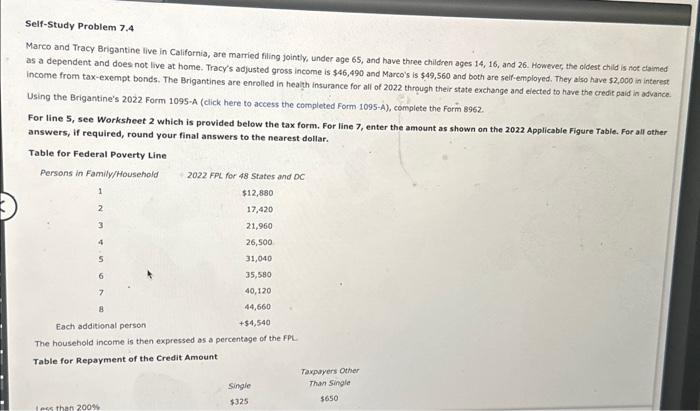

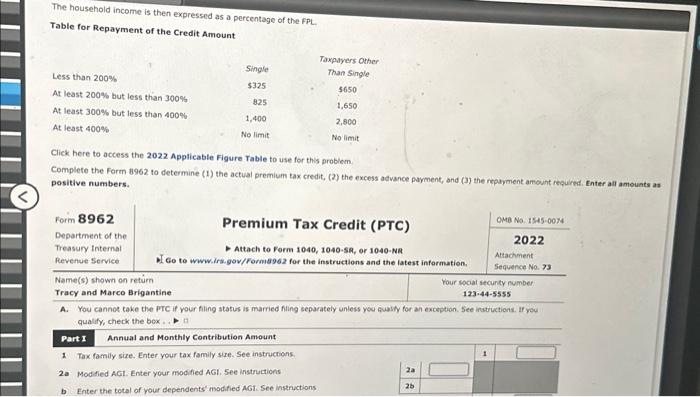

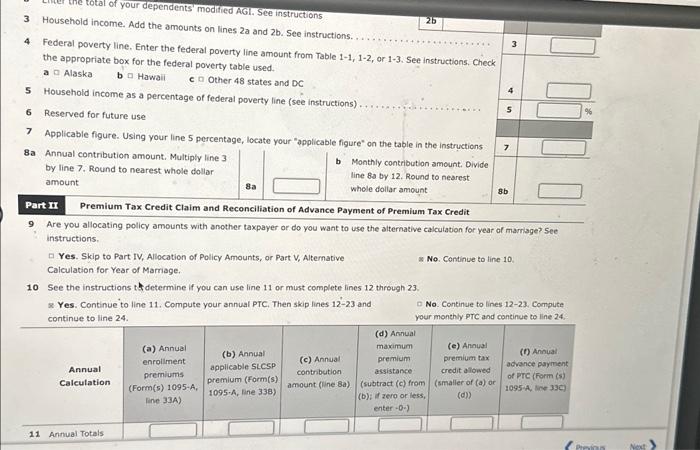

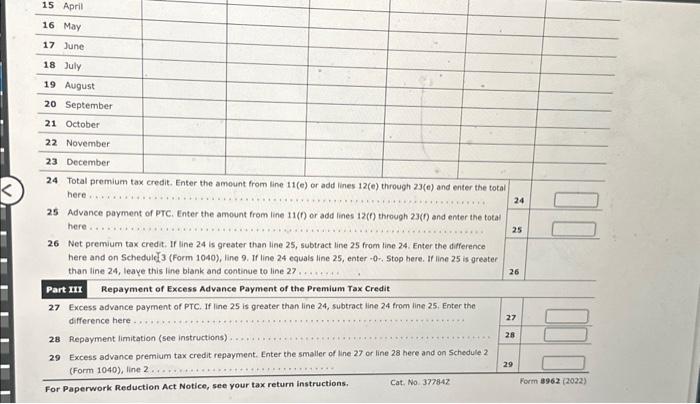

Marco and Tracy Brigantine live in California, are married filing jointly, under age 65 , and have three children ages 14, 16, and 26 . Howeve, the oldest chlld is not ctaimed as a dependent and does not live at home. Tracy's adjusted gross income is $46,490 and Marco's is $49,560 and both are seif-employed, They also have $2,000 in interest income from tax-exempt bonds. The Brigantines are enrolled in health insurance for all of 2022 through their state exchange and elected to have the credit paid in advance. Using the Brigantine's 2022 Form 1095-A (click here to access the completed Form 1095-A), complete the Form 8962. For line 5, see Worksheet 2 which is provided below the tax form. For line 7, enter the amount as shown on the 2022 Applicable Figure Table. For all ather answers, if required, round your final answers to the nearest dollar. The household income is then expressed as a percentage of the FPL. Table for Repayment of the Credit Amount The househoid income is then expressed as a percentage of the FPL. Table for Repayment of the Credit Amount Click here to access the 2022 Applicable Figure Table to use for this problem. Complete the Form 8962 to determine (1) the actual premium tax credit, (2) the excess advance payment, and (3) the repayment amount required. Enter all amounts as positive numbers. 9 Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage? See instructions. Yes. Skip to Part IV, Allocation of Policy Amounts, or Part V, Altemative Calculation for Year of Marriage. No. Continue to line 10 . 10 See the instructions th determine if you can use line 11 or must complete lines 12 through 23. \& Yes. Continue to line 11. Compute your annual PTC. Then skip lines 1223 and No. Continue to lines 12-23. Compute continue to line 24 . your monthly PTC and continue to line 24 . Part III Repayment of Excess Advance Payment of the Premium Tax Credit. 27 Excess advance payment of PTC. If line 25 is greater than line 24 , subtract line 24 from line 25 , Enter the difference here. 28 Repayment limitation (see instructions) 29 Excess advance premium tax credit repayment. Enter the smaller of line 27 or line 28 here and on Schedule 2 (Form 1040), line 2 For Paperwork Reduction Act Notice, see your tax return instructions. Cat, No. 377842 Marco and Tracy Brigantine live in California, are married filing jointly, under age 65 , and have three children ages 14, 16, and 26 . Howeve, the oldest chlld is not ctaimed as a dependent and does not live at home. Tracy's adjusted gross income is $46,490 and Marco's is $49,560 and both are seif-employed, They also have $2,000 in interest income from tax-exempt bonds. The Brigantines are enrolled in health insurance for all of 2022 through their state exchange and elected to have the credit paid in advance. Using the Brigantine's 2022 Form 1095-A (click here to access the completed Form 1095-A), complete the Form 8962. For line 5, see Worksheet 2 which is provided below the tax form. For line 7, enter the amount as shown on the 2022 Applicable Figure Table. For all ather answers, if required, round your final answers to the nearest dollar. The household income is then expressed as a percentage of the FPL. Table for Repayment of the Credit Amount The househoid income is then expressed as a percentage of the FPL. Table for Repayment of the Credit Amount Click here to access the 2022 Applicable Figure Table to use for this problem. Complete the Form 8962 to determine (1) the actual premium tax credit, (2) the excess advance payment, and (3) the repayment amount required. Enter all amounts as positive numbers. 9 Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage? See instructions. Yes. Skip to Part IV, Allocation of Policy Amounts, or Part V, Altemative Calculation for Year of Marriage. No. Continue to line 10 . 10 See the instructions th determine if you can use line 11 or must complete lines 12 through 23. \& Yes. Continue to line 11. Compute your annual PTC. Then skip lines 1223 and No. Continue to lines 12-23. Compute continue to line 24 . your monthly PTC and continue to line 24 . Part III Repayment of Excess Advance Payment of the Premium Tax Credit. 27 Excess advance payment of PTC. If line 25 is greater than line 24 , subtract line 24 from line 25 , Enter the difference here. 28 Repayment limitation (see instructions) 29 Excess advance premium tax credit repayment. Enter the smaller of line 27 or line 28 here and on Schedule 2 (Form 1040), line 2 For Paperwork Reduction Act Notice, see your tax return instructions. Cat, No. 377842