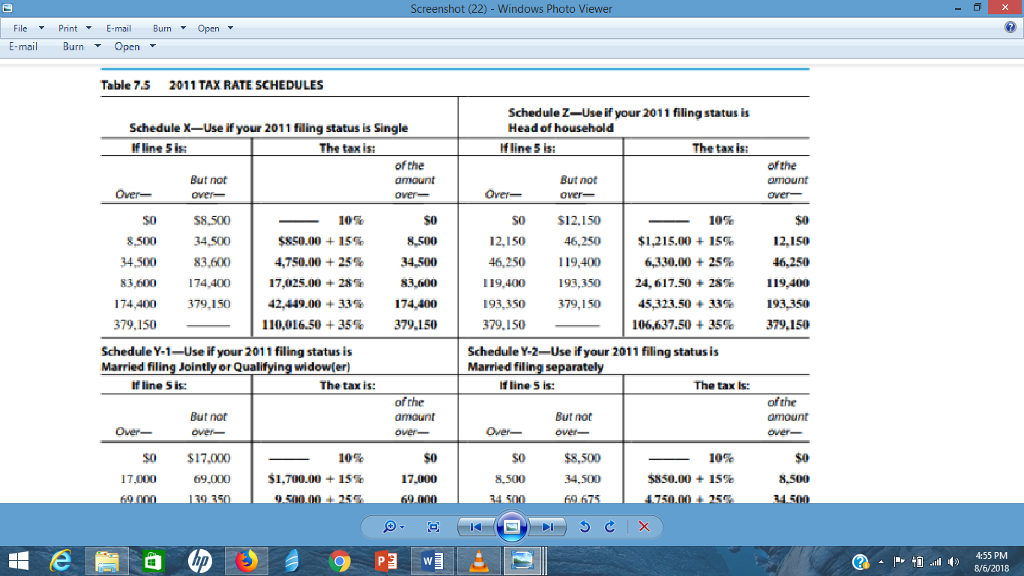

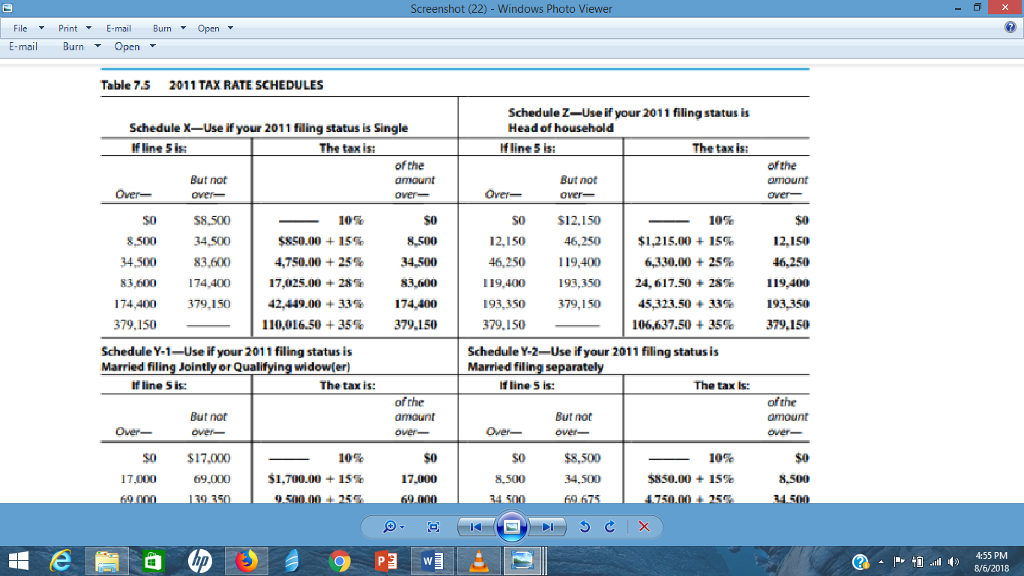

Many people count on tax returns for income to help them catch up on bills, buy something nice, etc. Lets say you claim head of household for tax purposes. With the new house though, your itemized deductions are $12,150. Gross wages are 57408. 11,100 in exemptions. Taxable income 34,158. Tax liability is 4698.70

16)Use the federal withholding amount of 529.92 (assuming that this is typical of a paycheck) to find the annual federal tax paid.

I'm not sure if this table is needed for this problem, if not then disregard. Thank you

The question is asking to find the annual federal tax that was paid.

Windo Viewer File PrintE-mai Burn Open E-mail Burn, Open Table 7.5 2011 TAX RATE SCHEDULES Schedule Z-Use if your 2011 filing status is Head of household Schedule X-Use if your 2011 filing status is Single If line Sis The tax is If line S is: The tax is of the ofthe But not But not S0 8,500 34,500 83,600 -10% $850.00 + 15% 4,750.00 + 25% 17,025.00 28 % 42,449.00 + 33% 110,016.50 + 35% 10% | $1,215.00 + IS% 6330.00 + 25% 24,617.50 + 28% | 45,323.50 + 33% 106,637.50 + 35% $0 12,150 46,250 119,400 193.350 379,150 SO 8,500 34,500 $12.150 40,250 46,250 19,400 193,350 193,350379,150 S0 34,500 83,600 174.400 174,400 379 150 12,150 119,400 174,400 379,150 379.150 379.150 ScheduleY-1-Use lif your 201 1 filing status is Married filing Jointly or Quali Schedule Y-2-Use if your 2011 filing status is widower Married filing se If line Sis The tax is If line 5 is: The tax Is: ofthe ofthe But not But not $0 $17,000 SO 17,000 69.000 S0 $o 1T,000 69,000 51,700.00 + 15% 8.500 5850.00 + 15% 34.500 4:55 PM Windo Viewer File PrintE-mai Burn Open E-mail Burn, Open Table 7.5 2011 TAX RATE SCHEDULES Schedule Z-Use if your 2011 filing status is Head of household Schedule X-Use if your 2011 filing status is Single If line Sis The tax is If line S is: The tax is of the ofthe But not But not S0 8,500 34,500 83,600 -10% $850.00 + 15% 4,750.00 + 25% 17,025.00 28 % 42,449.00 + 33% 110,016.50 + 35% 10% | $1,215.00 + IS% 6330.00 + 25% 24,617.50 + 28% | 45,323.50 + 33% 106,637.50 + 35% $0 12,150 46,250 119,400 193.350 379,150 SO 8,500 34,500 $12.150 40,250 46,250 19,400 193,350 193,350379,150 S0 34,500 83,600 174.400 174,400 379 150 12,150 119,400 174,400 379,150 379.150 379.150 ScheduleY-1-Use lif your 201 1 filing status is Married filing Jointly or Quali Schedule Y-2-Use if your 2011 filing status is widower Married filing se If line Sis The tax is If line 5 is: The tax Is: ofthe ofthe But not But not $0 $17,000 SO 17,000 69.000 S0 $o 1T,000 69,000 51,700.00 + 15% 8.500 5850.00 + 15% 34.500 4:55 PM