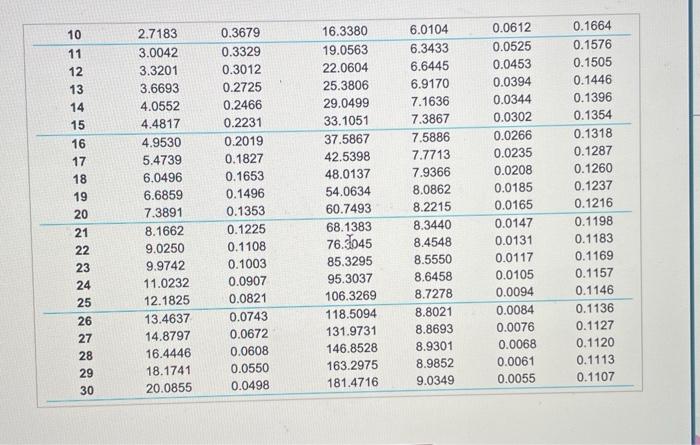

Many persons prepare for retirement by making monthly contributions to a savings program. Suppose that $1,700 is set aside each year and invested in a savings account that pays 10% interest per year, compounded continuously. a. Determine the accumulated savings in this account at the end of 23 years. b. In Part (a), suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 23 . The annuity will extend from the EOY 24 to the EOY 30 . What is the value of this annuity if the interest rate and compounding frequency in Part (a) do not change? Click the icon to view the interest and annuity table for continuous compounding when i=10% per year. a. The accumulated savings amount at the end of 23 years will be $. (Round to the nearest dollar.) \begin{tabular}{|l|l|llllll} \hline 10 & 2.7183 & 0.3679 & 16.3380 & 6.0104 & 0.0612 & 0.1664 \\ \hline 11 & 3.0042 & 0.3329 & 19.0563 & 6.3433 & 0.0525 & 0.1576 \\ \hline 12 & 3.3201 & 0.3012 & 22.0604 & 6.6445 & 0.0453 & 0.1505 \\ \hline 13 & 3.6693 & 0.2725 & 25.3806 & 6.9170 & 0.0394 & 0.1446 \\ \hline 14 & 4.0552 & 0.2466 & 29.0499 & 7.1636 & 0.0344 & 0.1396 \\ \hline 15 & 4.4817 & 0.2231 & 33.1051 & 7.3867 & 0.0302 & 0.1354 \\ \hline 16 & 4.9530 & 0.2019 & 37.5867 & 7.5886 & 0.0266 & 0.1318 \\ 17 & 5.4739 & 0.1827 & 42.5398 & 7.7713 & 0.0235 & 0.1287 \\ 18 & 6.0496 & 0.1653 & 48.0137 & 7.9366 & 0.0208 & 0.1260 \\ 19 & 6.6859 & 0.1496 & 54.0634 & 8.0862 & 0.0185 & 0.1237 \\ \hline 20 & 7.3891 & 0.1353 & 60.7493 & 8.2215 & 0.0165 & 0.1216 \\ \hline 21 & 8.1662 & 0.1225 & 68.1383 & 8.3440 & 0.0147 & 0.1198 \\ 22 & 9.0250 & 0.1108 & 76.5045 & 8.4548 & 0.0131 & 0.1183 \\ \hline 23 & 9.9742 & 0.1003 & 85.3295 & 8.5550 & 0.0117 & 0.1169 \\ \hline 24 & 11.0232 & 0.0907 & 95.3037 & 8.6458 & 0.0105 & 0.1157 \\ \hline 25 & 12.1825 & 0.0821 & 106.3269 & 8.7278 & 0.0094 & 0.1146 \\ \hline 26 & 13.4637 & 0.0743 & 118.5094 & 8.8021 & 0.0084 & 0.1136 \\ \hline 27 & 14.8797 & 0.0672 & 131.9731 & 8.8693 & 0.0076 & 0.1127 \\ \hline 28 & 16.4446 & 0.0608 & 146.8528 & 8.9301 & 0.0068 & 0.1120 \\ \hline 29 & 18.1741 & 0.0550 & 163.2975 & 8.9852 & 0.0061 & 0.1113 \\ \hline 30 & 20.0855 & 0.0498 & 181.4716 & 9.0349 & 0.0055 & 0.1107 \\ \hline \end{tabular}