Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marco, 23, earns $78,000 a year working as an electrician for a company in midtown Ontario. On the weekends, Marco likes to spend time

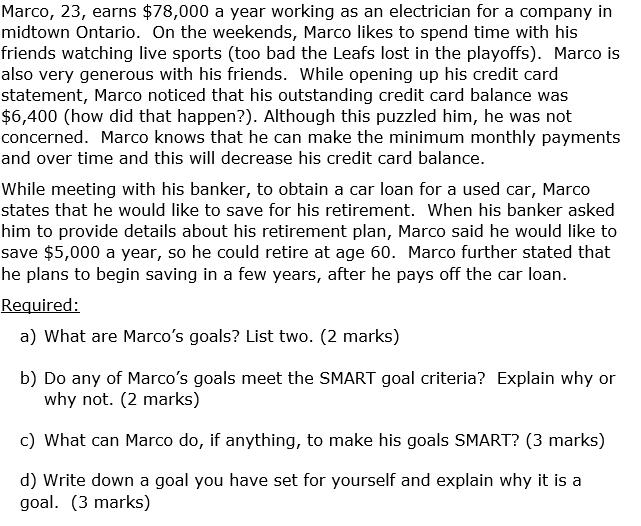

Marco, 23, earns $78,000 a year working as an electrician for a company in midtown Ontario. On the weekends, Marco likes to spend time with his friends watching live sports (too bad the Leafs lost in the playoffs). Marco is also very generous with his friends. While opening up his credit card statement, Marco noticed that his outstanding credit card balance was $6,400 (how did that happen?). Although this puzzled him, he was not concerned. Marco knows that he can make the minimum monthly payments and over time and this will decrease his credit card balance. While meeting with his banker, to obtain a car loan for a used car, Marco states that he would like to save for his retirement. When his banker asked him to provide details about his retirement plan, Marco said he would like to save $5,000 a year, so he could retire at age 60. Marco further stated that he plans to begin saving in a few years, after he pays off the car loan. Required: a) What are Marco's goals? List two. (2 marks) b) Do any of Marco's goals meet the SMART goal criteria? Explain why or why not. (2 marks) c) What can Marco do, if anything, to make his goals SMART? (3 marks) d) Write down a goal you have set for yourself and explain why it is a goal. (3 marks)

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Marcos goals are to pay off his credit card balance and to save 5000 a year for retirement b Marco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started