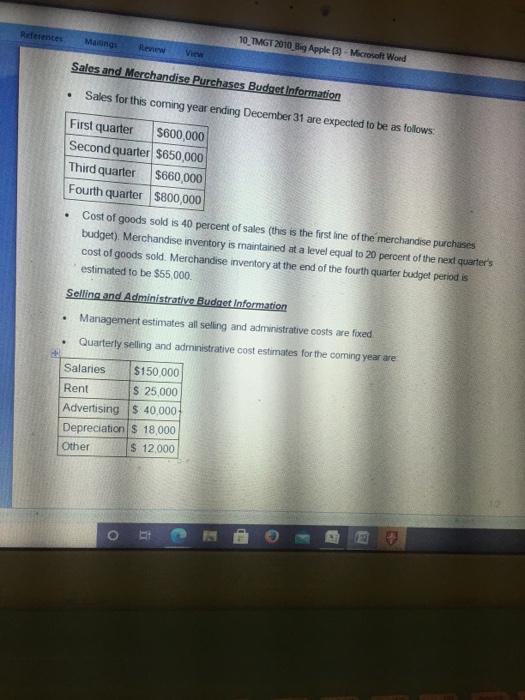

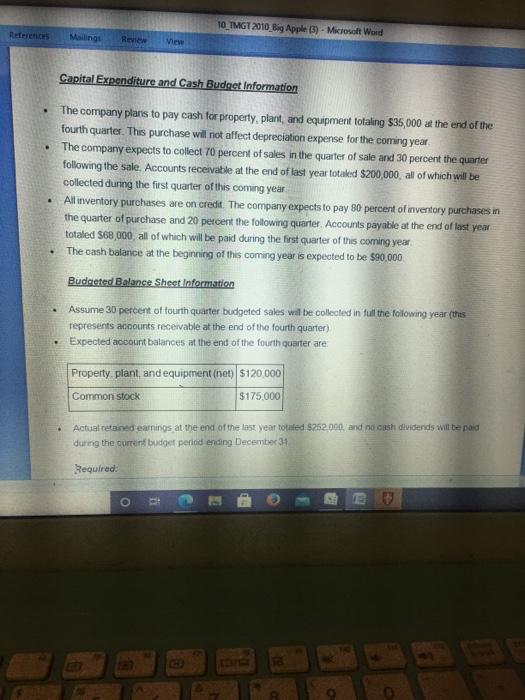

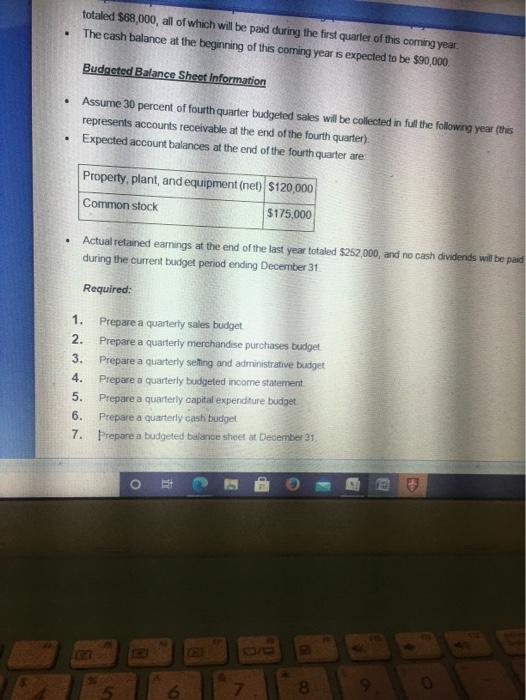

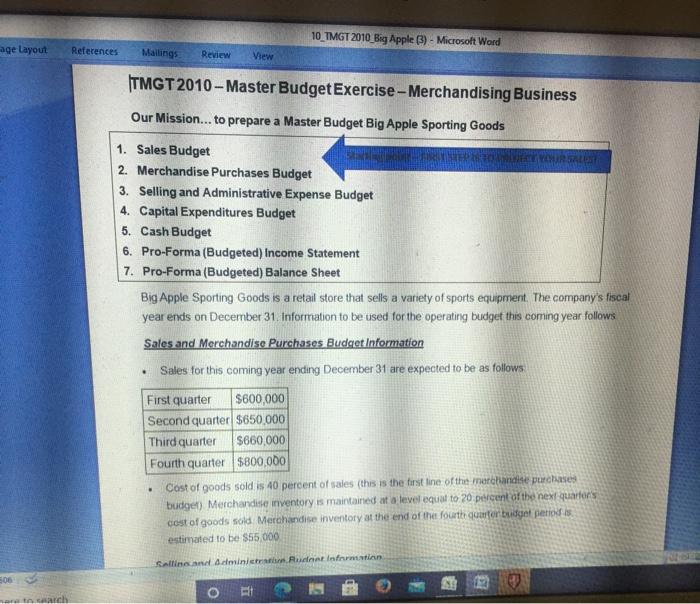

Maongs Review 10 TMGT 2010 Bug Apple (3) Microsoft Word Sales and Merchandise Purchases Budget information . First quarter . Sales for this coming year ending December 31 are expected to be as follows: $600,000 Second quarter $650,000 Third quarter $660 000 Fourth quarter $800,000 Cost of goods sold is 40 percent of sales (this is the first line of the merchandise purchases budget). Merchandise inventory is maintained at a level equal to 20 percent of the next quarter's cost of goods sold. Merchandise inventory at the end of the fourth quarter budget period is estimated to be $55,000 Selling and Administrative Budget Information Management estimates all selling and administrative costs are foxed Quarterly selling and administrative cost estimates for the coming year are Salaries $150 000 Rent $ 25000 Advertising $ 40.000 Depreciation $ 18,000 Other $ 12.000 10 TMGT 2010 Big Apple) - Microsoft Word References Mailing View Capital Expenditure and Cash Budget Information The company plans to pay cash for property, plant, and equipment totaling $35,000 at the end of the fourth quarter. This purchase will not affect depreciation expense for the coming year, The company expects to collect 70 percent of sales in the quarter of sale and 30 percent the quarter following the sale. Accounts receivable at the end of last year totaled $200,000, all of which will be collected during the first quarter of this coming year All inventory purchases are on credit . The company expects to pay 30 percent of inventory purchases in the quarter of purchase and 20 percent the following quarter Accounts payable at the end of last year totaled $68,000, all of which will be paid during the first quarter of this coming year The cash balance at the beginning of this coming year is expected to be $10,000 Budested Balance Sheet Information Assume 30 percent of fourth quarter budgeted sales will be collected in full the following year this represents accounts receivable at the end of the fourth quarter) Expected account balances at the end of the fourth quarter are Property, plant, and equipment (net) $120.000 Common stock $175.000 Actual retained earnings at the end of the last year totaled $262.000, and no cash dividends will be paid during the current budget period ending December 31 Required: o totaled $68,000, all of which will be paid during the first quarter of this coming year The cash balance at the beginning of this coming year is expected to be $90,000 Budgeted Balance Sheet Information Assume 30 percent of fourth quarter budgeted sales will be collected in full the following year this represents accounts receivable at the end of the fourth quarter) Expected account balances at the end of the fourth quarter are . Property, plant and equipment (net) $120,000 Common stock $175,000 Actual retained earnings at the end of the last year totaled $252,000, and no cash dividends will be paid during the current budget period ending December 31 Required: 1. Prepare a quarterly sales budget 2. Prepare a quarterly merchandise purchases budget 3. Prepare a quarterly selling and administrative budget 4. Prepare a quarterly budgeted income statement 5. Prepare a quarterly capital expenditure budget 6. Prepare a quarterly cash budget 7. Prepare a budgeted balance sheet at December 31 6. 7 8. 9 10 TMGT 2010_Big Apple ) - Microsoft Word age Layout References Mailings Review View TMGT 2010 - Master Budget Exercise-Merchandising Business Our Mission... to prepare a Master Budget Big Apple Sporting Goods 1. Sales Budget YR SALE 2. Merchandise Purchases Budget 3. Selling and Administrative Expense Budget 4. Capital Expenditures Budget 5. Cash Budget 6. Pro-Forma (Budgeted) Income Statement 7. Pro-Forma (Budgeted) Balance Sheet Big Apple Sporting Goods is a retail store that sells a variety of sports equipment . The company's fiscal year ends on December 31 Information to be used for the operating budget this coming year follows Sales and Merchandise Purchases Budget Information Sales for this coming year ending December 31 are expected to be as follows First quarter $600,000 Second quarter $650.000 Third quarter $660,000 Fourth quarter $800,000 Cost of goods sold is 40 percent of sales (this is the first line of the merchandise purchases budget) Merchandise inventory is maintained at a level equal to 20 percent of the next quarters cost of goods sold Merchandise inventory at the end of the fourth quarter budget period is estimated to be $55.000 Selline and Administra Rudent Information o ch