Answered step by step

Verified Expert Solution

Question

1 Approved Answer

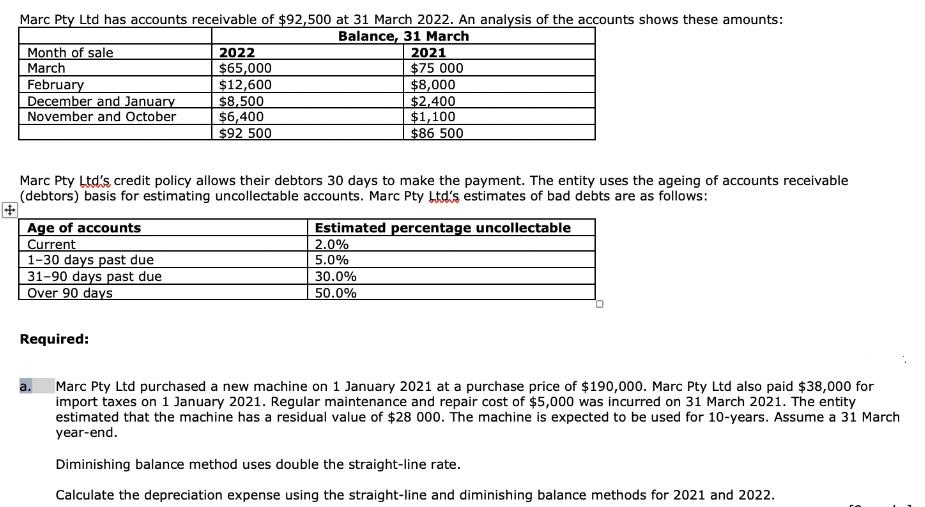

+ Marc Pty Ltd has accounts receivable of $92,500 at 31 March 2022. An analysis of the accounts shows these amounts: Balance, 31 March

+ Marc Pty Ltd has accounts receivable of $92,500 at 31 March 2022. An analysis of the accounts shows these amounts: Balance, 31 March 2021 $75 000 $8,000 $2,400 $1,100 $86 500 Month of sale March February December and January November and October Marc Pty Ltd's credit policy allows their debtors 30 days to make the payment. The entity uses the ageing of accounts receivable (debtors) basis for estimating uncollectable accounts. Marc Pty Ltd's estimates of bad debts are as follows: Age of accounts Current 1-30 days past due 31-90 days past due Over 90 days Required: 2022 $65,000 $12,600 $8,500 $6,400 $92 500 a. Estimated percentage uncollectable 2.0% 5.0% 30.0% 50.0% Marc Pty Ltd purchased a new machine on 1 January 2021 at a purchase price of $190,000. Marc Pty Ltd also paid $38,000 for import taxes on 1 January 2021. Regular maintenance and repair cost of $5,000 was incurred on 31 March 2021. The entity estimated that the machine has a residual value of $28 000. The machine is expected to be used for 10-years. Assume a 31 March year-end. Diminishing balance method uses double the straight-line rate. Calculate the depreciation expense using the straight-line and diminishing balance methods for 2021 and 2022.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Depreciation as per Straight Line Method as per g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started