Many parts. It's due 8 am central time on Monday (tomorrow)

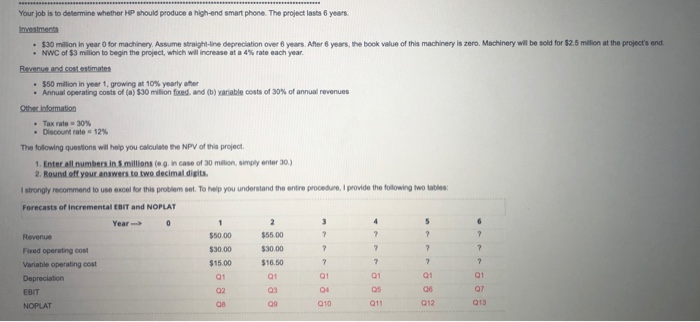

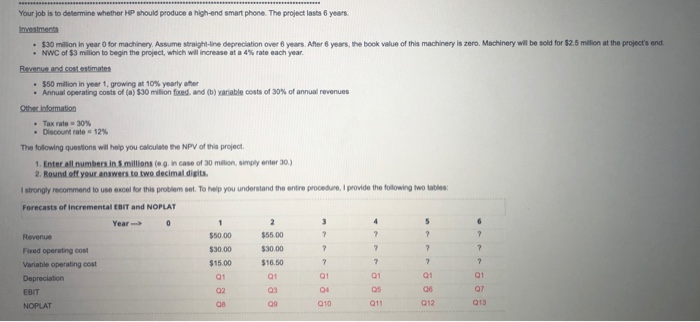

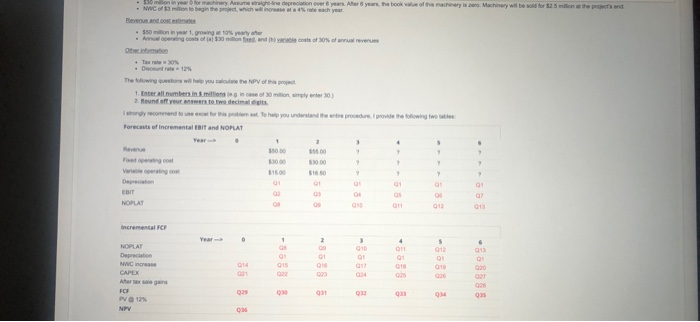

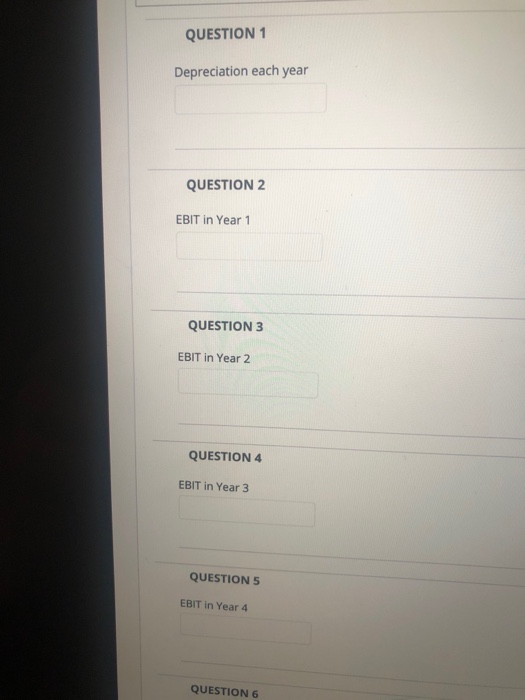

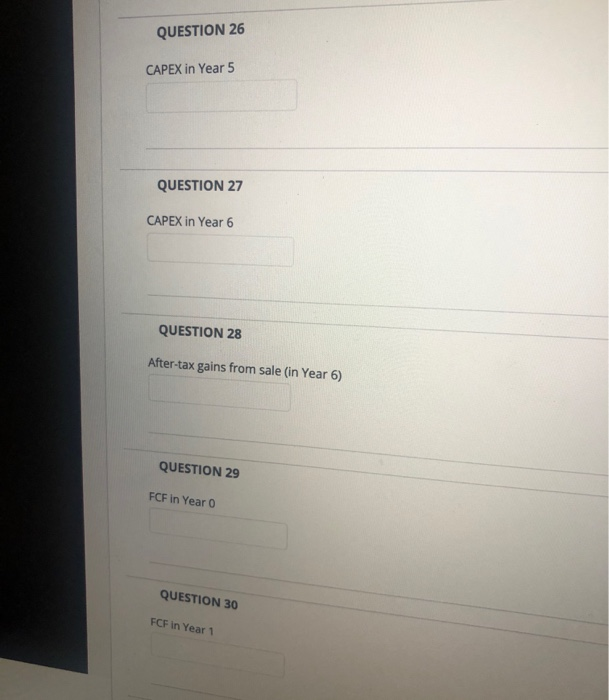

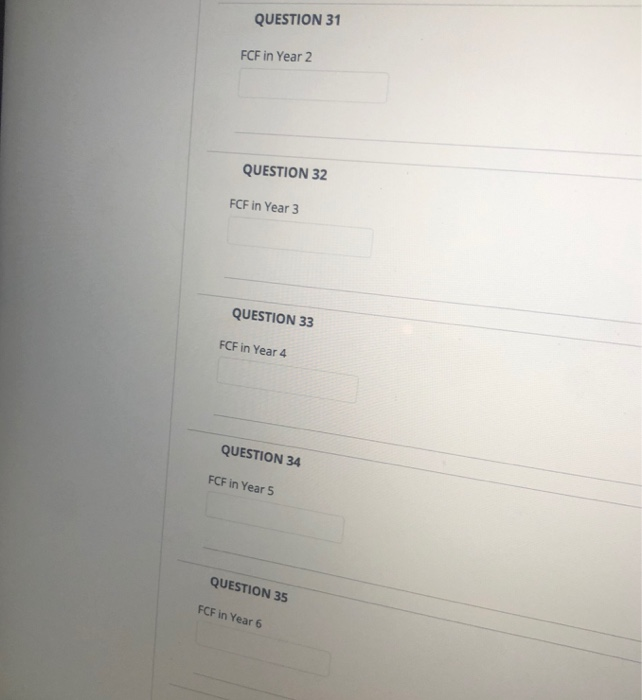

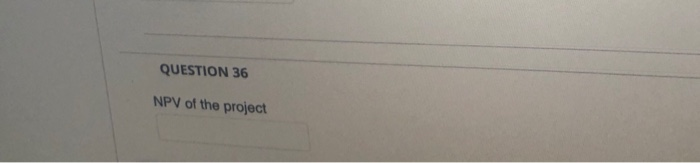

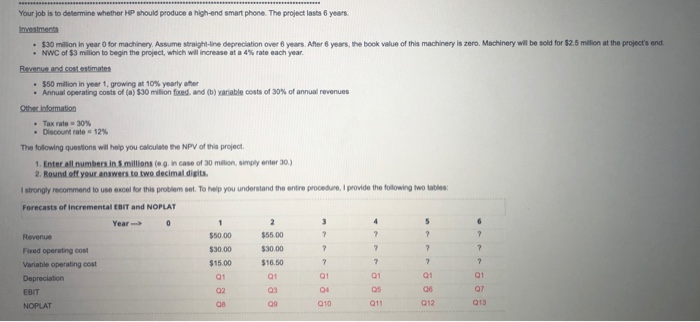

Your job is to determine whether HP should produce a high-end smartphone. The project last 6 years. book of this machinery is er Machinery will be sold for $2.5 million at the projects and $30 million in year for machinery Assumergine depreciation over years A rya NWC of $3 milion to begin the project which will increase t r ate each year Ber and cost estimates $50 million in year 1. growing 10% yearly Annual operating costs of (a) 530 million fod and (b) yarable costs of 30% of annual revenues Other Information Tax rate 30% Discount rate=12% The following questions will help you to the NPV of this project provide the following two tables 1. Enter all numbers in millions (eg in case of 30 milion simply enter 30) 2. Round off your answers to two decimal digits. I strongly recommend to use tool for this problem set. To help you understand the entire procedure Forecasts of incremental EBIT and NOPLAT Year - 0 $50.00 $5500 Fed operating cost 53000 Variable operating cost $16.50 Depreciation NOPLAT of this machinery . moni y orary we w ere depreciation over her years, the book . C on to begin het, which w as a 45 Brands = 30 m H H , PH H vay te . Along costs and the cost of 30% of al revenues Otomation t 0) The town won will help you call the NPV of 1. Enter all numbers in mi c e of 30 2. sound of your e rs to two decimal condo for this po s t to Forecasts of incremental EBIT and NOPLAT you understand the procedure provide the following wees 53000 Federico Var 55100 SO 180 NOLAT Incremental RCF 999 PV QUESTION 1 Depreciation each year QUESTION 2 EBIT in Year 1 QUESTION 3 EBIT in Year 2 QUESTION 4 EBIT in Year 3 QUESTIONS EBIT in Year 4 QUESTION 6 QUESTION 6 EBIT in Year 5 QUESTION 7 EBIT in Year 6 QUESTION 8 NOPLAT in Year 1 QUESTIONS NOPLAT in Year 2 QUESTION 10 NOPLAT in Year 3 QUESTION 11 NOPLAT in Year 4 QUESTION 12 NOPLAT in Year 5 QUESTION 13 NOPLAT in Year 6 QUESTION 14 Increase in NWC at Year 0 QUESTION 15 Increase in NWC at Year 1 QUESTION 16 Increase in NWC at Year 2 QUESTION 17 Increase in NWC at Year 3 QUESTION 18 Increase in NWC at Year 4 QUESTION 19 Increase in NWC at Year 5 QUESTION 20 Increase in NWC at Year 6 QUESTION 21 CAPEX in Year 0 QUESTION 22 CAPEX in Year 1 QUESTION 23 CAPEX in Year 2 QUESTION 24 CAPEX in Year 3 QUESTION 25 CAPEX in Year 4 QUESTION 26 CAPEX in Year 5 QUESTION 27 CAPEX in Year 6 QUESTION 28 After-tax gains from sale (in Year 6) QUESTION 29 FCF in Year o QUESTION 30 FCF in Year 1 QUESTION 31 FCF in Year 2 QUESTION 32 FCF in Year 3 QUESTION 33 FCF in Year 4 QUESTION 34 FCF in Year 5 QUESTION 35 FCF in Year 6 QUESTION 36 NPV of the project