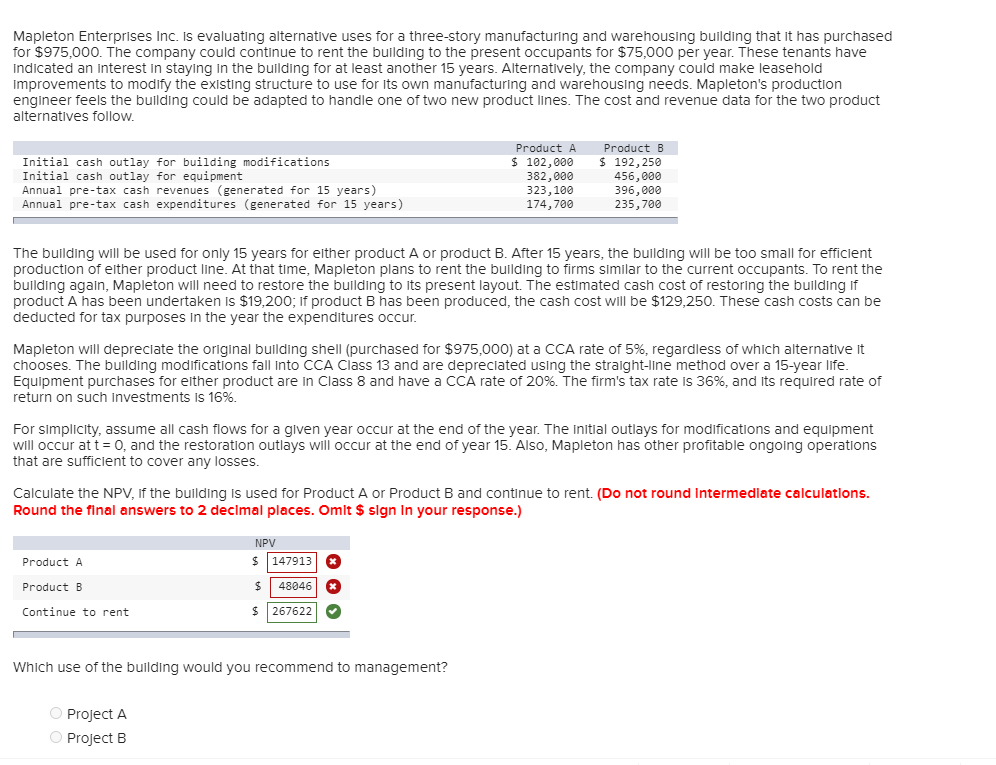

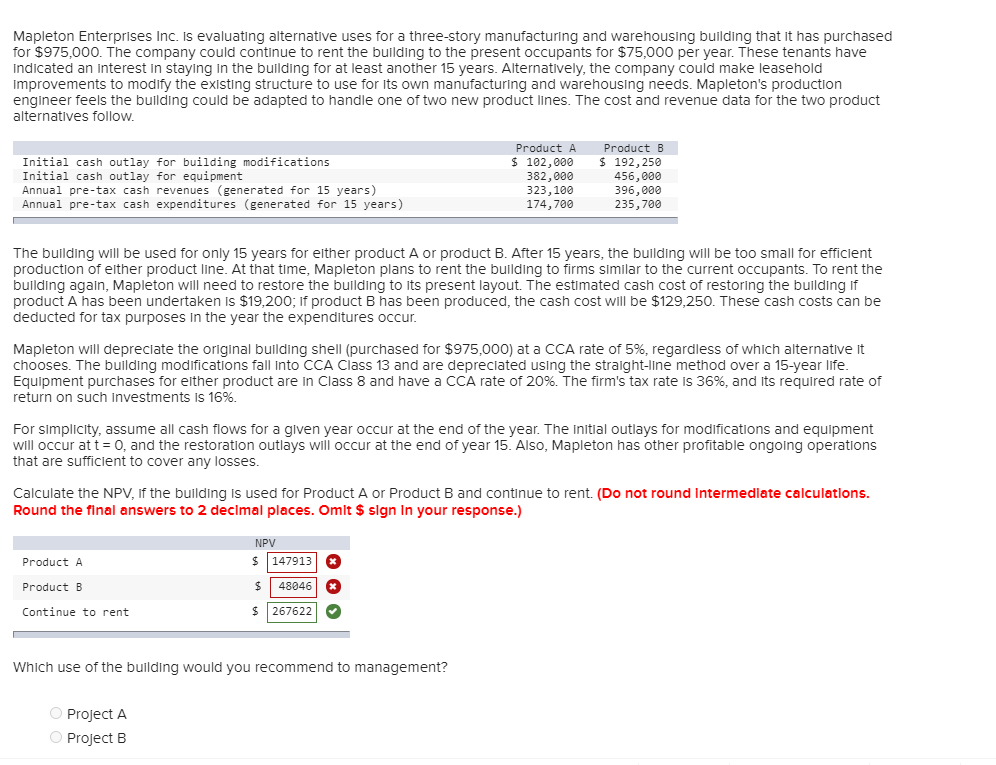

Mapleton Enterprises Inc. is evaluating alternative uses for a three-story manufacturing and warehousing building that it has purchased for $975,000. The company could continue to rent the building to the present occupants for $75,000 per year. These tenants have Indicated an interest in staying in the building for at least another 15 years. Alternatively, the company could make leasehold Improvements to modify the existing structure to use for its own manufacturing and warehousing needs. Mapleton's production engineer feels the building could be adapted to handle one of two new product lines. The cost and revenue data for the two product alternatives follow Initial cash outlay for building modifications Initial cash outlay for equipment Annual pre-tax cash revenues (generated for 15 years) Annual pre-tax cash expenditures (generated for 15 years) Product A $ 102,000 382,000 323, 100 174,700 Product B $ 192,250 456,000 396,000 235,700 The building will be used for only 15 years for either product A or product B. After 15 years, the building will be too small for efficient production of either product line. At that time, Mapleton plans to rent the building to firms similar to the current occupants. To rent the building again, Mapleton will need to restore the building to its present layout. The estimated cash cost of restoring the building if product A has been undertaken is $19,200; if product B has been produced, the cash cost will be $129,250. These cash costs can be deducted for tax purposes in the year the expenditures occur. Mapleton will depreciate the original building shell (purchased for $975,000) at a CCA rate of 5%, regardless of which alternative it chooses. The building modifications fall into CCA Class 13 and are depreciated using the straight-line method over a 15-year life. Equipment purchases for either product are in Class 8 and have a CCA rate of 20%. The firm's tax rate is 36%, and its required rate of return on such investments is 16%. For simplicity, assume all cash flows for a given year occur at the end of the year. The initial outlays for modifications and equipment will occur at t= 0, and the restoration outlays will occur at the end of year 15. Also, Mapleton has other profitable ongoing operations that are sufficient to cover losses. Calculate the NPV, if the building is used for Product A or Product B and continue to rent. (Do not round Intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) NPV $ 147913 % Product A Product B $ 48046 X Continue to rent $ 267622 Which use of the building would you recommend to management? Project A Project B