Question

Marc wants to invest in either LOP or ABC shares.He found out that last year LOP paid $0.50 in dividends while ABC paid dividends of

Marc wants to invest in either LOP or ABC shares.He found out that last year LOP paid $0.50 in dividends while ABC paid dividends of $1.25 last year.LOP dividends is anticipated to grow at a rate of 5%.ABC however, is expected to have its dividends grow at a rate of 10% for years 1 & 2, then to a constant growth rate of 5% from thereafter until infinity.If LOP share price is currently $20 and ABC $30, what advise will you give Marc if he can only invest in one company with an expect rate of return of 7%?

Give a reason for your answer.

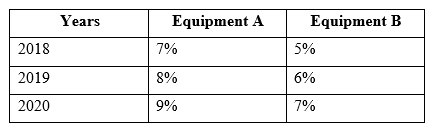

2)You are given the expected rate of return for two medical equipment:

Requirement:

a) Determine the standard deviation for the portfolio if 30% is invested in Equipment A and 70% in Equipment B.

b) Determine if this portfolio would be accepted if investments with a CV above 0.5 are rejected.

3)Kola Manufacturing has decided to raise funds by selling bonds $1,000 par value with a coupon interest rate of 5%. The bonds would mature in 9 years and interest would be paid annually. The required rate of return for similar bonds is expected to be 7%. What is the value of the bond?

2018 2019 2020 Years Equipment A 7% 8% 9% Equipment B 5% 6% 7%

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution Question 1 If Marc wants to invest in either LOP or ABC shares with an expected rate of ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started