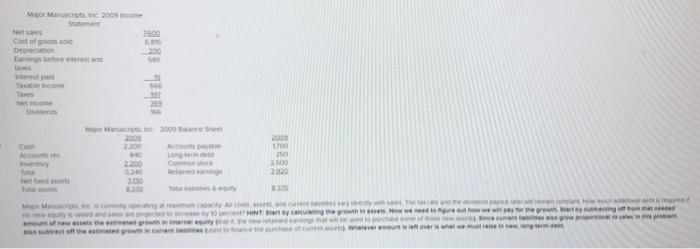

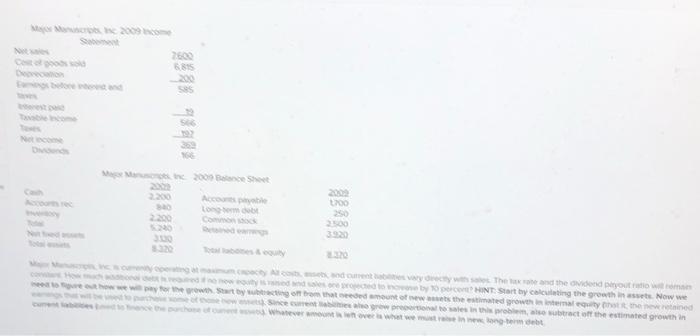

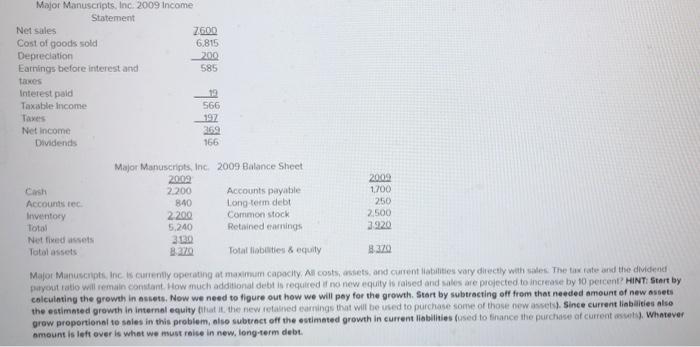

Marcos, Inc. 2009 Star TOR 6.15 200 Castot goods Depreciation ang Defoe wees Tec Di 2009 Dance Short 2005 2200 2000 700 Cash Acco 2200 COM To 2.500 2020 30 MMM MEET HINTS Chinese how we were getme new they wa Wher what TED SIS 58 1700 Lomb HINT Start by cling the growth in Now we Wheth Statybom that the stated at the wind Major Manuscripts, Inc. 2009 Income Statement Net sales 2600 Cost of goods sold G.815 Depreciation 200 Earnings before interest and 585 taxes Interest paid 12 Taxable income 566 Taxes 197 Net Income 369 Dividends 166 Accounts tec Inventory Total Net fixed assets Total assets Major Manuscripts, Inc. 2009 Balance Sheet 20.09 2.200 Accounts payable 840 Long-term debt 2 200 Common stock 5.240 Retained wings 3130 Totat loboties & equity 2009 1700 250 2,500 3920 Major Manuscripts, Inc is currently operating at maximum capacity All costs, assets, and current abilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10 percent? HINT: Start by calculating the growth in assets. Now we need to figure out how we will pay for the growth. Start by subtracting off from that needed amount of new assets the estimated growth in internal equity that it the new retained earnings that will be used to purchase some of those new assets. Since current libilities also grow proportional to sales in this problem, also subtract off the estimated growth in current liabilities fused to finance the purchase of current oss). Whatever amount is left over is what we must rose in new. long-term debt. Marcos, Inc. 2009 Star TOR 6.15 200 Castot goods Depreciation ang Defoe wees Tec Di 2009 Dance Short 2005 2200 2000 700 Cash Acco 2200 COM To 2.500 2020 30 MMM MEET HINTS Chinese how we were getme new they wa Wher what TED SIS 58 1700 Lomb HINT Start by cling the growth in Now we Wheth Statybom that the stated at the wind Major Manuscripts, Inc. 2009 Income Statement Net sales 2600 Cost of goods sold G.815 Depreciation 200 Earnings before interest and 585 taxes Interest paid 12 Taxable income 566 Taxes 197 Net Income 369 Dividends 166 Accounts tec Inventory Total Net fixed assets Total assets Major Manuscripts, Inc. 2009 Balance Sheet 20.09 2.200 Accounts payable 840 Long-term debt 2 200 Common stock 5.240 Retained wings 3130 Totat loboties & equity 2009 1700 250 2,500 3920 Major Manuscripts, Inc is currently operating at maximum capacity All costs, assets, and current abilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10 percent? HINT: Start by calculating the growth in assets. Now we need to figure out how we will pay for the growth. Start by subtracting off from that needed amount of new assets the estimated growth in internal equity that it the new retained earnings that will be used to purchase some of those new assets. Since current libilities also grow proportional to sales in this problem, also subtract off the estimated growth in current liabilities fused to finance the purchase of current oss). Whatever amount is left over is what we must rose in new. long-term debt