Question

Maple Enterprises Ltd. has always claimed maximum CCA. Maple had the net income of $121,000 excluding the following capital transactions: 1. The undepreciated capital cost

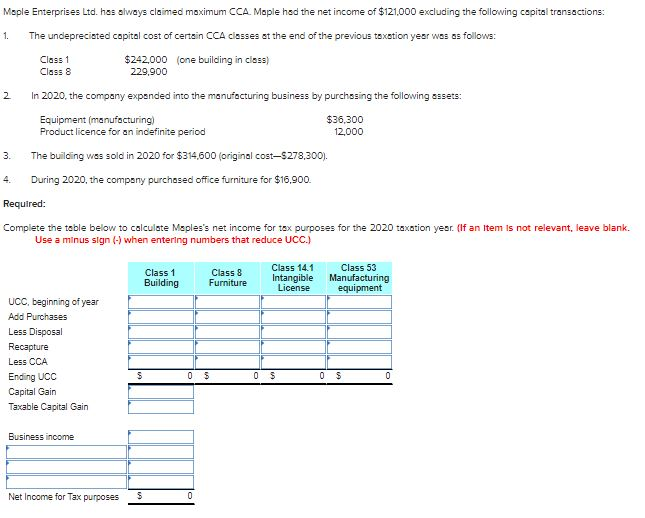

Maple Enterprises Ltd. has always claimed maximum CCA. Maple had the net income of $121,000 excluding the following capital transactions:

1. The undepreciated capital cost of certain CCA classes at the end of the previous taxation year was as follows:

| Class 1 | $242,000 | (one building in class) |

| Class 8 | 229,900 |

|

2. In 2020, the company expanded into the manufacturing business by purchasing the following assets:

| Equipment (manufacturing) | $36,300 |

| Product licence for an indefinite period | 12,000 |

3. The building was sold in 2020 for $314,600 (original cost$278,300).

4. During 2020, the company purchased office furniture for $16,900.

Required:

Complete the table below to calculate Mapless net income for tax purposes for the 2020 taxation year. (If an item is not relevant, leave blank. Use a minus sign (-) when entering numbers that reduce UCC.)

Complete the table with calculations.

2 Meple Enterprises Ltd. has always claimed maximum CCA. Maple had the net income of $121,000 excluding the following capital transactions: The undepreciated capital cost of certain CCA classes et the end of the previous taxation year was as follows: Class 1 $242,000 (one building in class) Class 8 229,900 In 2020, the company expanded into the manufacturing business by purchasing the following assets: Equipment manufacturing) $36,300 Product licence for an indefinite period 12,000 The building was sold in 2020 for $314,600 (original cost-5273,300). During 2020, the company purchased office furniture for $16,900. Required: Complete the table below to calculate Meples's net income for tex purposes for the 2020 taxation yesr. (If an Item is not relevant, leave blank. Use a minus sign (-) when entering numbers that reduce UCC.) 3. 4 Class 1 Building Class 8 Furniture Class 14.1 Intangible License Class 53 Manufacturing equipment UCC, beginning of year Add Purchases Less Disposal Recapture Less CCA Ending UCC Capital Gain Taxable Capital Gain S 0 $ 0 s 0 $ 0 Business income Net Income for Tax purposes S 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started