Answered step by step

Verified Expert Solution

Question

1 Approved Answer

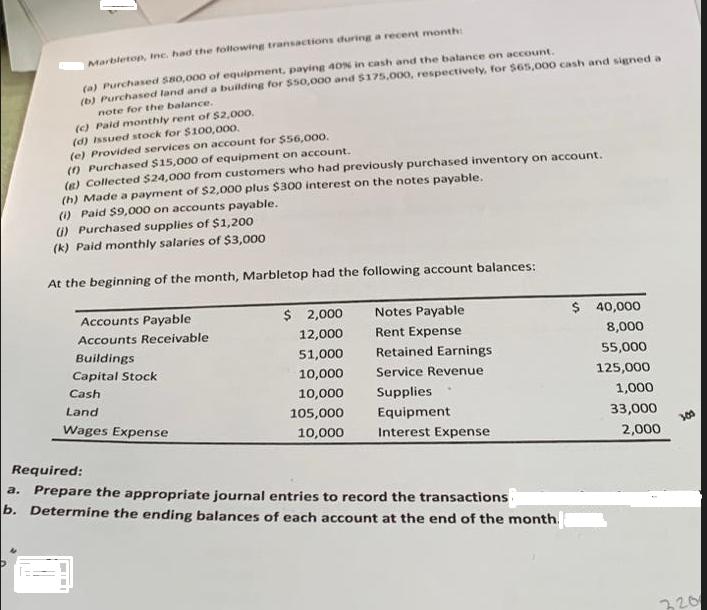

Marbletop, Inc. had the following transactions during a recent month: (a) Purchased $80,000 of equipment, paying 40% in cash and the balance on account.

Marbletop, Inc. had the following transactions during a recent month: (a) Purchased $80,000 of equipment, paying 40% in cash and the balance on account. (b) Purchased land and a building for $50,000 and $175,000, respectively, for $65,000 cash and signed a note for the balance.. (c) Paid monthly rent of $2,000. (d) Issued stock for $100,000. (e) Provided services on account for $56,000. (1) Purchased $15,000 of equipment on account. (8) Collected $24,000 from customers who had previously purchased inventory on account. (h) Made a payment of $2,000 plus $300 interest on the notes payable. (i) Paid $9,000 on accounts payable. (i) Purchased supplies of $1,200 (k) Paid monthly salaries of $3,000 At the beginning of the month, Marbletop had the following account balances: Accounts Payable Accounts Receivable Buildings Capital Stock Cash Land Wages Expense $ 2,000 12,000 51,000 10,000 10,000 105,000 10,000 Notes Payable Rent Expense Retained Earnings Service Revenue Supplies Equipment Interest Expense Required: a. Prepare the appropriate journal entries to record the transactions b. Determine the ending balances of each account at the end of the month. 40,000 8,000 55,000 125,000 1,000 33,000 2,000 300 320

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The photo appears to include a set of transactions that occurred within a given month for a company named Marbletop along with the companys account balances at the beginning of the month The question ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started