Answered step by step

Verified Expert Solution

Question

1 Approved Answer

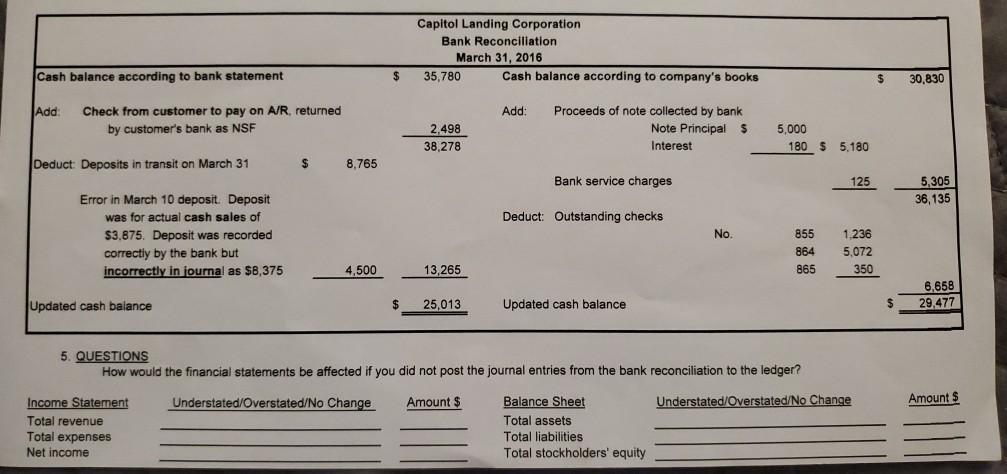

March 2016 bank reconciliation, detailed below was incorrectly prepared( Note: the disruptions and the amounts if the listed items are correct) Because the bank reconciliation

March 2016 bank reconciliation, detailed below was incorrectly prepared( Note: the disruptions and the amounts if the listed items are correct) Because the bank reconciliation did not balance. the ledger account balances provided (in the form T-accounts) are shown before journal entries were posted. What is the correct bank reconciliation? ( following the first page)

1st Page

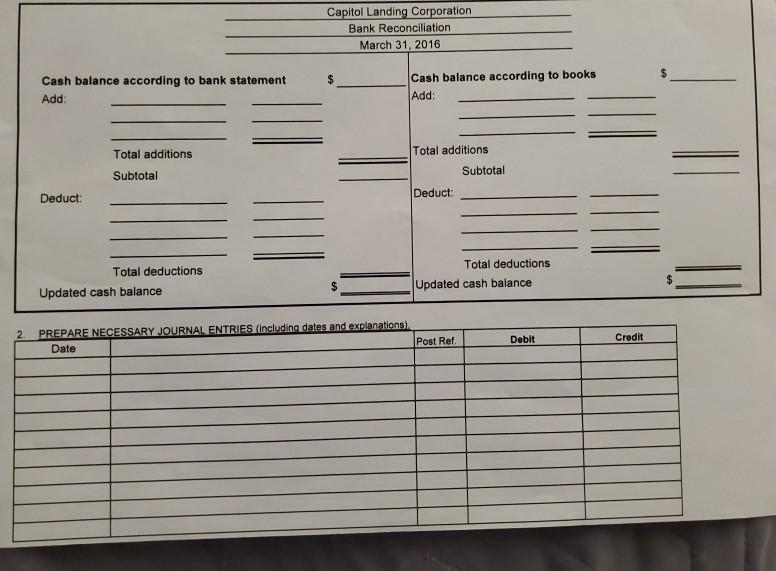

2nd Page

Cash balance according to bank statement Add: Check from customer to pay on A/R, returned by customer's bank as NSF Deduct: Deposits in transit on March 31 Error in March 10 deposit. Deposit was for actual cash sales of $3,875. Deposit was recorded correctly by the bank but incorrectly in journal as $8,375 Updated cash balance $ Income Statement Total revenue Total expenses Net income 8,765 4,500 $ $ Capitol Landing Corporation Bank Reconciliation March 31, 2016 35,780 2,498 38,278 13,265 25,013 Cash balance according to company's books Add: Proceeds of note collected by bank Note Principal S Interest Bank service charges Deduct: Outstanding checks Updated cash balance. No. Balance Sheet Total assets Total liabilities Total stockholders' equity 5,000 180 $ 5,180 855 864 865 125 5. QUESTIONS How would the financial statements be affected if you did not post the journal entries from the bank reconciliation to the ledger? Understated/Overstated/No Change Amount $ Understated/Overstated/No Change 1.236 5,072 350 $ 30,830 5,305 36,135 6.658 $ 29,477 Amount $

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 The correct bank reconciliation is shown below Capital Landing Corporation Bank Reconciliation M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started