Answered step by step

Verified Expert Solution

Question

1 Approved Answer

March 1 Take $5,225.00 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15

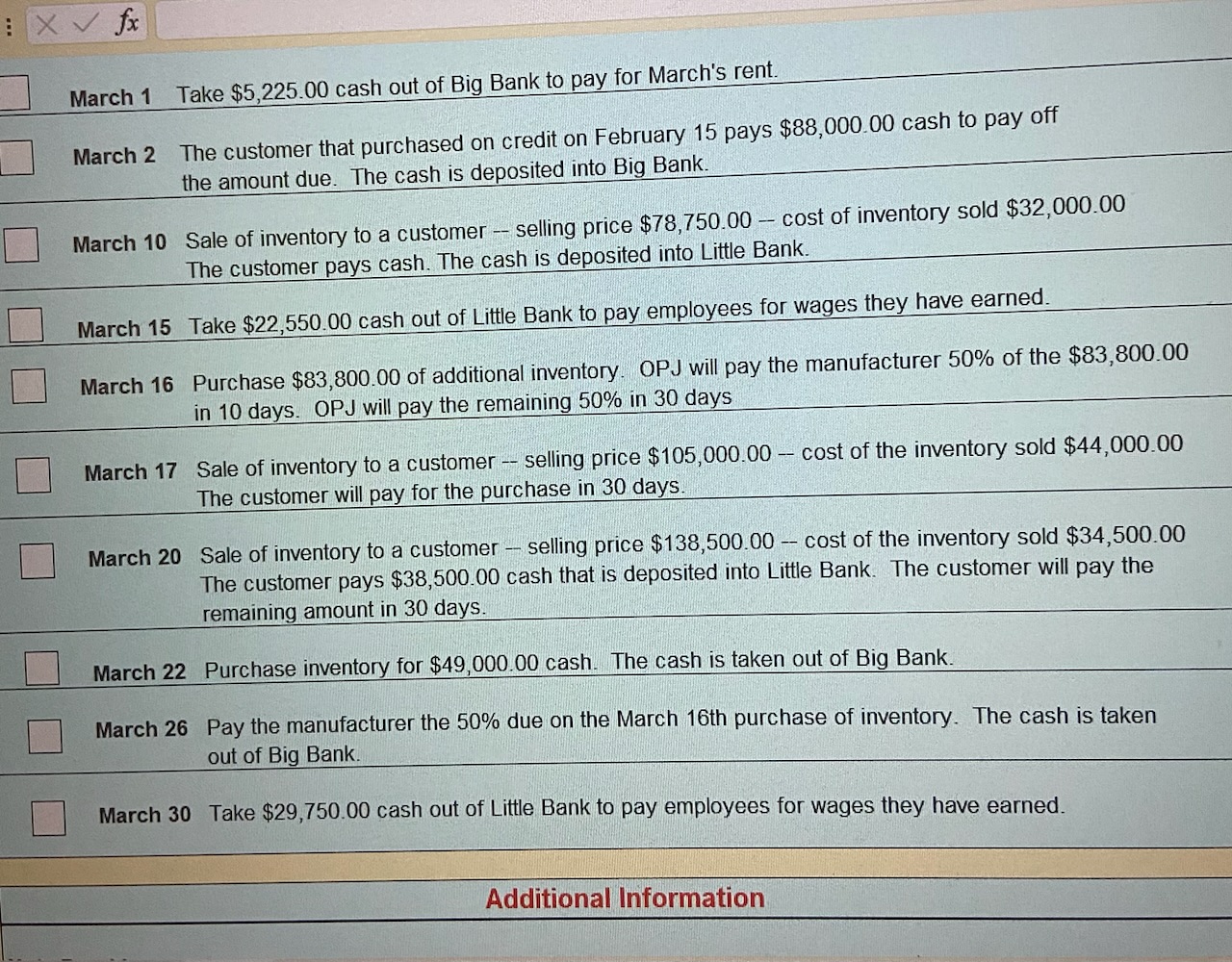

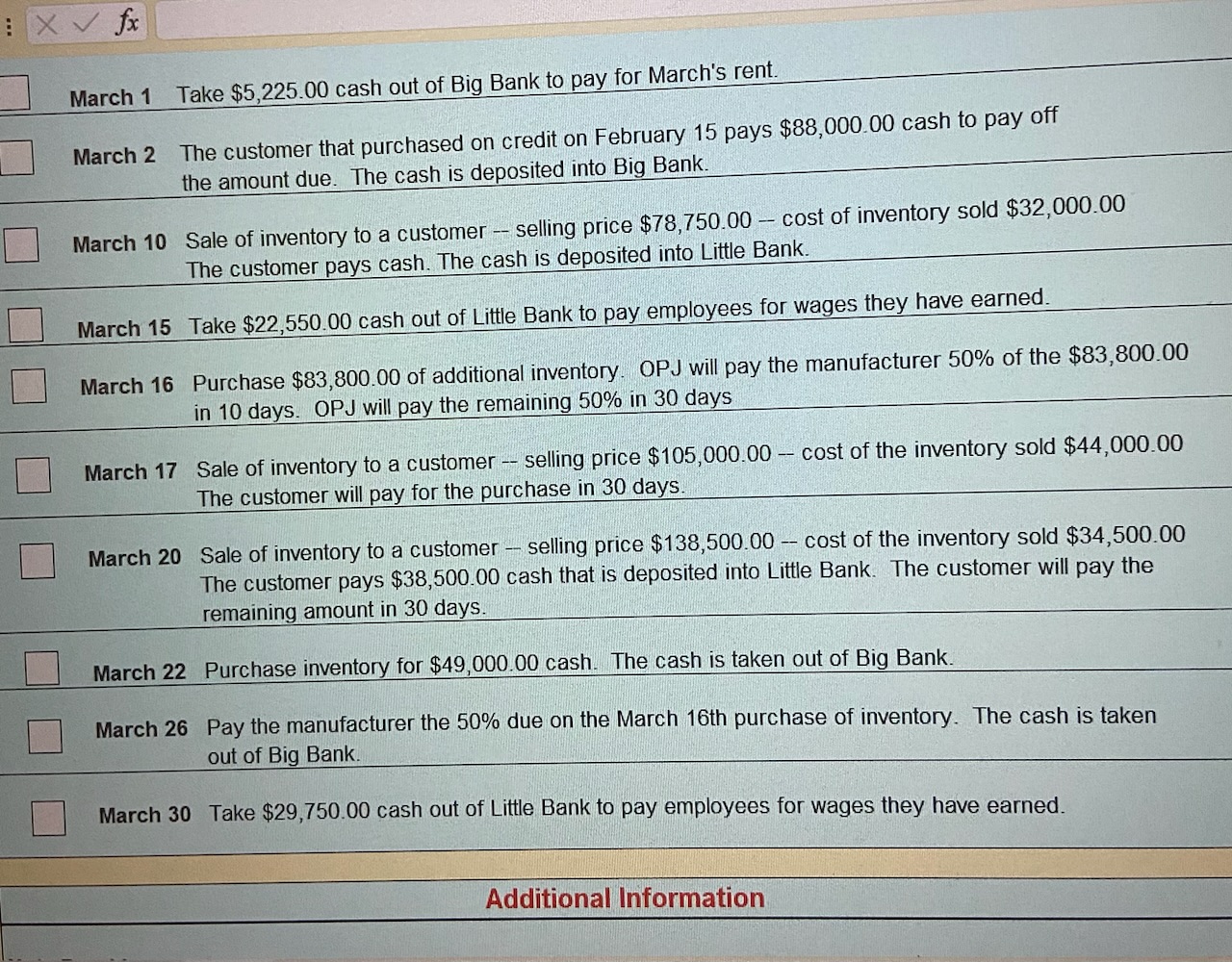

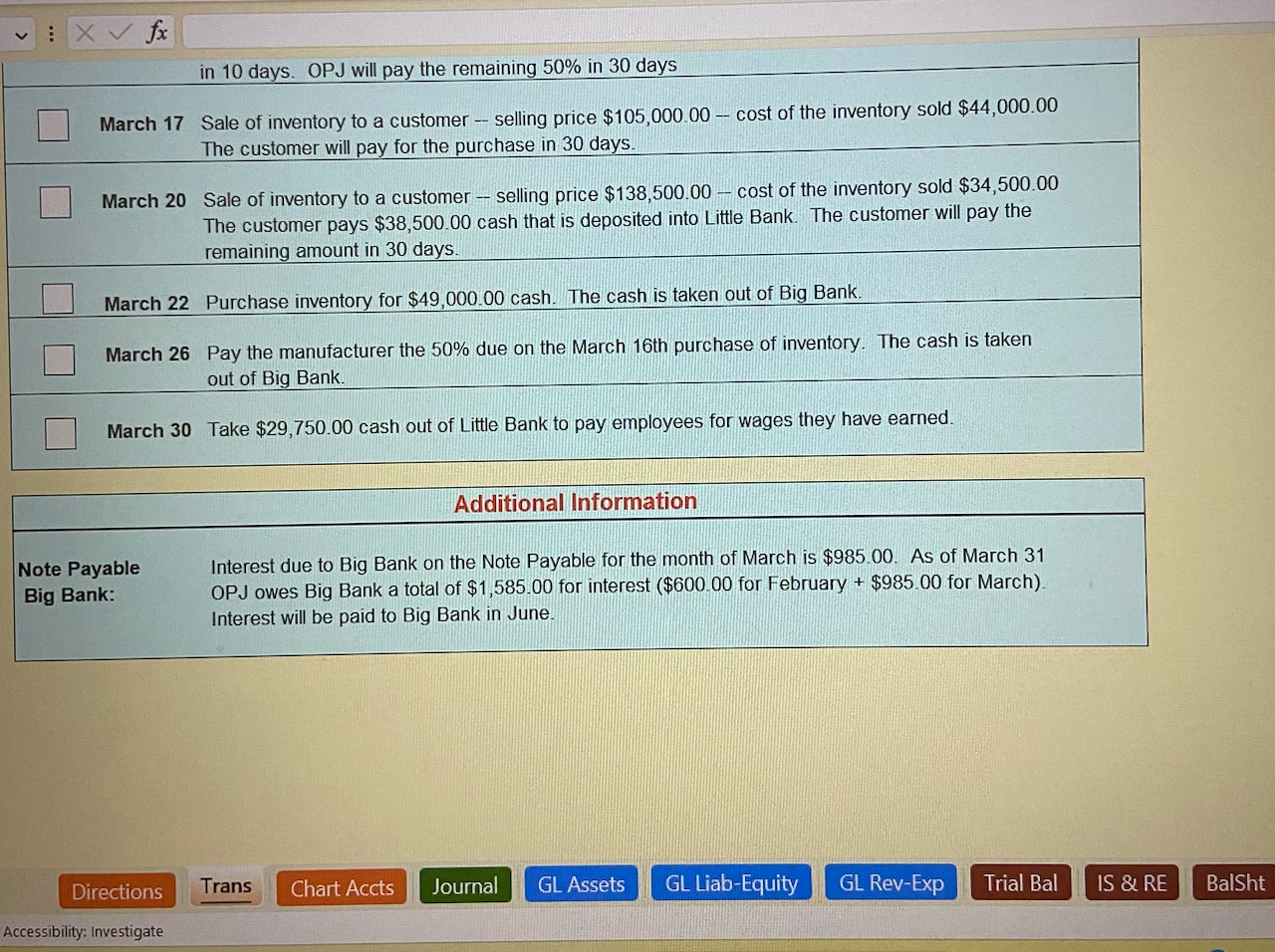

March 1 Take $5,225.00 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000.00 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer - selling price $78,750.00 - cost of inventory sold $32,000.00 The customer pays cash. The cash is deposited into Little Bank. March 15 Take $22,550.00 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $83,800.00 of additional inventory. OPJ will pay the manufacturer 50% of the $83,800.00 in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer - selling price $105,000.00 - cost of the inventory sold $44,000.00 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $138,500.00 - cost of the inventory sold $34,500.00 The customer pays $38,500.00 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $49,000.00 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $29,750.00 cash out of Little Bank to pay employees for wages they have earned. March 1 Take $5,225.00 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000.00 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer - selling price $78,750.00 - cost of inventory sold $32,000.00 The customer pays cash. The cash is deposited into Little Bank. March 15 Take $22,550.00 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $83,800.00 of additional inventory. OPJ will pay the manufacturer 50% of the $83,800.00 in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer - selling price $105,000.00 - cost of the inventory sold $44,000.00 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $138,500.00 - cost of the inventory sold $34,500.00 The customer pays $38,500.00 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $49,000.00 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $29,750.00 cash out of Little Bank to pay employees for wages they have earned. fx in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer - selling price $105,000.00 - cost of the inventory sold $44,000.00 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $138,500.00 - cost of the inventory sold $34,500.00 The customer pays $38,500.00 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $49,000.00 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16 th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $29,750.00 cash out of Little Bank to pay employees for wages they have earned. Note Payable Big Bank: Additional Information Interest due to Big Bank on the Note Payable for the month of March is $985.00. As of March 31 OPJ owes Big Bank a total of $1,585.00 for interest ( $600.00 for February +$985.00 for March). Interest will be paid to Big Bank in June. Directions Trans Chart Accts Journal GL Assets GL Liab-Equity GL Rev-Exp Trial Bal IS \& RE BalSht Accessibility: Investigate

March 1 Take $5,225.00 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000.00 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer - selling price $78,750.00 - cost of inventory sold $32,000.00 The customer pays cash. The cash is deposited into Little Bank. March 15 Take $22,550.00 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $83,800.00 of additional inventory. OPJ will pay the manufacturer 50% of the $83,800.00 in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer - selling price $105,000.00 - cost of the inventory sold $44,000.00 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $138,500.00 - cost of the inventory sold $34,500.00 The customer pays $38,500.00 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $49,000.00 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $29,750.00 cash out of Little Bank to pay employees for wages they have earned. March 1 Take $5,225.00 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000.00 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer - selling price $78,750.00 - cost of inventory sold $32,000.00 The customer pays cash. The cash is deposited into Little Bank. March 15 Take $22,550.00 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $83,800.00 of additional inventory. OPJ will pay the manufacturer 50% of the $83,800.00 in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer - selling price $105,000.00 - cost of the inventory sold $44,000.00 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $138,500.00 - cost of the inventory sold $34,500.00 The customer pays $38,500.00 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $49,000.00 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $29,750.00 cash out of Little Bank to pay employees for wages they have earned. fx in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer - selling price $105,000.00 - cost of the inventory sold $44,000.00 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $138,500.00 - cost of the inventory sold $34,500.00 The customer pays $38,500.00 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $49,000.00 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16 th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $29,750.00 cash out of Little Bank to pay employees for wages they have earned. Note Payable Big Bank: Additional Information Interest due to Big Bank on the Note Payable for the month of March is $985.00. As of March 31 OPJ owes Big Bank a total of $1,585.00 for interest ( $600.00 for February +$985.00 for March). Interest will be paid to Big Bank in June. Directions Trans Chart Accts Journal GL Assets GL Liab-Equity GL Rev-Exp Trial Bal IS \& RE BalSht Accessibility: Investigate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started