Answered step by step

Verified Expert Solution

Question

1 Approved Answer

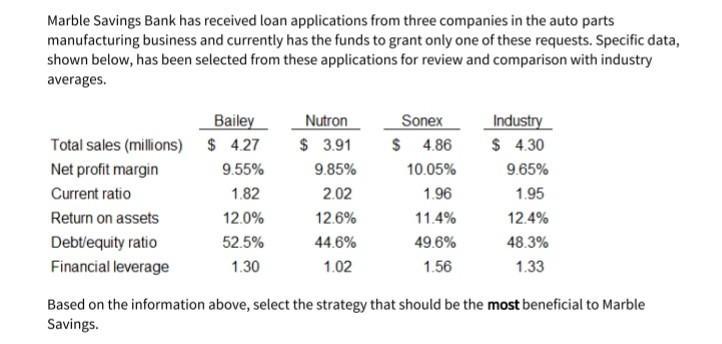

Marble Savings Bank has received loan applications from three companies in the auto parts manufacturing business and currently has the funds to grant only

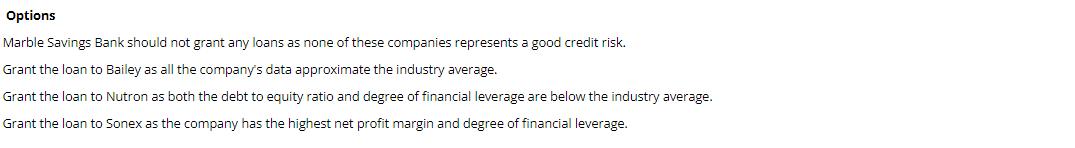

Marble Savings Bank has received loan applications from three companies in the auto parts manufacturing business and currently has the funds to grant only one of these requests. Specific data, shown below, has been selected from these applications for review and comparison with industry averages. Total sales (millions) Net profit margin Current ratio Return on assets Debt/equity ratio Financial leverage Bailey $ 4.27 9.55% 1.82 12.0% 52.5% 1.30 Nutron $ 3.91 9.85% 2.02 12.6% 44.6% 1.02 Sonex $ 4.86 10.05% 1.96 11.4% 49.6% 1.56 Industry $ 4.30 9.65% 1.95 12.4% 48.3% 1.33 Based on the information above, select the strategy that should be the most beneficial to Marble Savings. Options Marble Savings Bank should not grant any loans as none of these companies represents a good credit risk. Grant the loan to Bailey as all the company's data approximate the industry average. Grant the loan to Nutron as both the debt to equity ratio and degree of financial leverage are below the industry average. Grant the loan to Sonex as the company has the highest net profit margin and degree of financial leverage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Based on the provided i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started