Question: manufacturing process of guitars. the data is not given. Create the data based on a random product, in this case guitars. Cost Characteristics and Basics

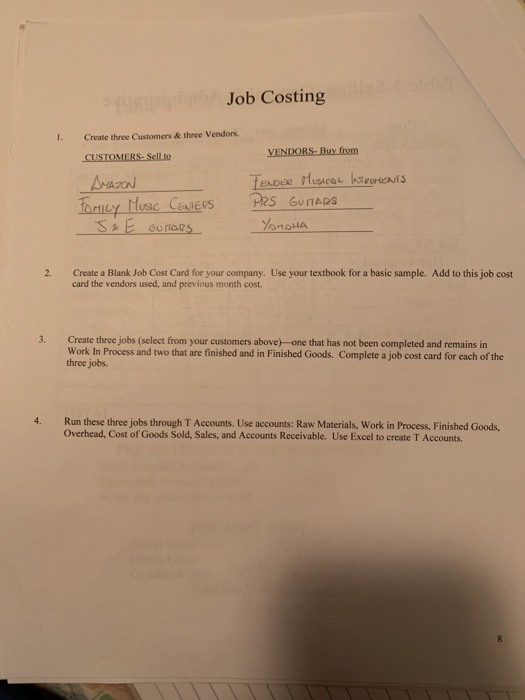

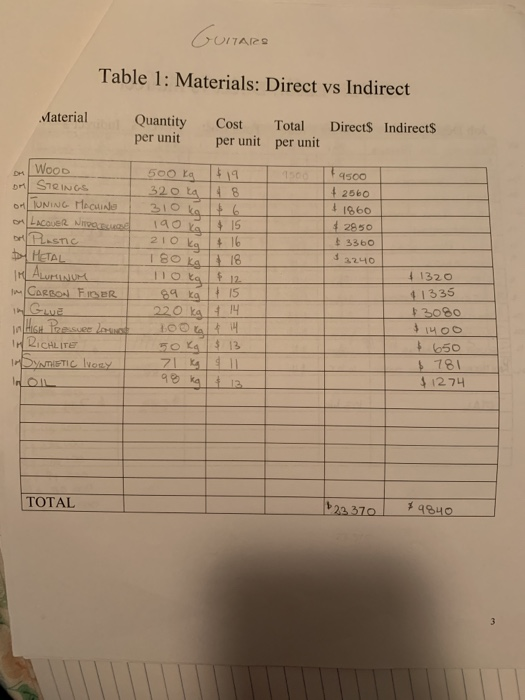

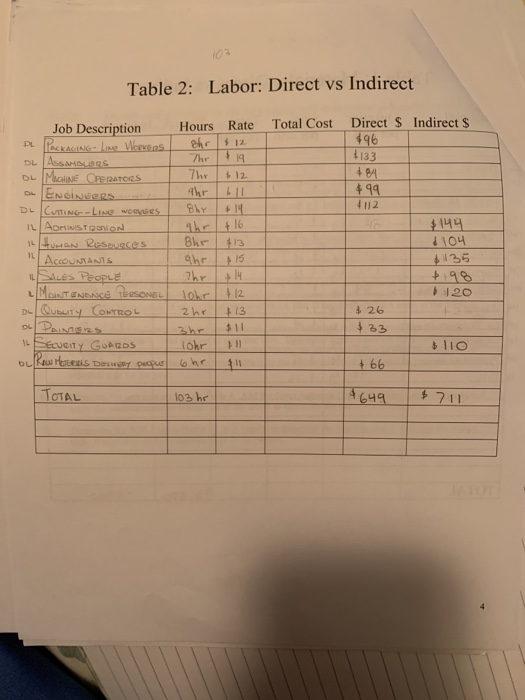

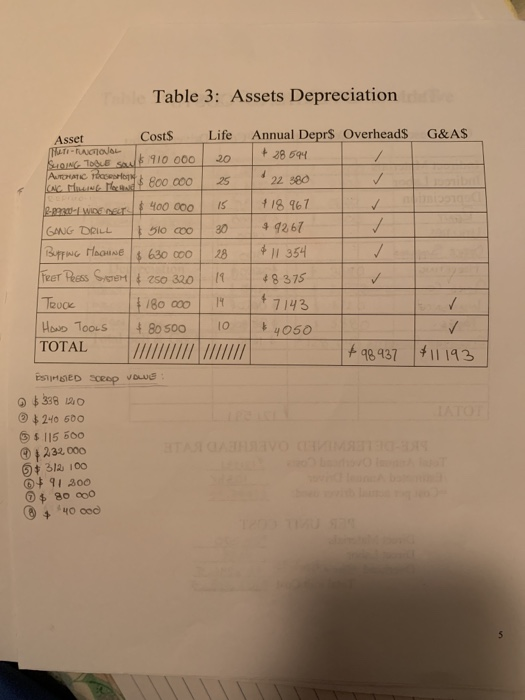

Cost Characteristics and Basics NOTE: Details and accuracy at the beginning will make your job easier in the lat chapters and the presentation. Create a flow chart of the manufacturing process. Show each activity required to make the product Show the material and labor as it is added to each activity. Enter the materials from the flow chart on Table 1. Determine the quantity per unit (ex: pounds required for cach unit), cost per quantity (price per pound), total dollars per unit for each material and then determine whether it is direct or indirect. Total the direct material cost and indirect material cost. Transfer the indirect material costs to the overhead chart. (Table 4) Enter the labor from the flow chart on Table 2. Determine the hours per labor type (ex: 5hrs for machine operator), determine an average rate for this type of labor. Total the cost and determine the direct labor and indirect labor dollars. Transfer the indirect labor costs to the overhead chart. (Table 4) Decide what assets (property plant and equipment) you will use to in your business to make your product and run the business. Enter the cost, life, and annual depreciation for each asset on Table 3. Decide whether the depreciation is an overhead cost or a SG&A cost. Transfer the SG&A costs to the Table 5 Add other overhead costs to the indirect materials, indirect labor and factory depreciation. (ex: rent, insurance) in Table 4. Total the cost of each line item. Determine the driver to use for your overhead costs. It may be helpful to determine driver for each cost, taking the most used driver as your overhead driver. Add the total annual overhead costs then divide it by the estimated driver. This will be your predetermined overhead rate for the year. 6. Complete the unit cost portion on Table 4. Add the direct materials (Table 1). Direct Labor (Table 2) and apply the predetermined overhead rate to the driver to determine the per unit overhead cost. Determine the SG&A costs (Table 5). It is helpful to determine the monthly cost to calculate the annual cost. You will need these numbers later in the project. Job Costing Create three Customers & three Vendors. VENDORS- Buy from CUSTOMERS. Sell to AMAZON Torily Music CEMERS 5% E CUMPS TENDER MUSICAL INTRUMENTS Pizs GUITARS Yanona 2. Create a Blank Job Cost Card for your company. Use your textbook for a basic sample. Add to this job cost card the vendors used, and previous month cost. 3. Create three jobs (select from your customers above) one that has not been completed and remains in Work In Process and two that are finished and in Finished Goods. Complete a job cost card for each of the three jobs. 4. Run these three jobs through T Accounts. Use accounts: Raw Materials, Work in Process, Finished Goods, Overhead, Cost of Goods Sold, Sales, and Accounts Receivable. Use Excel to create T Accounts. Cost Behavior Analysis Determine whether the costs you have previously entered (Materials, Labor, Overhead, SCRA) are fixed or variable. (Table 6) Enter the dollar amount in the fixed column or the variable column. Total the two columns. You will need these numbers for the CVP (Cost Volume Profit) formula Determine the fixed and variable costs of your mixed costs. (Utilities and maintenance are examples. However, don't get too creative) Estimate the amount of utilities costs per month for 12 months. If your process is machine intensive you will have a high amount of utility cost and maintenance cost. if it is labor intensive your utilities should be a minimal Cost-Volume-Profit (CVP)Relationships 1. Selling Price: Estimate a selling price for your product, remembering to cover ALL costs. Start with the selling price of your product in a local store. Subtract the store's estimated Selling. General and Administration and Profit from the store's price to determine your selling price. 2. Breakeven point: Using the previous developed numbers AND Table 6. determine the breakeven point. Be sure to include the fixed component of mixed cost in your fixed costs and the variable component in the variable cost. Show your breakeven in Sales units and in Sales Dollars 3. Profit Planning: Determine the number of units you must produce to make a profit (not a loss) using 3 assumptions concerning your net income (profit), both in sales units and sales dollars. Put each assumption into a CVP formula a. Aggressive Profit (This will be a great year for your product) b. Conservative Profit (Your profit is slightly above breakeven.) c. Average Profit (Your profit will be between aggressive and conservative) Determine the contribution margin ratio using the conservative sales figure. 5. Determine your Margin of Safety. 6. Determine your degree of operating leverage GUITARE Table 1: Materials: Direct vs Indirect Material Quantity per unit Cost Total per unit per unit Direct Indirects $14 4500 + 2560 1860 #2950 210 kg 3360 $3240 Woon 500 La DM STINGS 320 La O TUNING Mecline 310 kg OLAC MIO 190 kg one Plastic + METAL 180 K 18 IM ALUMINUM Tota F12 Corso FIBER 89 k tis in GLUE 220 kg 14 In HIGH Precer last IH LICALITET 50 kg 13 IMDYNTETIC IVORY FLO 98 kg 13 1320 11335 13080 1400 650 . 781 $1274 TOTAL 23 370 9840 Table 2: Labor: Direct vs Indirect Total Cost Rate & 12 19 & 12 Direct $ Indirect $ I 196 1133 Job Description DE PESKAGING Le Merves DL ASS OLME CPDATORS ENGINERS DL Cuti-Linwoods IL AORISTION toman Resources ACCOUNTANTS "SALES PEOPLE MOTINDAKE TONEL Du QuouTY CONTROL ou Paimond 14 SECURITY GUARDS oc Raw MOTERINS DELvery peopus Hours shr Ihr Ihr thr 8hr shr Bhr ahr The $144 14 16 $13 15 44 99 120 2hr 2hr Tohr ohr +13 $11 II 1 TOTAL I 103hr Table 3: Assets Depreciation 30 Asset Costs Life HI-CHTJL 20 SONGTE SU 910 000 AUTOMATIC Phaet on kec Mate 800 000 BI MOGLA 400 000 15 GANG DRILL 1 510 cool Buppa Hoone $ 630 000 FRET Pesss Sem & 250 320 19 | Truck 1180000 14 HOND TOOLS + 80500 10 TOTALT MIT ESTHED SCRAP VOLVO $338 120 $ 240 500 $ 115 600 232,000 $ 312 100 0+ 91 300 $ 80 000 $ 40000 Annual Deprs Overheads G&AS + 28694 22380 | 418 967 $9267 1 & 11 354 48375 +7143 4050 +98 937 &11193 | Cost Characteristics and Basics NOTE: Details and accuracy at the beginning will make your job easier in the lat chapters and the presentation. Create a flow chart of the manufacturing process. Show each activity required to make the product Show the material and labor as it is added to each activity. Enter the materials from the flow chart on Table 1. Determine the quantity per unit (ex: pounds required for cach unit), cost per quantity (price per pound), total dollars per unit for each material and then determine whether it is direct or indirect. Total the direct material cost and indirect material cost. Transfer the indirect material costs to the overhead chart. (Table 4) Enter the labor from the flow chart on Table 2. Determine the hours per labor type (ex: 5hrs for machine operator), determine an average rate for this type of labor. Total the cost and determine the direct labor and indirect labor dollars. Transfer the indirect labor costs to the overhead chart. (Table 4) Decide what assets (property plant and equipment) you will use to in your business to make your product and run the business. Enter the cost, life, and annual depreciation for each asset on Table 3. Decide whether the depreciation is an overhead cost or a SG&A cost. Transfer the SG&A costs to the Table 5 Add other overhead costs to the indirect materials, indirect labor and factory depreciation. (ex: rent, insurance) in Table 4. Total the cost of each line item. Determine the driver to use for your overhead costs. It may be helpful to determine driver for each cost, taking the most used driver as your overhead driver. Add the total annual overhead costs then divide it by the estimated driver. This will be your predetermined overhead rate for the year. 6. Complete the unit cost portion on Table 4. Add the direct materials (Table 1). Direct Labor (Table 2) and apply the predetermined overhead rate to the driver to determine the per unit overhead cost. Determine the SG&A costs (Table 5). It is helpful to determine the monthly cost to calculate the annual cost. You will need these numbers later in the project. Job Costing Create three Customers & three Vendors. VENDORS- Buy from CUSTOMERS. Sell to AMAZON Torily Music CEMERS 5% E CUMPS TENDER MUSICAL INTRUMENTS Pizs GUITARS Yanona 2. Create a Blank Job Cost Card for your company. Use your textbook for a basic sample. Add to this job cost card the vendors used, and previous month cost. 3. Create three jobs (select from your customers above) one that has not been completed and remains in Work In Process and two that are finished and in Finished Goods. Complete a job cost card for each of the three jobs. 4. Run these three jobs through T Accounts. Use accounts: Raw Materials, Work in Process, Finished Goods, Overhead, Cost of Goods Sold, Sales, and Accounts Receivable. Use Excel to create T Accounts. Cost Behavior Analysis Determine whether the costs you have previously entered (Materials, Labor, Overhead, SCRA) are fixed or variable. (Table 6) Enter the dollar amount in the fixed column or the variable column. Total the two columns. You will need these numbers for the CVP (Cost Volume Profit) formula Determine the fixed and variable costs of your mixed costs. (Utilities and maintenance are examples. However, don't get too creative) Estimate the amount of utilities costs per month for 12 months. If your process is machine intensive you will have a high amount of utility cost and maintenance cost. if it is labor intensive your utilities should be a minimal Cost-Volume-Profit (CVP)Relationships 1. Selling Price: Estimate a selling price for your product, remembering to cover ALL costs. Start with the selling price of your product in a local store. Subtract the store's estimated Selling. General and Administration and Profit from the store's price to determine your selling price. 2. Breakeven point: Using the previous developed numbers AND Table 6. determine the breakeven point. Be sure to include the fixed component of mixed cost in your fixed costs and the variable component in the variable cost. Show your breakeven in Sales units and in Sales Dollars 3. Profit Planning: Determine the number of units you must produce to make a profit (not a loss) using 3 assumptions concerning your net income (profit), both in sales units and sales dollars. Put each assumption into a CVP formula a. Aggressive Profit (This will be a great year for your product) b. Conservative Profit (Your profit is slightly above breakeven.) c. Average Profit (Your profit will be between aggressive and conservative) Determine the contribution margin ratio using the conservative sales figure. 5. Determine your Margin of Safety. 6. Determine your degree of operating leverage GUITARE Table 1: Materials: Direct vs Indirect Material Quantity per unit Cost Total per unit per unit Direct Indirects $14 4500 + 2560 1860 #2950 210 kg 3360 $3240 Woon 500 La DM STINGS 320 La O TUNING Mecline 310 kg OLAC MIO 190 kg one Plastic + METAL 180 K 18 IM ALUMINUM Tota F12 Corso FIBER 89 k tis in GLUE 220 kg 14 In HIGH Precer last IH LICALITET 50 kg 13 IMDYNTETIC IVORY FLO 98 kg 13 1320 11335 13080 1400 650 . 781 $1274 TOTAL 23 370 9840 Table 2: Labor: Direct vs Indirect Total Cost Rate & 12 19 & 12 Direct $ Indirect $ I 196 1133 Job Description DE PESKAGING Le Merves DL ASS OLME CPDATORS ENGINERS DL Cuti-Linwoods IL AORISTION toman Resources ACCOUNTANTS "SALES PEOPLE MOTINDAKE TONEL Du QuouTY CONTROL ou Paimond 14 SECURITY GUARDS oc Raw MOTERINS DELvery peopus Hours shr Ihr Ihr thr 8hr shr Bhr ahr The $144 14 16 $13 15 44 99 120 2hr 2hr Tohr ohr +13 $11 II 1 TOTAL I 103hr Table 3: Assets Depreciation 30 Asset Costs Life HI-CHTJL 20 SONGTE SU 910 000 AUTOMATIC Phaet on kec Mate 800 000 BI MOGLA 400 000 15 GANG DRILL 1 510 cool Buppa Hoone $ 630 000 FRET Pesss Sem & 250 320 19 | Truck 1180000 14 HOND TOOLS + 80500 10 TOTALT MIT ESTHED SCRAP VOLVO $338 120 $ 240 500 $ 115 600 232,000 $ 312 100 0+ 91 300 $ 80 000 $ 40000 Annual Deprs Overheads G&AS + 28694 22380 | 418 967 $9267 1 & 11 354 48375 +7143 4050 +98 937 &11193 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts