Answered step by step

Verified Expert Solution

Question

1 Approved Answer

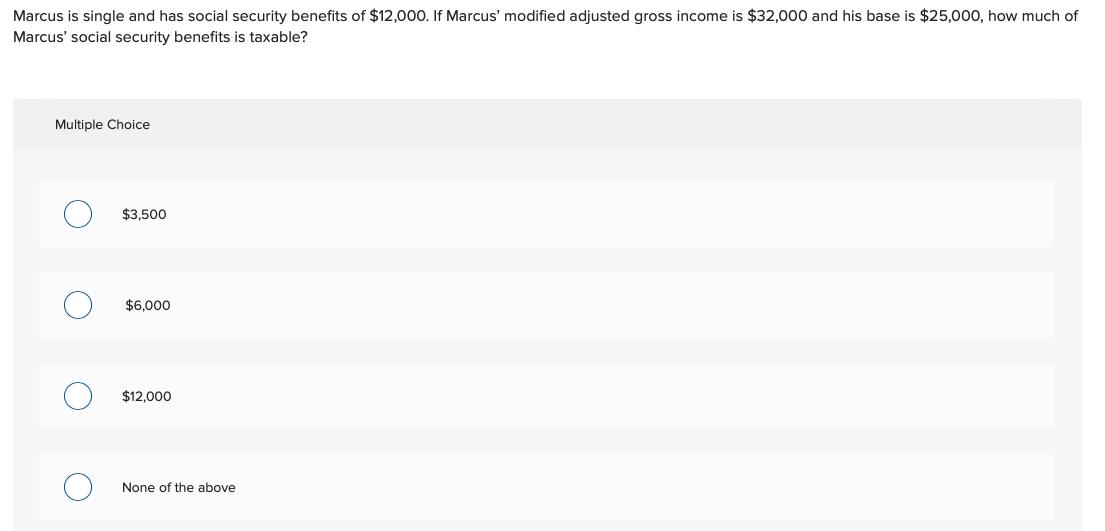

Marcus is single and has social security benefits of $12,000. If Marcus' modified adjusted gross income is $32,000 and his base is $25,000, how

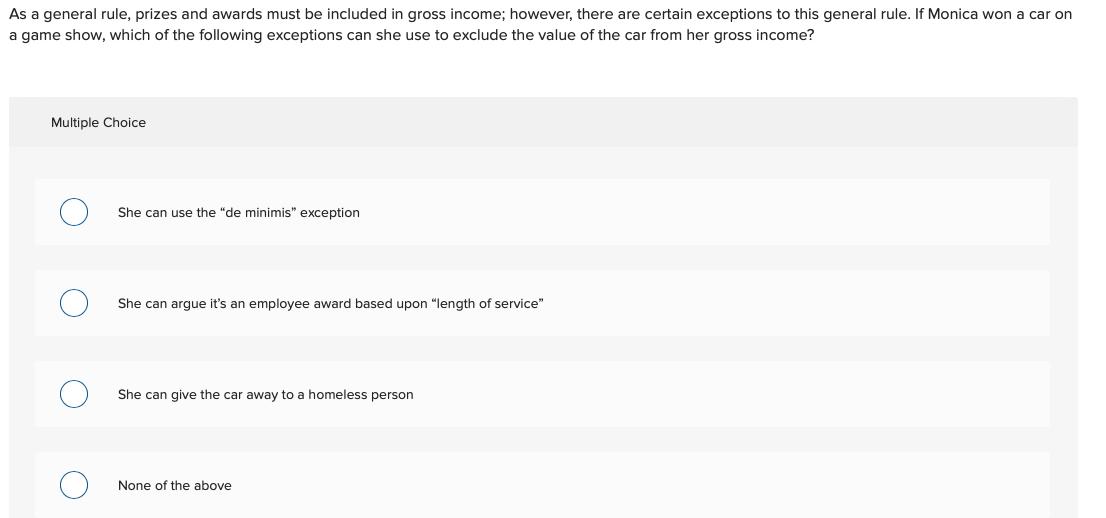

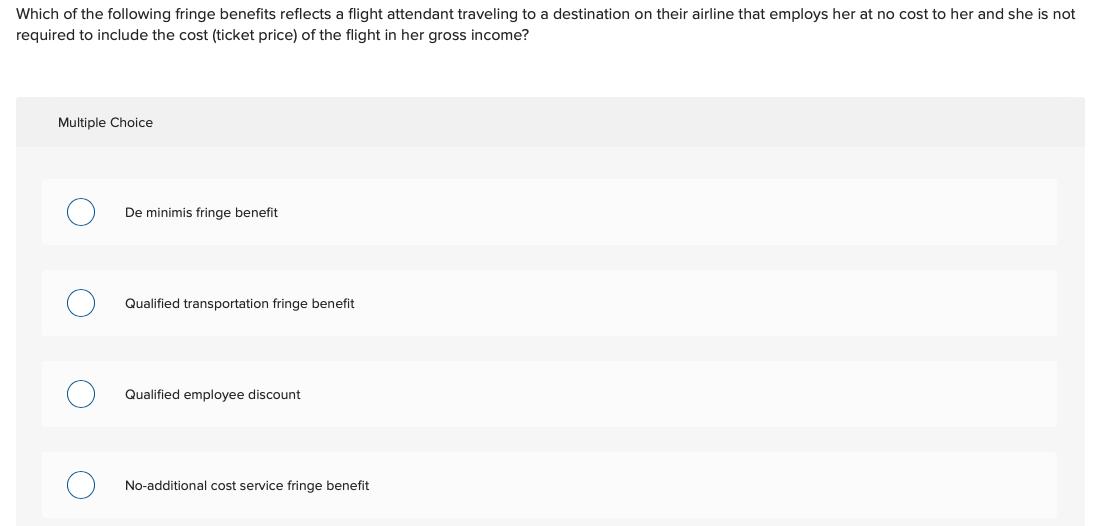

Marcus is single and has social security benefits of $12,000. If Marcus' modified adjusted gross income is $32,000 and his base is $25,000, how much of Marcus' social security benefits is taxable? Multiple Choice $3,500 $6,000 $12,000 None of the above As a general rule, prizes and awards must be included in gross income; however, there are certain exceptions to this general rule. If Monica won a car on a game show, which of the following exceptions can she use to exclude the value of the car from her gross income? Multiple Choice She can use the "de minimis" exception She can argue it's an employee award based upon "length of service" She can give the car away to a homeless person None of the above Which of the following fringe benefits reflects a flight attendant traveling to a destination on their airline that employs her at no cost to her and she is not required to include the cost (ticket price) of the flight in her gross income? Multiple Choice De minimis fringe benefit Qualified transportation fringe benefit Qualified employee discount No-additional cost service fringe benefit Describe the one circumstance in which "points" paid to secure a mortgage loan would be FULLY deductible in the year the loan was acquired. Short Answer Toolbar navigation BIUS E A 5

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

1 Social taxable 12 12000 32000 25 050 x 20 100 A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started