consist of P400,000 for variable overhead and P400,000 for fixed overhead. What is the predetermined overhead rate base on units of production, using the expected actual capacity activity level? a. P80 per unit b. P75 per unit c. P65 per unit d. P85 per unit 2. Using the data in No. 1 , what is the predetermined overhead rate base on material cost? a. 200% b. 150% c. 250% d. 300% 3. Using the data in No. 1, what is the predetermined overhead rate base on direct labor cost? a. 133% b. 153% c. 166% d. 113% 4. Using the data in No. 1 , what is the predetermined overhead rate base on direct labor hours? a. P32 per direct labor hour b. P35 per direct labor hour c. P40 per direct labor hour d. P45 per direct labor hour 5. Using the data in No. 1 , what is the predetermined overhead rate base on machine hours? a. P2.40 per machine hour b. P3.00 per machine hour c. P3.50 per machine hour d. P4.00 per machine hour 6. Using the data in No. 1 , what is the overhead rate base on units of production using the normal capacity activity level? a. P64 per unit b. P70 per unit c. P75 per unit d. P80 per unit 7. Using the data in No. 1 , what is the overhead rate base on material cost using the normal capacity activity level? a. 160% b. 155% c. 165% d. 200% 8. Using the data in No. 1, what is the overhead rate base on machine hours using the normal capacity activity level? a. P92 b. P85 c. P75 d. P60 Items 9 to 11 are based on the following data: Data for the past two years for MAC Company are: The company determines overhead rates based on estimated units to be produced. 9. What are the estimated units of production used to obtain the overhead allocation rates in 2017 and 2018? 10. What is the overapplied (underapplied) overhead in 2017 ? a. P(5,000) b. P5,000 c. P7,000 d. P(7,000) 11. What is the overapplied (underapplied) overhead in 2018 ? a. P7,000 b. P(7,000) c. P5,000 d. P(5,000) 12. The normal annual capacity for Nena Company is 48,000 units with production rates being level throughout the year. The March budget shows fixed manufacturing overhead of P1,440 and an estimated variable manufacturing overhead rate of P2.10 per unit. During March, actual output was 4,100 units, with a total manufacturing overhead of P9,000. What is the applied manufacturing overhead? a. P10,086 b. P15,086 c. P8,733 d. P7,833 13. Using the data in No. 12 , what is over or underapplied manufacturing overhead for March? a. P1,086 underapplied b. P1,086 overapplied c. P267 underapplied d. P 267 overapplied 14. The normal capacity for Maria Company is 36,000 machine hours, with fixed manufacturing overhead budgeted at P16,920 and an estimated variable manufacturing overhead rate of P2.10 per hour. During July, actual production required 2,700 machine hours, with a total overhead of PT,800. What is the applied manufacturing overhead? a. P20,898 b. P19,290 c. P6,939 d. P9,639 15. Using the data in No. 14 , what is the over or underapplied manufacturing overhead for July? a. P13,098 overapplied b. P13,098 underapplied c. P861 underapplied d. P861 overapplied

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started