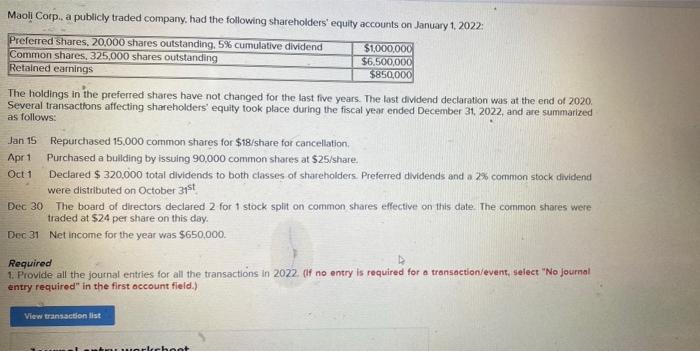

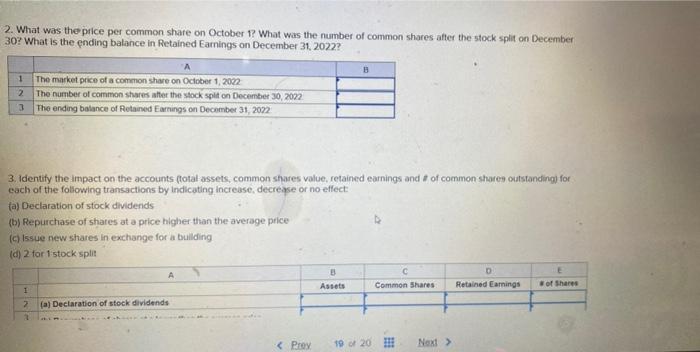

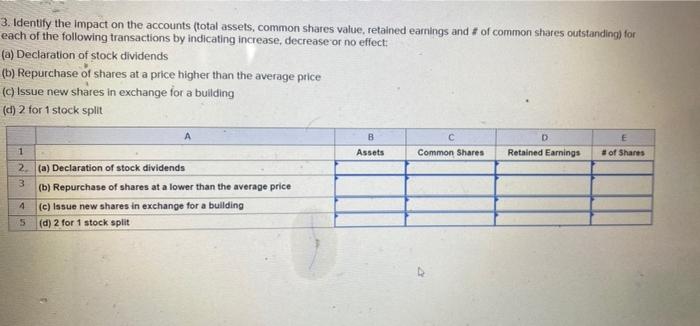

Maoll Corp., a publicly traded company, had the following shareholders' equity accounts on January 1, 2022: Preferred shares, 20,000 shares outstanding, 5% cumulative dividend $1,000,000 Common shares, 325,000 shares outstanding $6.500,000 Retained earnings $850,000 The holdings in the preferred shares have not changed for the last five years. The last dividend declaration was at the end of 2020, Several transactions affecting shareholders' equity took place during the fiscal year ended December 31, 2022, and are summarized as follows: Jan 15 Repurchased 15.000 common shares for $18/share for cancellation, Apr 1 Purchased a building by issuing 90,000 common shares at $25/share, Oct 1 Declared $ 320,000 total dividends to both classes of shareholders. Preferred dividends and a 2% common stock dividend were distributed on October 31st Dec 30 The board of directors declared 2 for 1 stock split on common shares effective on this date. The common shares were traded at $24 per share on this day. Dec 31 Net Income for the year was $650,000 Required 1. Provide all the journal entries for all the transactions in 2022. Of no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Tammarkchant 2. What was the price per common share on October 1? What was the number of common shares after the stock split on December 30? What is the ending balance in Retained Earnings on December 31, 2022? 3 1 2 3 The market price of a common share on October 1, 2002 The number of common shares after the stock split on December 30, 2022 The ending balance of Retained Earrings on December 31, 2022 3. Identify the impact on the accounts (total assets, common shares value, retained earnings and of common shares outstanding for each of the following transactions by indicating increase, decrease or no effect fa Declaration of stock dividends (b) Repurchase of shares at a price higher than the average price (c) Issue new shares in exchange for a building id) 2 for 1stock split E A B Assets Common Shares Retained Earnings of Shares 1 2 (a) Declaration of stock dividends 2 3. Identify the impact on the accounts (total assets, common shares value, retained earnings and # of common shares outstanding) for each of the following transactions by indicating increase, decrease or no effect (a) Declaration of stock dividends (b) Repurchase of shares at a price higher than the average price (c) Issue new shares in exchange for a building (d) 2 for 1 stock split D E 1 Assets Common Shares Retained Earnings # of Shares 2. (a) Declaration of stock dividends 3 (b) Repurchase of shares at a lower than the average price 4 (c) Issue new shares in exchange for a building 5 (d) 2 for 1 stock split B C