Answered step by step

Verified Expert Solution

Question

1 Approved Answer

March 1 Brooks invested $185,000 cash along with $21,000 in office equipment in the company in exchange for common stock. March 2 The company prepaid

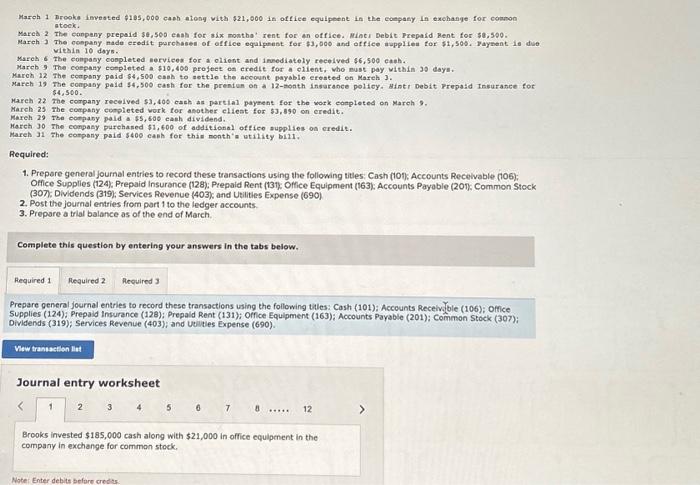

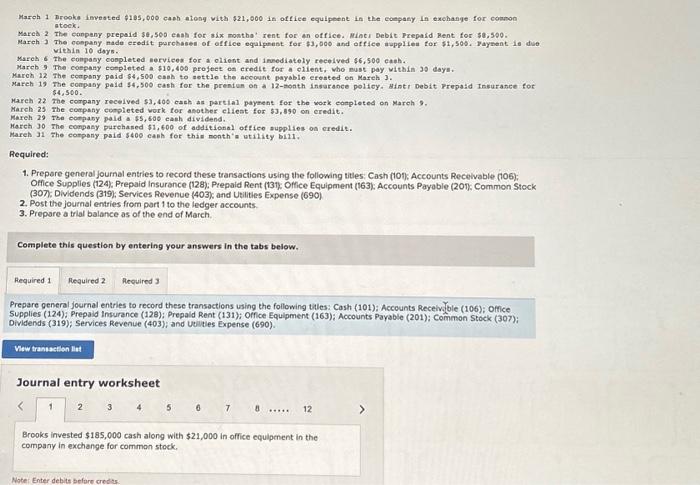

March 1 Brooks invested $185,000 cash along with $21,000 in office equipment in the company in exchange for common stock. March 2 The company prepaid $8,500 cash for six months' rent for an office. Hint: Debit Prepaid Rent for $8,500. March 3 The company made credit purchases of office equipment for $3,000 and office supplies for $1,500. Payment is due within 10 days. March 6 The company completed services

for a client and immediately received $6,500 cash. March 9 The company completed a $10,400 project on credit for a client, who must pay within 30 days. March 12 The company paid $4,500 cash to settle the account payable created on March 3. March 19 The company paid $4,500 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $4,500. March 22 The company received $3,400 cash as partial payment for the work completed on March 9. March 25 The company completed work for another client for $3,890 on credit. March 29 The company paid a $5,600 cash dividend. March 30 The company purchased $1,600 of additional office supplies on credit. March 31 The company paid $400 cash for this month's utility bill. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319); Services Revenue (403); and Utilities Expense (690). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319); Services Revenue (403); and Utilities Expense (690). View transaction list Journal entry worksheet

atock. viebia 10 doys. Mares of The eompasy conpleted nervices for a olient and innediately recelved $6,500 canh. March 9 The cospany conpleted a $10,400 project os credit for a elifent, who must pay within 39 days. March 12 The ecopony paid $4,509 eash to nettle the account paybble erosted on Mareh 3. $4,560. Mareh 22 the company recelved $3,400 eash as partial payment for the work eonpleted on Mareh 9. March 25 The company conpleted vork for apother eliest for $3,590 on eredit. Wareh 29 The company pald a $5,600 cash dividend. March 30 The compasy purehased $1,600 of ddiltional oftice supplies on credit. Mareh 31 the company paid $400 cash for this month' atility bili. Required: 1. Prepere general joumal entries to record these transactions using the following titles: Cash (10); Accounts Recelvable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131): Office Equipment (163); Accounts Payable (201): Common Stock (307): Dividends (319); Services Revenue (403); and Utilities Expense (690) 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of March. Complete this question by entering your answers in the tabs below. Prepare general journal entries to record these transactions using the following tiles: Cash (101): Accounts Receivi ble (106); Office Supplies (124); Prepaid Insurance (128); Prepald Rent (131); Office Equlpment (163); Accounts Payable (201); Common Stock (307); Dividends (319); Services Revenue (403); and Uvilities Expense (690)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started